Silver’s New Playbook:

AI, Defence and the Power Build-Out Shifting Demand (and Risk) Profile

BOTTOM LINE

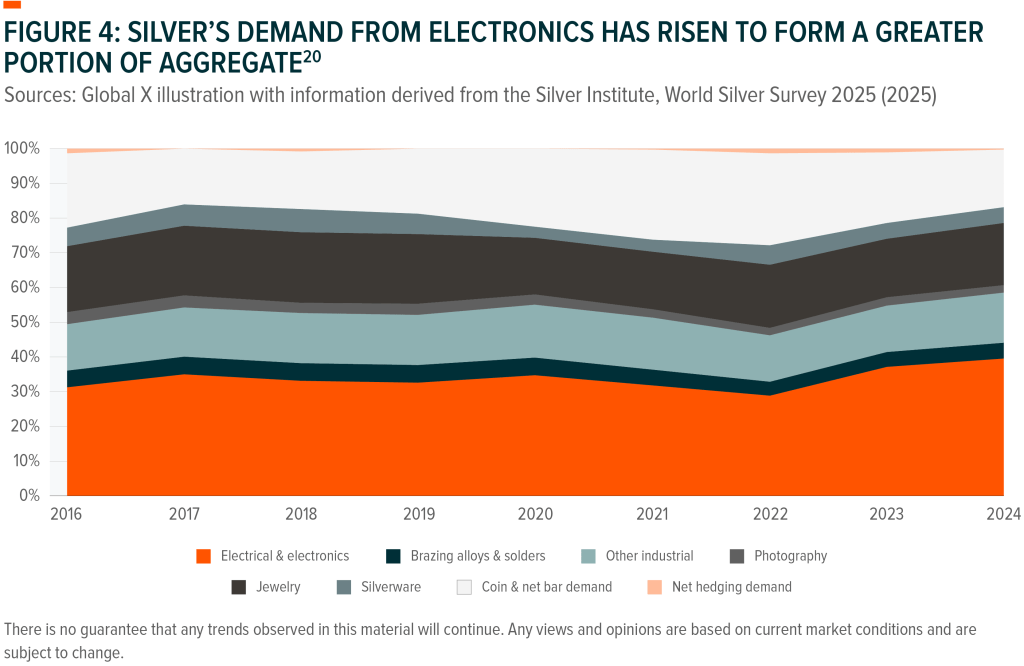

Silver’s demand profile is shifting from a largely cyclical blend (electronics, jewellery, investment) toward multi-year, programmatic build-outs in AI-driven data centres, defence modernisation and the power infrastructure that feeds a more electricity-centred world (via grids and solar).1,2,3 This matters for investors: if more of silver’s consumption comes from long-lead projects and sovereign-level budgets, the metal’s demand could decouple from shorter business cycles – potentially changing its risk profile to be determined by intermediate- and long-term buying.

