Key Points

- Growth stocks have sold off indiscriminately, not based on operational performance or prospects

- Against a difficult backdrop, investors favour short-term certainties over long-term opportunity

- The future is brighter for growth stocks as innovation accelerates and there are more opportunities to own businesses with outlier potential

The value of an investment, and any income from it, can fall as well as rise and investors may not get back the amount invested.

After sky-high gains during the pandemic, growth stocks have come crashing down to earth over the last eight months or so. This year, the Nasdaq has given up around 25 per cent, putting it among the bears.

Tech stocks have sold off indiscriminately, regardless of reputation. Any slight disappointment in quarterly results has triggered a dramatic drawdown.

The volatility of share prices of growth stocks has been both staggering and sobering. It has been a humbling experience for managers such as Baillie Gifford and more so for our clients. Indeed, we are acutely aware that 2022 has been very uncomfortable for those that invest with us.

As a result, we have revisited the investment case for every stock we hold. We are gauging their long-term prospects in the prevailing environment and beyond. We are more than happy to continue holding most; some are in the waiting room and a few have been shown the door.

More importantly, our philosophy and process remain unchanged. We continue to seek exceptional companies that offer significant returns to investors on five-to-ten-year horizons.

Some clients may be wrestling with more immediate concerns:

- Have growth stocks been justifiably revalued?

- Is there a possible dislocation between their share prices and prospects?

- Or are we facing recession and the potential for more widespread market negativity?

Embracing the future

As we know, lockdown threw up a series of big winners. Share prices rose exponentially for those companies catering for the stay-at-home lifestyle. Netflix and Zoom became bywords in entertainment and communication. Amazon and Ocado flourished by bringing necessities to the door.

In addition to shopping, education and medicine went online. Biotech went to work on vaccines with speedy results. Greater digitalisation increased interest in the cloud and demand for computing power.

The future was embraced with both arms. The share prices of alternative energy companies and electric vehicle providers rose on a wave of tech fervour. With market momentum behind the winners, valuations become stretched, while asset managers considered whether this growth was long term or brought forward by circumstance.

The clouds gather

As we emerged from Covid-19 Mr Market provided an answer. Those stocks that stood to benefit from the resumption of economic activity became immediately popular, such as energy, financials, commodities and property.

At the same time, the clouds gathered for growth:

- Easy money, pent-up demand and supply chain issues stoked vicious inflation;

- China first cracked down on tech platforms then re-engaged battle with Covid-19;

- and, most destructive of all, President Putin invaded Ukraine with tragic consequences.

This cocktail of concerns has had serious short-term consequences for growth managers such as Baillie Gifford. While many investors have seen drawdowns of 30 per cent or more over the past few months, this does not necessarily make us villains. In the same way that we were not heroes in 2020, when some portfolios rose by over 100 per cent.

Caught in the crossfire

Our style of investing will inevitably see periods of share price volatility. Tesla, for example, has endured 11 sharp declines ranging from -60 to -17 per cent on the way to an almost 2,000 per cent gain for investors in many of our portfolios.

Unsurprisingly, investors are now finding it difficult to digest long-term uncertainty. They prefer to embrace what they believe are short-term certainties.

The market has revalued growth in a way last seen in the tech bust and the Great Financial Crisis. But this may not be fair. Many of these revalued growth stocks are in significantly better shape than those damaged during earlier crises. Indeed, there is a strong chance that quality growth has become dislocated in share price terms from corporate fundamentals and prospects.

Market inefficiency creates opportunity

If this is the case, then we could be on the cusp of a great opportunity. Netflix and Zoom have seen share prices fall back below 2019 levels. This is despite revenues and margins doubling in the case of the former and revenues multiplying by five for the latter. The much-maligned China tech giants Alibaba and Tencent are priced at 2016 and 2017 levels. Again, despite revenues increasing five times and doubling respectively. Significant operational progress and savage ratings creates market inefficiency and therefore opportunity.

