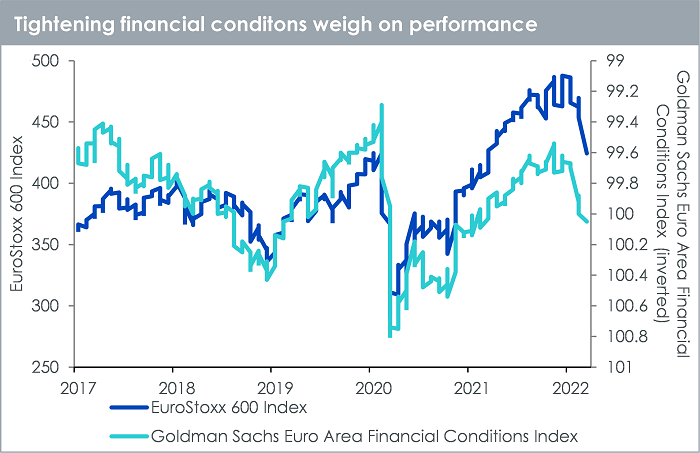

European equities are caught in the crosshairs of the war between Russia and Ukraine, down 12.6% Year to Date1. Equity risk premiums2 in Europe have risen sharply owing to accelerating earnings yields despite the recent rise in bond yields. Europe is most at risk owing to its high dependence on Russia for energy and its proximity to the situation. While European equity performance has declined in lockstep with tightening financial conditions, we feel investors are discounting three important factors in their allocation to Europe (1) consensus earnings revisions re-accelerating for 2022 (2) continued fiscal support via the Resilience and Recovery Fund (3) monetary policy is likely to remain accommodative until de-escalation of the war.

Source: Bloomberg, WisdomTree as of 28 February 2022. Please note – Goldman Sachs Financial Conditions Index (FCI) is defined as a weighted average of riskless interest rates, the exchange rate, equity valuations, and credit spreads, with weights that correspond to the direct impact of each variable on GDP.

Historical performance is not an indication of future performance, and any investments may go down in value.

ECB’s remains hamstrung by new risk dimension

Russia is a major energy supplier to Europe. The war in Ukraine is fuelling concerns of disruption of gas supplies to Europe. Rising energy prices are passing through to headline inflation mechanically, as we saw this week. Eurozone headline inflation jumped to 5.8% in February, driven by higher energy costs, and this trend is likely to accelerate given the intensification of the conflict. The core inflation rate – excluding energy, food, alcohol and tobacco – also surged to 2.7%, reversing January’s fall as both services inflation and non-energy industrial goods inflation accelerated. Rising energy prices could soon start to be a drag on consumer spending. However, some of the passthrough to retail would be limited in several European countries and those offering government offset schemes such as France and Italy. The complex combination of a war and severe sanctions are likely to prompt the European Central Bank (ECB) to ignore higher inflation and postpone the withdrawal of the stimulus for now. However, the war in Ukraine complicates the ECB’s dilemma of tackling accelerating inflation that cannot be softened by monetary policy. Russia’s invasion of Ukraine is adding to the long list of constraints and bottlenecks that are impacting global supply chains since the start of the pandemic. As a result, commodity prices are surging higher amidst concerns of supply disruptions and port closures.

Navigating European equity exposure amidst a higher inflationary backdrop

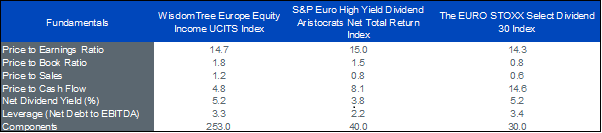

Figure 2 shows comparative valuations and dividend yields of different strategies focused on high yielding European equity strategies: WisdomTree Europe Equity Income UCITS Index (Ticker: WTEHYTE Index), S&P Euro High Yield Dividend Aristocrats Net Total Return Index (Ticker: SPEUHDAN Index), the EuroStoxx Select Dividend 30 Index (Ticker: SD3E Index).

WisdomTree Europe equity income UCITS Index also offers high weight in value-oriented sectors such as financials (24.3%), materials (15.8%), utilities (15.4%), healthcare (13.8%) and energy (7.5%).

Figure 2: Fundamentals of high yielding European equity strategies

Source: Bloomberg, WisdomTree as of 3 March 2022

2 Equity Risk Premium difference between earnings yield and