“The electric light did not come from the continuous improvement of candles.” – Oren Harari

In the year 1900, the world had a simple energy mix. One half of total energy supply came from coal and the other came from biomass. Gas, oil, and hydropower existed but paled in comparison. Fast forward 121 years, by 2021, things had changed in two key aspects. First, oil and gas had come head-to-head with coal to collectively account for nearly 77% of the energy mix. And second, total energy consumption had increased 14x1.

This drastic increase in our energy consumption, and demand mostly satiated by fossil fuels, has created a problem. It has left us with a carbon budget of 380 gigatons of CO2 equivalent from the start of 2023. In other words, we could hit 1.5°C of warming in 9 years2.

That is, unless things change meaningfully. Not continuous improvement, but radical change. Like shunning fossil fuels for cleaner alternatives. Not only is this essential but, luckily, it is now achievable thanks to the advancement of renewable energy.

At the heart of the energy transition

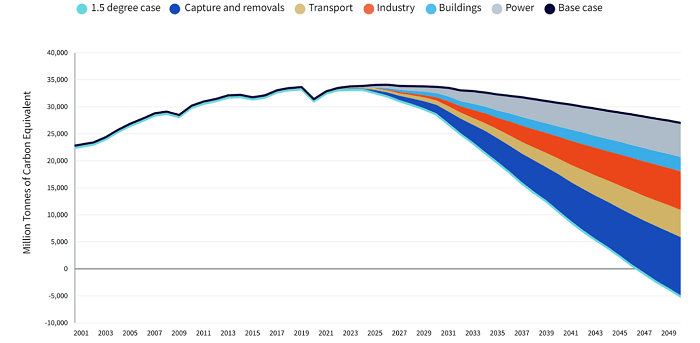

Consider the gap between the base case (dark blue line in the chart below) in Figure 1 and the path we must adopt in the 1.5°C scenario (teal line). The teal scenario appears to be possible by doing a combination of two things. Where decarbonisation of power and transportation is possible, it must be done. Where it isn’t, say heavy industries like steel and cement, carbon capture must be employed. Scaling up renewable sources of energy, therefore, is at the heart of this endeavour.

Figure 1: The difference between the base case and 1.5 degree and what’s needed to get there

Source: WisdomTree, Wood Mackenzie.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

A more efficient alternative

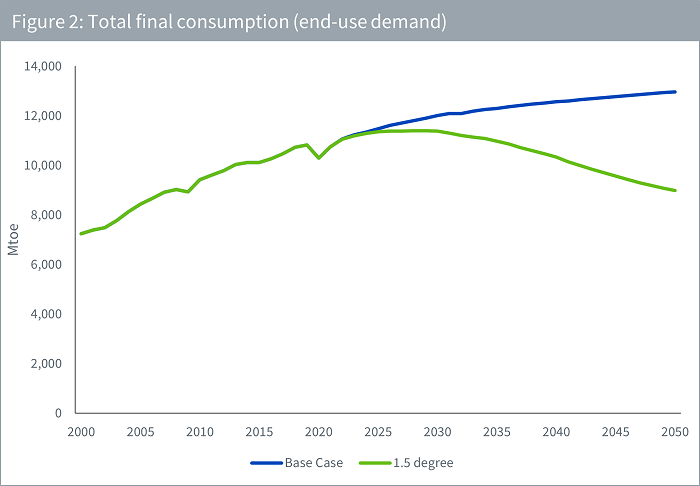

Historically, our total energy consumption has only moved in one direction – upwards. While population growth and advancement in industrialisation and technology are the prime reasons for this, another contributing factor is that energy efficiency has seldom been achieved on a large scale. But with the rapid electrification of transport and buildings, efficiency gains vs using fossil fuels could result in total end-use demand for energy peaking by 2028 and, potentially, declining thereafter (in a 1.5°C scenario).

Source: WisdomTree, Wood Mackenzie. Mtoe = mega tonnes of oil equivalent.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

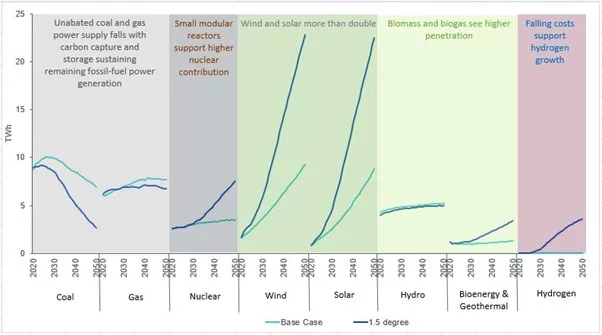

Wind and solar have arrived

Among renewables, wind and solar are expected to play the leading role (see Figure 3). There are numerous reasons for this. First, both technologies have been around long enough to see significant cost reductions in recent years. According to a Bloomberg New Energy Finance report published in June 2022, new onshore wind now costs about $46 per megawatt-hour (MWh), while large-scale solar plants cost $45 per megawatt-hour. In comparison, new coal-fired plants cost $74 per MWh, while gas plants cost $81 per MWh.