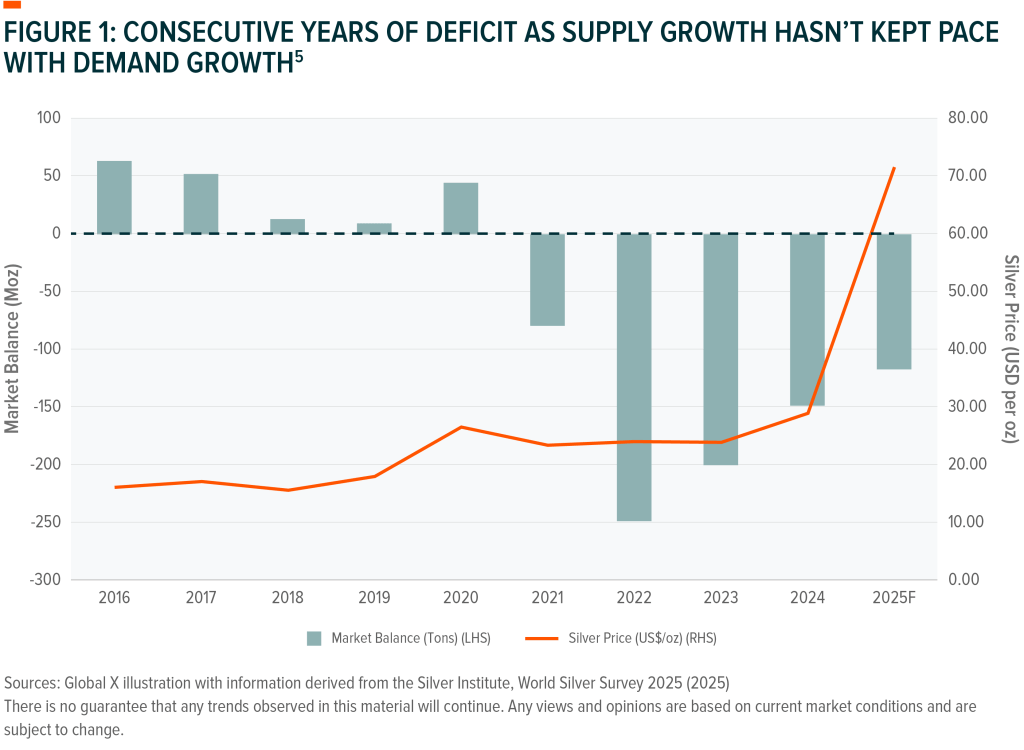

On the supply side, incremental growth remains low while the market continues to run deficits; 2024 marked a fourth straight structural shortfall (~149 Moz), with a cumulative stock draw of ~678 Moz since 2021, as industrial demand sets another record.4 Miners with capital discipline, savvy M&A strategies and high quality assets could stand to gain from these structural shifts.

1) AI & Data Centres: From Code to Concrete

Why growth is “real economy” and sticky

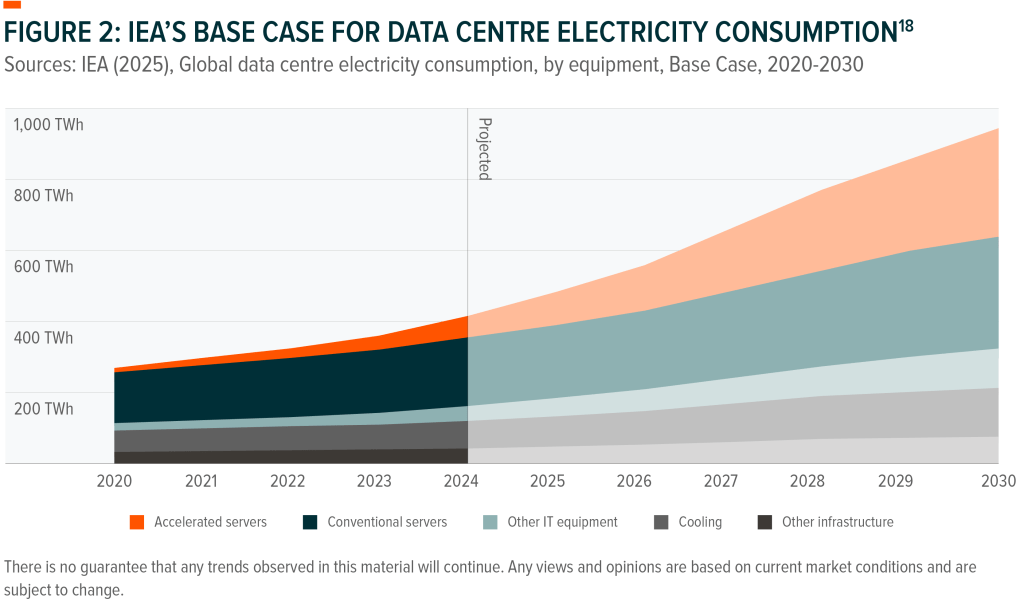

- Electricity pull is expanding, and projected to continue:

- The IEA estimates total data-centre electricity use could roughly double to ~945 TWh by 2030, with AI a rapidly rising share (50% of electricity demand growth).9 That’s grid-scale demand that persists for the life of facilities.10