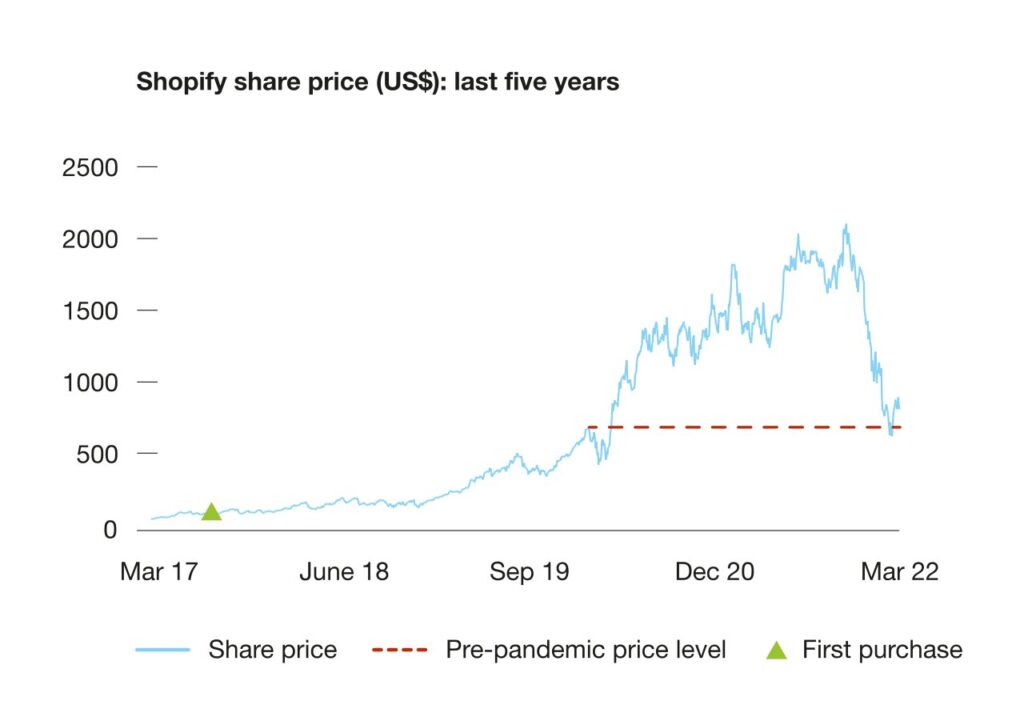

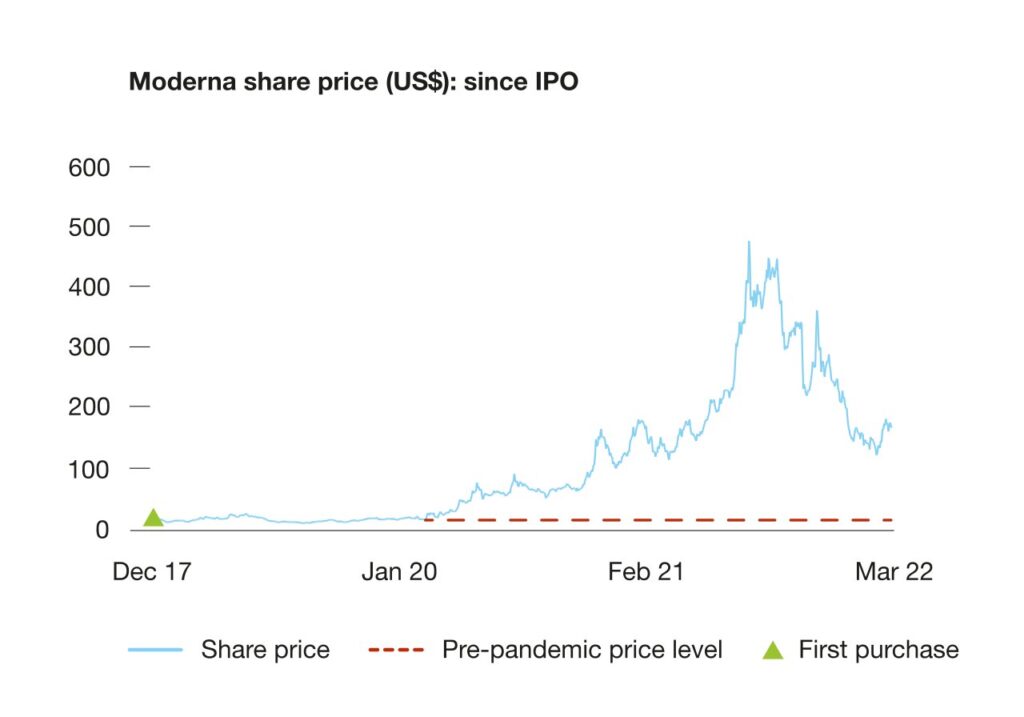

Even more striking are the graphs of Shopify and Moderna below. In both cases share price is back to pre-Covid levels while revenues have grown strongly. The former has been revalued on slowed growth, which has some logic post-pandemic. But the company has abundant scope to grow its business many times over.

