An impending global recovery that includes higher consumer spending, a new capex cycle and greater regulatory oversight for selected growth sectors suggests that investors in Emerging Market equities will need to seek out a different approach in order to outperform over the coming years.

Following a decade of underperformance of Value investing in Emerging Markets, we have seen Growth and Quality equities become extremely overpriced. Looking forward we now see both a tactical valuation tailwind for Value equities, and a strategic opportunity in an investment environment supportive of Value irrespective of the valuation starting point.

Since September 2020, equity markets have continued to rally on the back of the rollout of COVID-19 vaccines alongside coordinated global fiscal and monetary stimulus. Within this rally, Value equities have outperformed substantially. Investors are now wondering whether the Value rally has much further to run or if Growth equities will be able to find their footing. We argue that the outlook for the next few years looks significantly less like the post-Global Financial Crisis (GFC) decade we have just exited and is much more similar to previous recovery periods including the post-dot-com era.

A very different recovery

The start of the decade post the GFC was a period where governments globally rolled out some of the most severe fiscal austerity plans on record to try to recover what they could of the financial system. Along with this fiscal austerity, we saw low levels of corporate investment which led to tepid and uncertain economic growth. Governments looked to motivate consumers to deleverage and central banks aimed to curb any signs of inflation.

In contrast, today, we have unprecedented fiscal and monetary expansion plans, more akin to other periods of economic recovery including the post dot-com era. Governments are focused on supporting real economic growth and not just the banking system. The inability to spend over the last 18 months has resulted in historically high levels of savings which we expect to lead to increased consumer demand in the short-term. In addition, we are seeing an impending capex cycle from governments (in the form of infrastructure spending) and corporates. Given the absence of inflationary pressures over the last few years, central banks are far more restrained in responding to incipient inflationary signals. Rising inflationary expectations and by extension higher interest rates tend to be positive for cyclical sectors such as financials, energy and industrials.

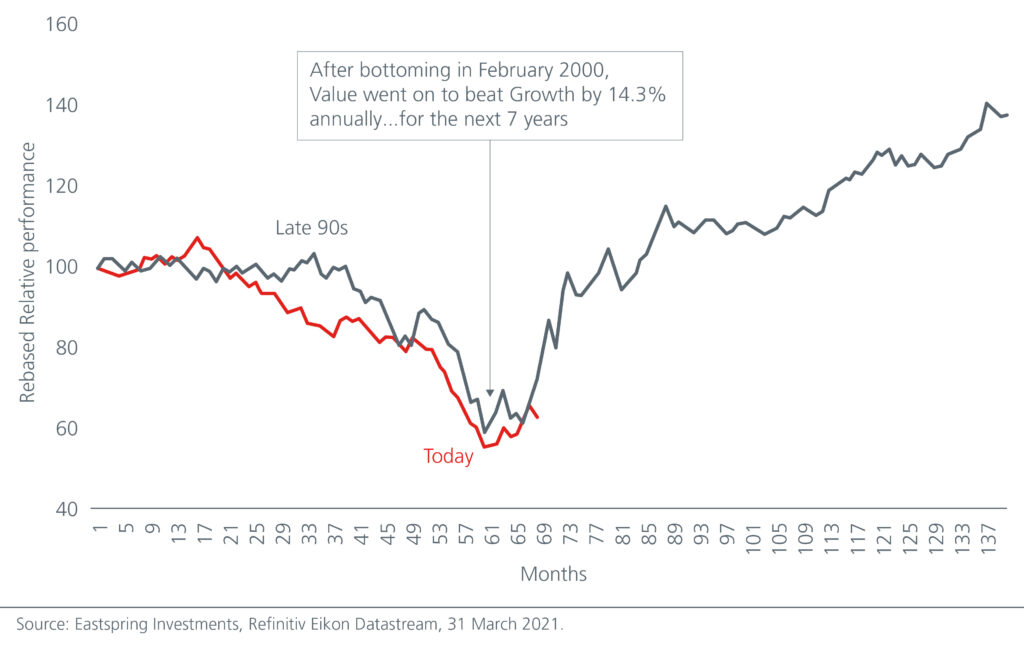

We believe that the economic recovery ahead will be closer to previous economic recoveries including the 2002-2008 era which saw the long-term outperformance of Value equities. Using the Russell 1000 Value and Growth indices below as a proxy for the relative performance of Value globally, we can see in Fig. 1 that we may be following a similar pattern from the late 90s and into the 2000s. The red line which represents the relative performance of value versus growth from 2015 to present, appears to be tracking the grey line which represents the relative performance of the two styles from 1995 to 2007.