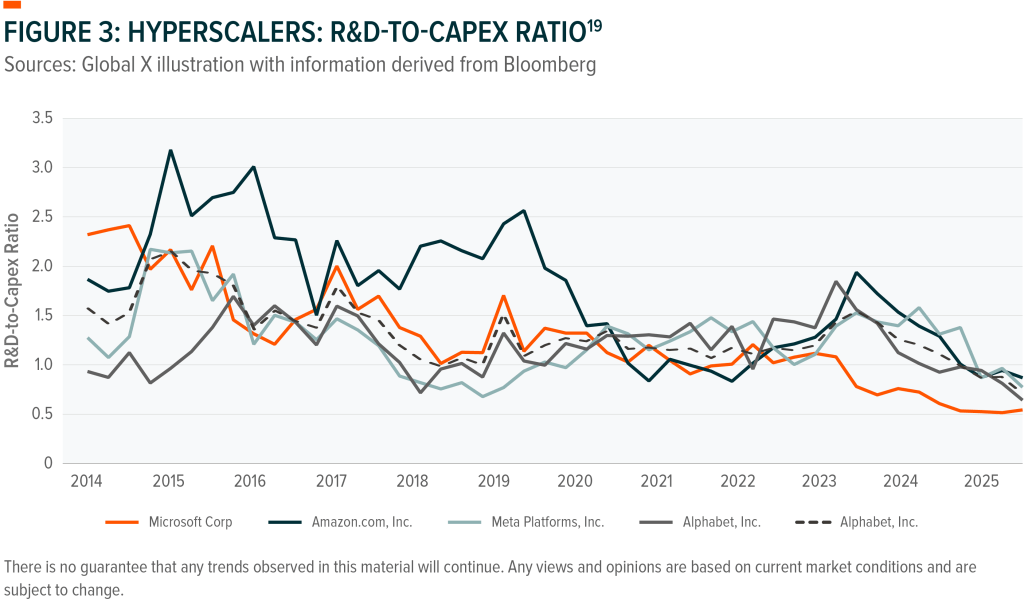

- Hyperscalers are pivoting from R&D spend to physical build-out Capex:

- Hyperscaler data-centre capex is now the growth engine, with Dell’Oro forecasting global DC capex to reach ~$1.2T by 2029 (21% CAGR) with ~50 GW additional capacity; hyperscalers drive about half of that.11 Synergy counts 1,100+hyperscale sites and a pipeline adding 130–140 new sites per year—bigger buildings, denser racks.12 (Figure 3)

- Long-dated power contracts lock in build cycles and signal commitment:

- Microsoft’s 20-year PPA to restart Three Mile Island Unit 1(835 MW) and AWS’s 1,920 MW nuclear PPA with Talen run into the 2030s/2040s; these are long-term commitments that anchor multi-year equipment purchases (and silver use) for servers, power distribution and cooling systems.13

- Balance-of-plant bottlenecks reinforce this theme:

- Transformer shortages and long lead times (order backlogs tripling at Hitachi Energy to about $43B in three years) show that the AI wave is stressing physical grid equipment—not just GPUs.14 That equipment is shot-through with silvered contacts and buswork.15

Persistence of Demand

AI demand is not just “IP spend”; it’s anchored in multi-year power and facility capex that have profound effects on relevant metals’ demand profiles.16 The nature of these builds is inherently less cyclical than consumer electronics refresh cycles, supporting a steadier industrial draw for silver.17

How silver is used here (at a glance):

- Solder: SAC305 (Sn-96.5/Ag-3.0/Cu-0.5) is the default lead-free solder in servers, networking, storage, and power electronics.4

- Power path & protection: silver-plated copper busbars, breakers, relays and high-current contacts (low contact resistance, arc resistance).7

- Switchgear & UPS: silver surfaces in bolted joints and contactors reduce heat losses and improve reliability.8

2) Defence Modernisation: From R&D to Procurement (and Production)

The spending pivot that benefits physical metals:

