Key Takeaways

- In recent weeks and months, the Contingent Convertible (CoCo) bond market has experienced notable tightening in spreads, approaching historical lows.

- One of the primary drivers behind the tightening spreads of CoCo bonds is the consistent action of issuers calling these bonds at par (price 100). This practice has created a strong “pull to par” effect, encouraging prices to converge towards their face value.

- The absence of significant adverse macroeconomic effects and a favourable monetary policy for banks have further supported the tightening of spreads.

- Related ProductsWisdomTree AT1 CoCo Bond UCITS ETF – USD AccFind out more

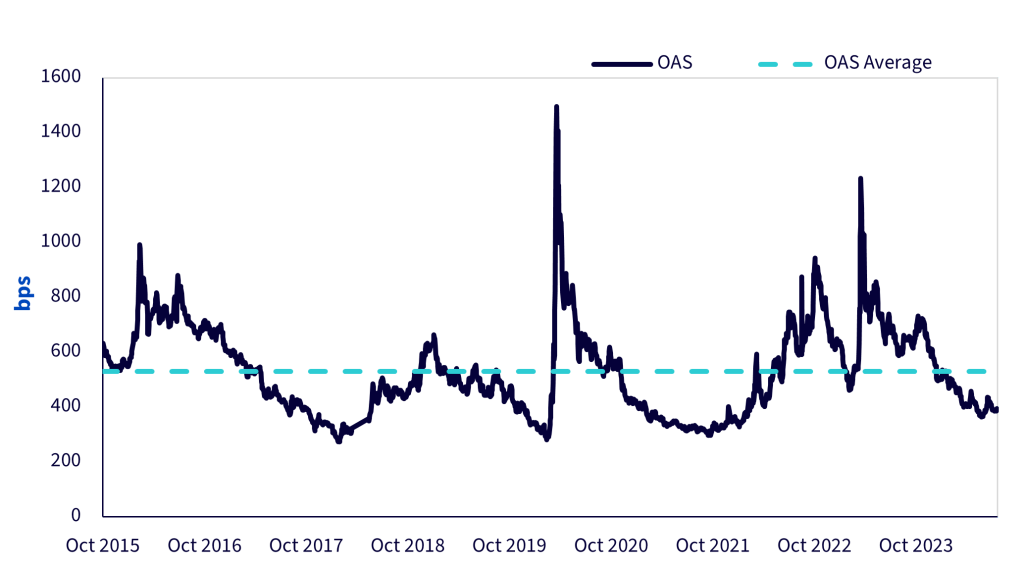

In recent weeks and months, the Contingent Convertible (CoCo) bonds market has experienced notable tightening in spreads, approaching historical lows. This trend reflects several market dynamics and external factors influencing investor behaviour and market sentiment.

Figure 1: Historical OAS

Source: WisdomTree, Markit. Period from 01 October 2015 to 23 Jul 2024. Calculations include backtested data. OAS is the option-adjusted spread reported by Markit and is based on the effective duration-adjusted market value weighting. Workout dates used in the OAS calculation of individual bonds are reset at the end of the month in case the bonds are not called. This calculation approach impacts the OAS figures for the index intramonth until the workout dates are reset. The strategy is represented by the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.

Tighter spreads and pull to par effect

One of the primary drivers behind the tightening spreads of CoCo bonds is the consistent action of issuers calling these bonds at par (price 100). This practice has created a strong “pull to par” effect, encouraging prices to converge towards their face value. Issuers’ reliability in calling these bonds has reassured investors, contributing to the recovery in prices observed since the Credit Suisse event last year.

Impact of the Credit Suisse event

The Credit Suisse event had initially caused significant market disruption, leading to a widening of spreads and a drop in bond prices. However, the subsequent recovery in CoCo bond prices indicates a resilient market response. The steady call actions by banks, both large and small, have restored confidence among investors. This regularity in calling bonds, post-Credit Suisse, underscores the stability and attractiveness of CoCo bonds as a financial instrument.

Macro effects and market sentiment

The absence of significant adverse macroeconomic effects has further supported the tightening of spreads. While there was some spread widening due to uncertainty surrounding the French elections, this was quickly reversed, illustrating the market’s capacity to absorb political uncertainties without long-term adverse impacts. The swift recovery following the French election uncertainty highlights the robustness of the CoCo bond market in the face of potential macroeconomic disruptions.