Second, most places in the world have access to either wind or sunshine (if not both). The only challenge that needs to be overcome, therefore, is obtaining the necessary funding required to install renewable energy farms.

And third, wind and solar are seeing some exciting innovations. Consider floating offshore wind as an example. Floating offshore wind power has several benefits as a source of renewable energy. First, floating wind turbines can be deployed in deeper waters where traditional fixed-bottom turbines cannot reach. This allows for greater access to stronger and more consistent wind resources, which can generate more electricity at a lower cost. Additionally, floating offshore wind turbines are less visible from shore and have a smaller environmental footprint compared to onshore and fixed-bottom offshore wind farms. Furthermore, floating offshore wind farms have the potential to be located closer to population centres, reducing transmission costs, and improving energy security. Lastly, because they are not limited by the ocean floor, floating wind turbines can be moved to different locations if needed, making them a more flexible option for renewable energy production.

Wind and solar can be complemented by emerging sources of renewable energy like hydrogen. Green hydrogen, which is produced through the renewable electrolysis of water, that is, passing a current of renewable electricity through water, has the potential to help decarbonise both heavy-duty transport like trucks, ships, trains, and airplanes, and energy-intensive industries like steel and coal. As the production of green hydrogen achieves scale, cost-reductions will foster further growth.

Figure 3: Wind and solar have a significantly large role to play in a net zero world

Source: Wood Mackenzie, 2023.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

The pathway forward

Renewable energy can help the energy sector deliver net zero with the aid of the following:

1. Effective policy design – regulatory, commercial, and technical barriers to entry be removed.

2. Capital – by 2050, US$47 trillion is required to deliver the generation and infrastructure of a net zero energy system3.

3. Technology – wind and solar will need to be supported by emerging technologies like hydrogen and carbon capture.

4. System flexibility – innovative ways of energy storage and distribution will need to support renewable energy.

5. Sustainability – recycling will need to be scaled up to ensure we efficiently utilise natural resources.

Renewable energy is being fuelled by political will, technological progress, and investor interest. It is an exciting time to employ this tool in our fight against climate change.

How does WisdomTree capture the opportunity

We are delighted to announce the launch of the WisdomTree Renewable Energy UCITS ETF which is classified as an SFDR Article 9 fund4.

The WisdomTree Renewable Energy UCITS ETF tracks the WisdomTree Renewable Energy Index and gives investors a way to capture the energy transition megatrend by accessing the diversified and rapidly emerging renewable energy value chain. WisdomTree has built this product by extending its thematic equities and commodities partnership in the energy transition space with Wood Mackenzie. Wood Mackenzie is a globally recognised industry leader that has been providing quality data, analytics, and insights used to power the energy, renewables, and natural resources industry for nearly 50 years.

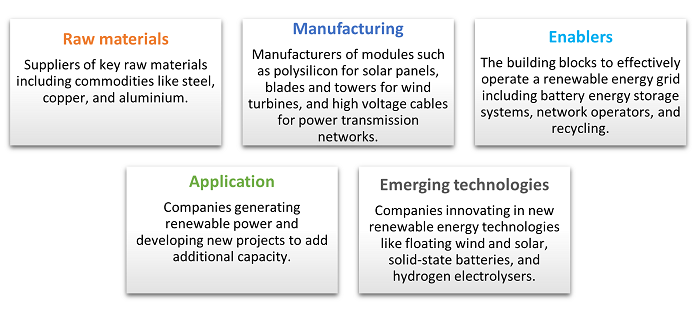

The partnership has allowed us to identify and build an exposure that is representative of the renewable energy theme. This includes up to 32 different subsectors across five categories:

The product, therefore, seeks to capture the core components of the renewable energy value chain and does so by utilising the deep knowledge of industry experts who identify exciting innovations and select companies. The strategy provides a diversified exposure across the renewable energy value chain with a tilt towards more pure-play companies in the space.

Sources

1 Source: Visual Capitalist as of 10 March 2023 with original data from ‘Our World in Data’.

2 Intergovernmental Panel on Climate Change, 2023.

3 Wood Mackenzie, 2023.

4 Sustainable Finance Disclosure Regulation.

Related blogs

+ Are we seeing a breakout moment in renewable energy?

+ The 1.5 degree goal driving the energy transition

Related products