Fig. 1. Relative performance of Russell 1000 Value vs Growth (Cumulative)

Drivers of change

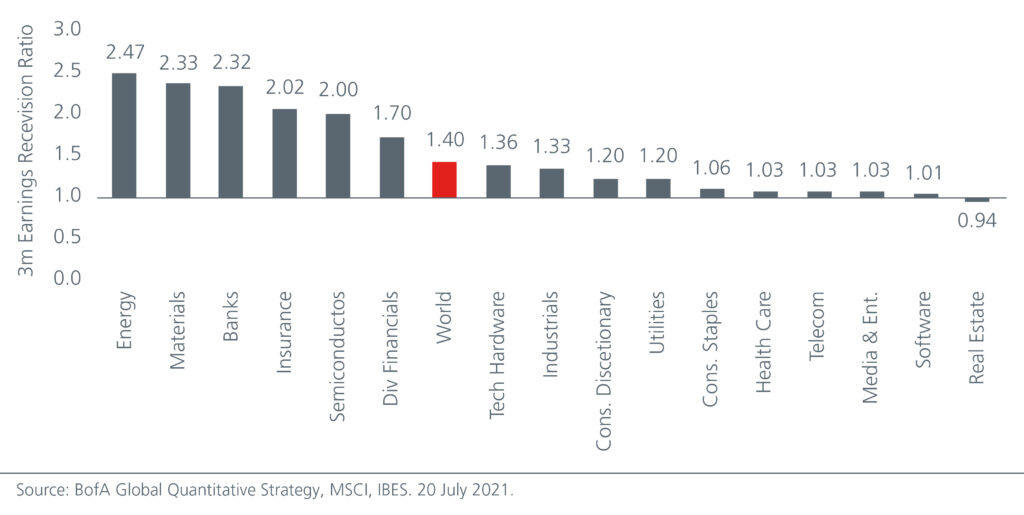

We note the strong trend in earnings revisions as the global economy recovers. In the last three months, the trend in earnings revision has been positive with more upgrades than downgrades across most sectors. That said, earnings revisions have been most positive for the cyclical sectors such as Energy, Materials and Banks. This bodes well for Value equities. Fig. 2.