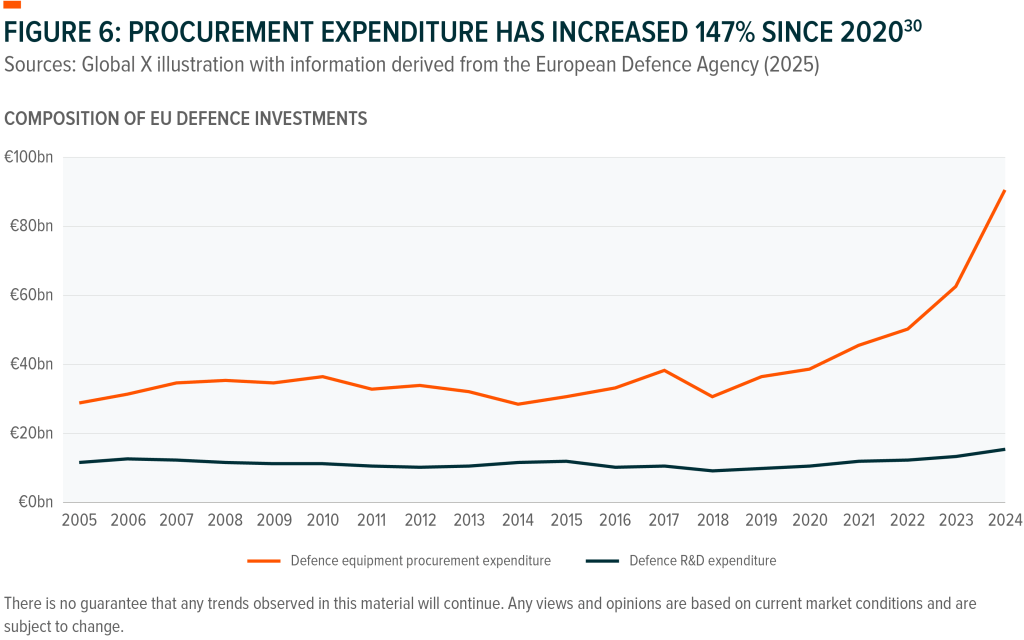

In the EU, procurement growth is outpacing R&D. EDA’s latest Defence Data show defence investments hit €72B in 2023 (26% of spend) and are projected >€100B in 2024. >80% of those investments went to equipment procurement (~€61B); R&D was ~€11B and R&T ~€4B.24 That is a tangible pivot from “ideas” to “hardware”, which should constitute a tailwind for relevant metals’ demand. (Figure 6)

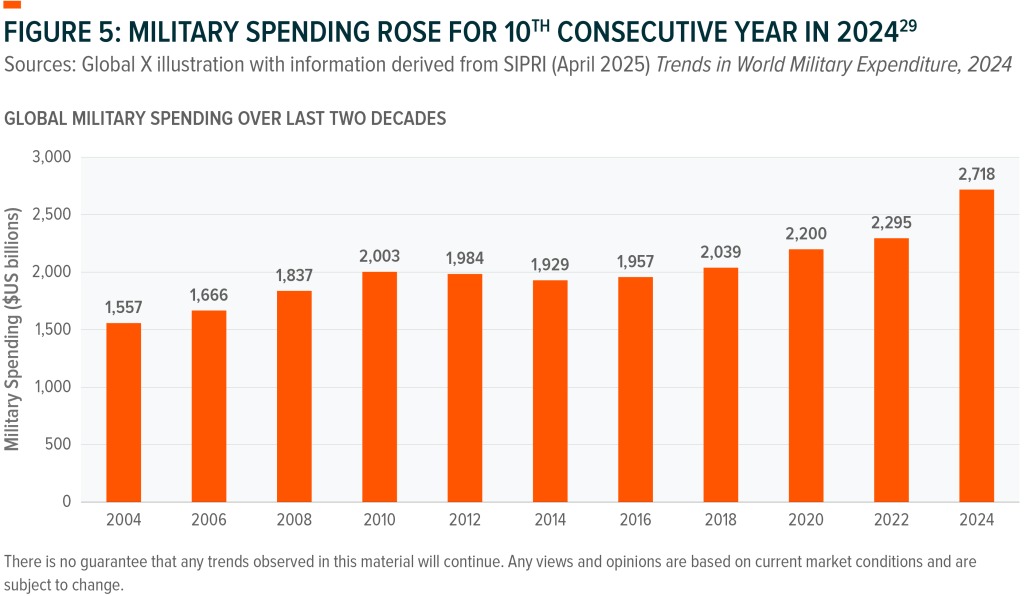

The breadth of spend is increasing, rather than just the U.S. NATO says all Allies are expected to meet or exceed 2% of GDP in 2025, while SIPRI records $2.718T in 2024 global military expenditure—the fastest y/y rise since at least 1988—with Europe and the Middle East leading the surge.25