Shopify is building the digital infrastructure to make commerce better for everyone. Its platform helps merchants of all sizes manage their businesses across every channel and any device. It is forging lasting relationships with high-quality products. With less than 2 per cent of US sales, Shopify has a long runway of potential success ahead.

The market is treating Moderna and its Covid-19 vaccine as a one-trick pony. It has failed to price in that the mRNA technology platform is highly scalable. Unlike existing technologies, mRNA delivers its intracellular and membrane proteins directly into cells. And it can target multiple areas of disease from flu to cancer too. Moderna already has big pharma scale revenues, but if it succeeds in developing this new class of medicine, it could become the first trillion-dollar biotech business.

Investing in the future

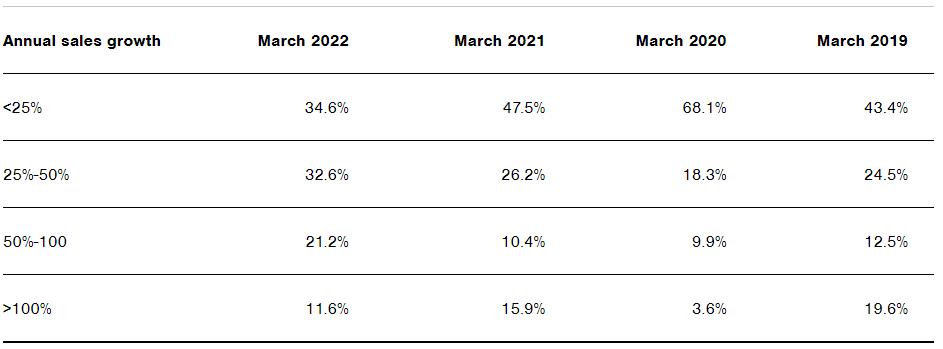

Another key difference between the growth of today and yesterday is its resilience, especially in the face of reinvigorated inflation. In many cases, the stocks held in our portfolios are growing sales faster than before Covid-19. This suggests customers value their products and they have pricing power. These growth companies have net cash on their balance sheets, or at least positive free cash flow. They are busy investing in their future, not maximising profits in the present. Delivery Hero, for example, last year spent £632m on marketing while making £492m in profits. The table below shows just how companies owned within the Scottish Mortgage portfolio are growing their revenues year on year. It is an improving picture.

We can’t tell you when or how share prices will bounce back. Nobody can with accuracy. Stock markets are unpredictable and in the short run are affected by all sorts of human behaviours. Panic, excitement and herding, to name a few.

Our investment process deliberately invests through that noise. We know that over five years and longer, market sentiment becomes much less important to investment returns. Company fundamentals dominate over these longer time frames. Therefore, we search for those rare businesses with exceptional and underappreciated growth potential.

In contrast to current market sentiment, we believe that the opportunities to own businesses with outlier potential are expanding as innovation accelerates in almost every industry. In times like these, it becomes harder to exercise patience, but that’s exactly when our investment edge is at its most important.

What threat recession?

A key influence on any potential for recovery is the threat of recession. There has been talk that a tech correction may extend into a wider recession. This is on the back of a global slowdown in business growth and consumer confidence, amplified by higher interest rates to combat inflation, as well as continuing issues in China and conflict in Europe.

Should the world slide into recession, then company revenues and profits will dissipate, and valuations deteriorate. Investors will no doubt seek traditional safe havens such as gold, fixed interest and companies with strong balance sheets and resilient franchises.

The last category may encompass today’s great growth companies, with growth being more highly prized in a no-growth world. Recent recessions have lasted as much as two years. Our horizons are longer than that so we will remain optimistic.

There’s no going back

Current market sentiment favours a return to how it was before. Put another way, it thinks fossil fuels can trump alternative energy and that the rise of electric vehicles may be illusory. It says we will return to the high street rather than shop more online and that health will remain impersonal, reactive and driven by trial and error.

There are plenty of other such examples. Looking out three, five or ten years, today’s market view seems myopic. The opportunity offered by growth companies looms large in front of us all. Those who are patient can reap the rewards.