Fig. 2. 3-month earnings revision by global sectors

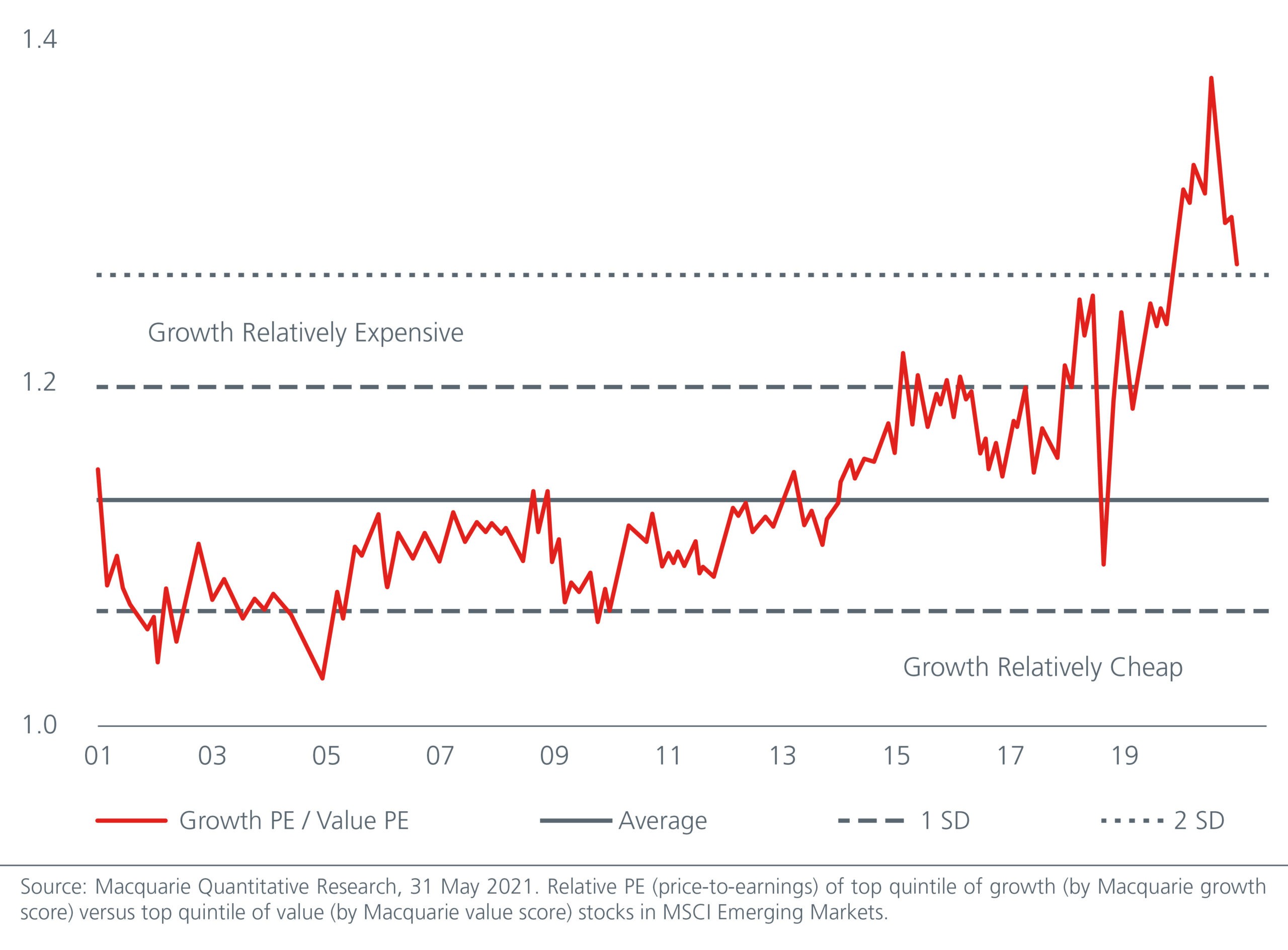

Today’s bullish macroeconomic outlook for Value equities is also supported by valuation extremes between Value versus Quality and Growth equities. Fig. 3. We did not have this level of valuation dispersion post the GFC. At that time, we faced a poor economic environment which was supportive of Growth and Quality equities relative to Value.

Fig. 3. EM Growth relative to EM Value – Price to earnings

Additionally, digital revolution was one of the key investment themes post the GFC. Corporates, governments, and consumers were building and integrating software and digital platforms which were relatively capex light. While digitization remains an important trend, we believe that the decarbonisation revolution would mark the next decade. This will require massive infrastructure and capex investments in the real economy, as consumers and companies shift away from high carbon consumption.

Meanwhile, many of the large expensive eCommerce, technology and internet-related businesses that have outperformed in recent years are relatively unregulated. These businesses are facing increasing scrutiny from governments and regulators which could put them on a level playing field with existing businesses and moderate their growth rates going forward.

Investors need a different response

Most Emerging Market equity strategies do not appear well-prepared for this scenario. Many of these strategies are still biased towards expensive technology and new economy themes, when Value today is represented more clearly in the cheaper real economy sectors such as financials, industrials and utilities. Strategies that have a disciplined Value approach have outperformed in the last six months.

The future is inherently uncertain, but if we are right on the likely shape of the economic recovery and the equity markets’ reaction to it, there remains a very large opportunity for a disciplined Value investor to capture. We believe investors in Emerging Market equities should be hedging this risk with a disciplined Value approach.