“ReArm Europe / Readiness 2030” lays out build-outs by category. The Commission’s plan prioritises air & missile defence, artillery systems, ammunition & missiles, drones/counterUAS, military mobility, and AI/Quantum/Cyber/EW, all of which may translate into electronics, power conditioning and high-reliability interconnects (i.e., more silver).26 Financing tools (SAFE) and coordinated procurement targets are meant to accelerate production capacity, not just research.27

Persistence of Demand

Defence procurement and readiness programs run on multi-year build-outs and alliance pledges; once in motion, they tend to persist across political cycles—another reason silver’s demand mix is becoming stickier and less GDP-sensitive.28

How silver is used here (at a glance):

- Connectors & contacts: MIL-spec circular connectors (e.g., MIL-DTL-5015/38999) commonly use silver-plated high-current contacts for low resistance and thermal stability.21

- Power electronics & sensors: silvered relay/contact materials (AgNi, AgSnO₂) in avionics, radar, EW and missile systems; solder in boards/assemblies across platforms.22

- Ground systems: silver-plated busbars and switchgear in command/control, radar stations, hardened data facilities.23

3) Secondary Effects: Power Grids & Solar

Why growth could be durable

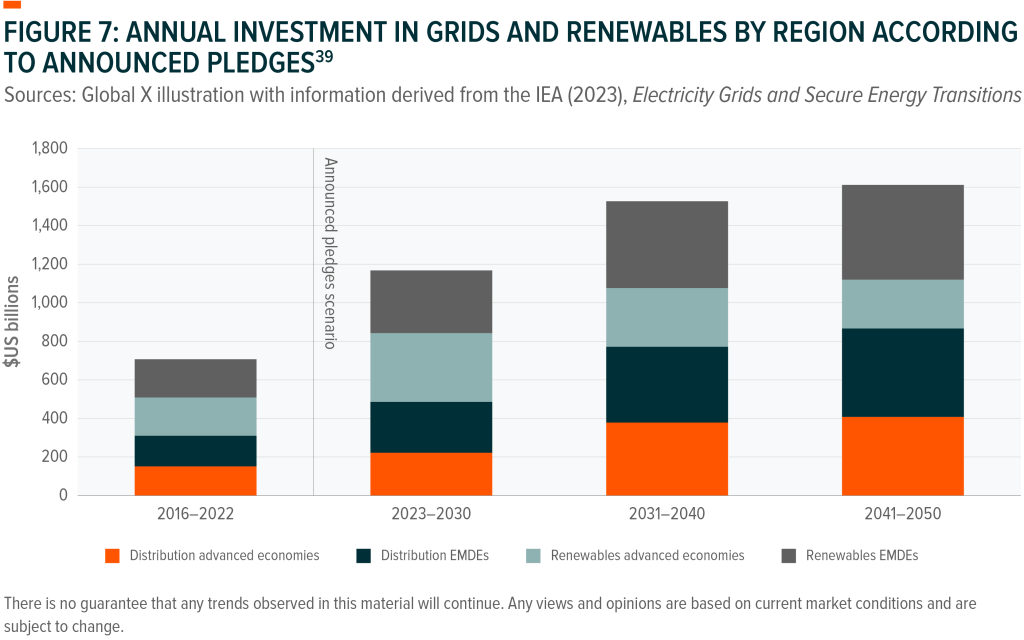

Global electricity demand is now re-accelerating, driven not only by AI/data-centre load but also by wider electrification in transport, buildings (heat pumps) and industry, which may push demand growth close to 4% annually through 2027.31 To keep pace, grids must scale dramatically: the IEA warns annual grid investment needs to nearly double to >USD 600bn by 2030.32 Complementing this, BloombergNEF’s Net Zero Scenario pegs required grid spending at roughly USD 811bn per year by 2030, underscoring that networks – and the generation to feed them – will have to expand rapidly.33 (Figure 7)