Issuer behaviour and market recovery

Post-Credit Suisse, most banks have resumed their regular calling schedules, reinforcing the market’s stability. Notable exceptions include Raiffeisen International, which faces challenges due to its exposure to Russia, and PBB and Aareal Bank, which are affected by concerns related to commercial real estate (CRE) exposures. Despite these exceptions, the overall trend of regular calls has significantly contributed to the market’s recovery and the tightening of spreads.

Higher interest rates

The primary mechanism through which banks profit is the spread between the interest they pay on deposits and the interest they earn on loans and investments. As interest rates rise, banks are generally able to charge disproportionally more for loans compared to the interest they pay to account holders, which can significantly enhance their interest income. This environment has been particularly beneficial in recent years, as central banks across major economies have hiked rates to combat inflation and stabilise financial markets. For banks, higher interest rates have directly supported return on equity (ROE) by widening the interest margin. This favourable interest rate regime has also contributed to the tightening of spreads.

Conclusion

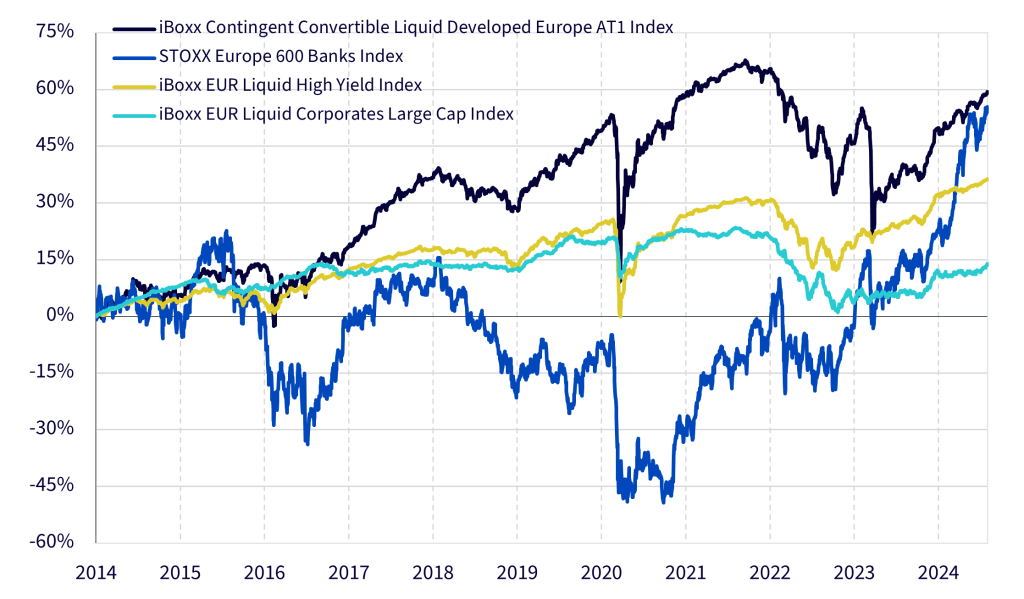

The recent trends in the CoCo bond market are characterised by a notable tightening of spreads, driven by the consistent behaviour of issuers calling bonds at par, the recovery of prices following the Credit Suisse event, a favourable monetary environment and the absence of significant adverse macroeconomic effects. As issuers continue to call bonds and market confidence remains strong, the CoCo bond market is poised to maintain its stability and attractiveness to investors, even in the face of occasional uncertainties. It is notable that AT1 CoCos have maintained their outperformance over other comparable asset classes since their inception and have also witnessed much lower volatility than the STOXX Europe 600 Bank Index.

Figure 2: Cumulative returns

Source: WisdomTree, Bloomberg. Period from 31 December 2013 to 30 Jun 2024. Based on returns in EUR. All fixed income indices are total return indices; all equity indices are net total return indices. Performance includes backtested data. Performance of the iBoxx Contingent Convertible Liquid Developed Europe AT1 Index is based on the EUR-hedged version of the strategy. The iBoxx Contingent Convertible Liquid Developed Europe AT1 Index (EUR Hedged) started its live calculation on 09 March 2018. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.