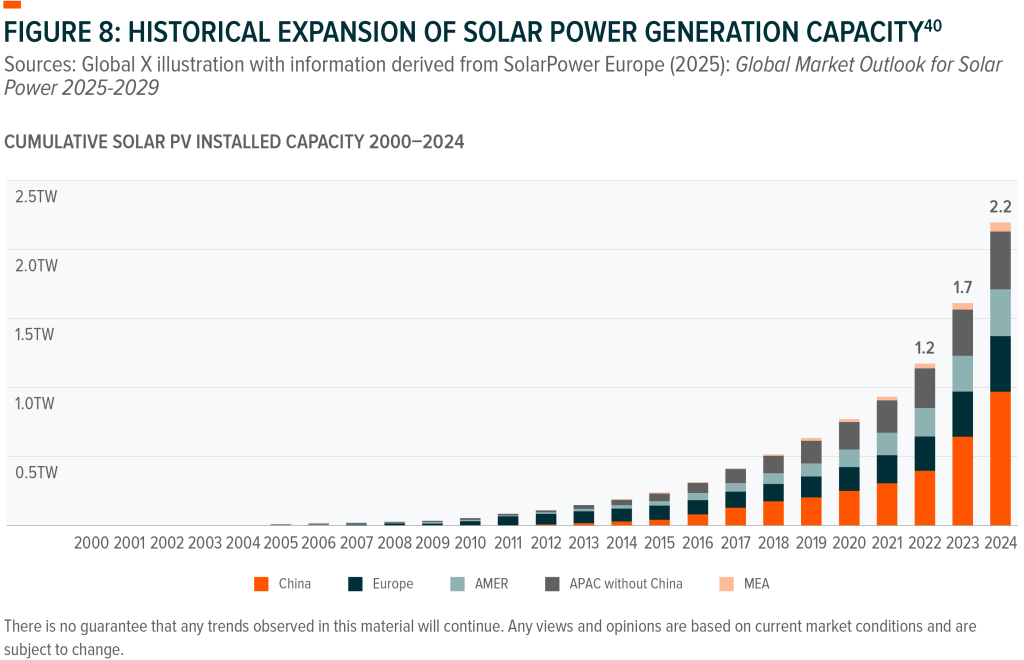

Solar keeps compounding, which benefits silver

Wind and solar PV are expected to cover over 90% of the increase in global electricity demand in 2025.34 A record 597 GW of solar power capacity was added in 2024.35 Silver in PV hit ~197.6 Moz in 2024 despite thrifting— because module volumes exploded.36

Grid upgrades are essential and constrained

AI/data-centre surges amplify the need for new transformers, lines and substations; backlogs have doubled/tripled since 2019, extending lead times and prices.37 These systems use silvered contacts and busbars throughout.38

How silver is used here (at a glance):

- Grid gear: silver-plated copper busbars, breakers and contact sets in substations/switchgear; relay contacts in protection systems.7

- PV cells (solar): silver is the critical front-and back-contact metallisation paste in mainstream cell architectures (PERC/TOPCon/HJT), even as loadings are thrifted.19

4) Adjacent structural drivers: Healthcare, 5G & Quantum

Beyond the core pillars, three smaller but sticky niches round out the industrial picture

- 5G/6G & RF

- More gear = more silver. Rolling out faster networks likely means more radios and backhaul equipment; many of these parts rely on silver finishes/contacts for performance, so densification appears to directly lift silver use and replacement demand over time.41

- QUANTUM COMPUTING

- Small but growing niche. Rising public funding and new labs likely mean more quantum systems, each needing specialised cryogenic and RF hardware that uses silver components—building a sticky, high-spec demand pocket even at modest volumes.42,43

- HEALTHCARE

- Steady, regulation-backed pull. Hospitals and device makers use silver-based antimicrobials in dressings and coatings; as infection-control standards spread, this may create a recurring, baseline draw for silver in medical products.44

Why it matters

These markets are smaller than solar or the grid, but they’re driven by multi-year programs, likely rendering their silver demand comparatively durable through cycles.

5) What this means for miners

- Pricing leverage if deficits persist

- A demand mix increasingly anchored in AI power-hungry infrastructure, defence procurement, and solar set against constrained primary supply supports a constructive multiyear setup for well-run, disciplined producers.45

- Discipline over dilation

- After prior boom-bust scars, management teams are prioritising returns on capital and brownfield/bolt-on expansions instead of aggressive greenfield capacity – rational given by-product dependence and permitting drag.46 Streaming has crept higher while producer hedging sits near multi-decade lows, consistent with a measured stance.47

- M&A revival to solve grade and scale

- With high-grade discoveries scarce and timelines long, miners are buying ounces and optionality (projects and near-term restarts) rather than over-building.48 2024’s ~$3B in silver-sector deals appear to reflect that pivot and represents a win-win for investors (through premiums paid for acquisitions) and miners themselves (through lower risk supply), if the trend persists.49

1 IEA (10/04/2025) Energy & AI – Energy demand from AI

2 European Commission (06/03/2025) White Paper for European Defence – Readiness 2030

3 SolarPower Europe (2025) Global Market Outlook 2025

4 Silver Institute (16/04/2025) World Silver Survey 2025 — deficits & record industrial demand.

5 Analysis by Global X, using data sourced from the Silver Institute, World Silver Survey 2025 (16/04/2025)

6 AIM Solder (n.d.) SAC305 Alloy Composition – TDS.

7 ABB (2011) Busbar Selection & Design – Technical Note (silver plating per ASTM B700).

8 Eaton (17/04/2025) Magnum PXR Low-Voltage Switchgear – Design & Application Guide.

9 IEA (10/04/2025) AI is set to drive surging electricity demand from data‑centres

10 Ibid

11 Dell’Oro Group (06/08/2025) Hyperscalers to Account for Half the $1.2 Trillion Global Data Center Capex by 2029

12 Synergy Research Group (19/03/2025) Hyperscale Data Center Count Hits 1,136; Average Size Increases; US Accounts for 54% of Total Capacity

13 S&P Global (18/04/2025) Despite renewed interest in nuclear, skepticism on financing persists

14 FT (04/07/2025) Hitachi Energy says AI power spikes threaten to destabilise global supply

15 Financial Times (21/07/2025) Hitachi Energy: transformer backlog tripled to ~$43bn.

16 Ibid

17 Ibid

18 IEA (2025), Global data centre electricity consumption, by equipment, Base Case, 2020-2030

19 Analysis by Global X, using data sourced from Bloomberg

20 Analysis by Global X, using data sourced from the Silver Institute, World Silver Survey 2025 (16/04/2025)

21 TE Connectivity (n.d.) MIL-DTL-38999 Series overview (defence interconnect platform, silver-plated contacts)

22 NASA (n.d.) NASA Technical Reports Silver plating ensures reliable diffusion bonding of dissimilar metals

23 Ibid

24 European Defence Agency (04/12/2024) Defence Data 2023–2024 — €72bn investments; procurement share

25 SIPRI (28/04/2025) Trends in World Military Expenditure 2024 — $2.718T (+9.4% y/y).

26 Council of the EU (27/05/2025) SAFE instrument adopted — EU defence procurement financing.

27 Ibid

28 Ibid

29 SIPRI (April 2025) Trends in World Military Expenditure, 2024

30 European Defence Agency (2025)

31 IEA (2025) Demand: Global electricity use to grow strongly in 2025 and 2026

32 IEA (2025) Electricity Grids and Secure Energy Transitions

33 BloombergNEF (20/12/2024) Significant Investment Needed to Ready the Global Power Grid for Net Zero: BloombergNEF report

34 Ibid

35 Ibid

36 Ibid

37 IEA (17/10/2023) Electricity Grids and Secure Energy Transitions

38 Ibid

39 IEA (2023), Electricity Grids and Secure Energy Transitions

40 SolarPower Europe (2025): Global Market Outlook for Solar Power 2025-2029

41 MDPI Applied Sciences (2023) Review of Low Loss Waveguide Technology

42 Bank of America Global Research (16 Jul 2025) Nothing Compares to Q – Quantum Computing Primer

43 Oxford Instruments NanoScience (2025) Silver-Sinter Heat Exchangers for Dilution Refrigeration

44 NIH (05/092012) Appropriate use of silver dressings in wounds: International consensus document

45Ibid

46 S&P Global Ratings (14/01/2025) Industry Credit Outlook Metals and Mining

47 Silver Institute / Metals Focus (16/04/2025) WSS 2025 Launch Slides — silver-sector M&A ≈$3.0B

48 S&P Global (10/04/2024) Average lead time almost 18 years for mines started in 2020–23

49 Ibid