Last month, the UN International Maritime Organization (IMO) pledged to reduce greenhouse gas emissions from shipping to net zero “by or around 2050”.

This is an encouraging step forward from an industry that was previously in the doldrums on the climate transition. The IMO agreement sets interim decarbonisation “checkpoints”, and confirms the development of new fuel standards and an emission pricing mechanism. However, the new targets still fail to align with a warming trajectory of 1.5 degrees, pushing key decisions out to the next meeting in 2025. In this article, we explore the implications of the new agreement for the industry and investors and outline how we will engage with our holdings to support the net zero transition.

The shipping industry has historically been the problem child of the net zero transition. It is responsible for nearly 3% of global emissions, roughly the same amount as Germany’s carbon footprint. While the emissions efficiency of international shipping has improved over the last fifteen years, the growth in the global fleet has meant that absolute emissions from the sector have continued to rise. In 2018, the IMO established goals to reduce the carbon intensity of shipping to 40% by 2030 and to halve emissions by 2050, compared to 2008. These goals were grossly misaligned well below 2°C degrees global warming ambition of the Paris Agreement, and were more closely aligned with 3-4°C of global warming[1]. The old IMO targets acted as an inhibitor on industry ambition, as shipping companies chose to align with the recent IMO targets.

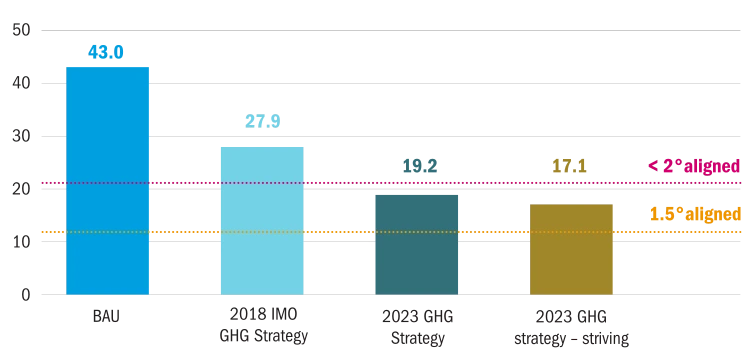

Figure 1: Cumulative emissions reduction alignment for the 2023 and 2018 IMO strategies against a business-as-usual (BAU) scenario from 2020-2050

Source: ICCT

In July 2023, the IMO’s 175 member states agreed to cut the shipping industry’s emissions to net zero “by or around 2050”. Countries agreed to cut the sectors emissions against a 2008 baseline by “at least 20%, striving for 30%” by 2030, and by “at least 70%, striving for 80%” by 2040. These objectives are not legally binding but have been approved unanimously by IMO countries who will establish legally binding measures to follow through on their pledges. These targets are not deemed to be aligned with 1.5°C, but are compatible with the well below 2°C degrees ambition of the Paris Agreement2. These targets will be reviewed in 2028, where industry insiders suggest they could be brought into line with 1.5°C3.

The IMO also agreed that the achievement of these targets would be driven by a basket of medium-term measures. These are likely to include a fuel standard that set limits on the amount of emissions shipping fuels can produce which then declines over time, a carbon price that increases the cost of fossil fuels, raising and distributing revenues to aid the transition. There was considerable debate about the precise details of these instruments, and they are due to be finalised in 2024 to enter into force in 2027. However, member states did agree to set a target for at least 5%, striving for 10% of the energy used by shipping by 2030 to be from energy sources with zero or near-zero emissions.

At Columbia Threadneedle Investments we believe the 2023 IMO strategy will have a series of implications for shipping providers and users:

- The IMO has shifted its carbon accounting system from a Tank-To-Wake to a Well-To-Wake focus. Essentially, this means that the emissions from fuel extraction and production need to be accounted for, as well as emissions from the fuel combustion in a ship’s engine. This is important as it drastically reduces the carbon competitiveness of fuels with large upstream emissions, such as LNG and blue hydrogen.

- 5-10% of green fuels by 2030 target will boost biofuels, wind power, hydrogen and ammonia. Biofuels will be further supported by the IMO approving interim guidance on biofuel use.

- Ships tend to have long lifetimes of over 20 years. The 2023 IMO GHG strategy sends a clear signal that ships being ordered today, and many already built, have to be capable of running on zero emission fuels.

Investor expectations will also harden around a series of asks and datapoints to appraise shipping providers and user readiness for the climate transition:

- The majority of shipping emission reductions in the short term will come from energy efficiency improvements – these measures could deliver 25-30% carbon savings across the global fleet4. Investors will expect shipping providers to disclose carbon intensity targets and disclose the fuel efficiency of their fleets against the IMO Carbon Intensity Indicator system.

- As the imperative for green fuels grow, investors will expect shipping providers to develop and disclose long-term and transitional fuel strategies, addressing factors such as demand projections and infrastructure needs.

- Given that the IMO roadmap for instituting a carbon price is set, and the EU’s emissions trading system (ETS) will cover shipping from January 2024, investors will expect shipping providers to embed carbon price projections in financial stress testing and fleet strategy.

The IMO agreement on a set of climate targets that are aligned with the Paris Agreement is a welcome boon for the shipping sector. However, shipping’s climate transition still needs plenty of work to be made shipshape. At Columbia Threadneedle Investments, we will continue to work closely with our investee companies that provide or use shipping services to strengthen their climate strategies and manage their exposure to climate risks.

1 Climate Action Tracker, International Shipping, 30 June 2023

2 Icct, IMO’S NEWLY REVISED GHG STRATEGY: WHAT IT MEANS FOR SHIPPING AND THE PARIS AGREEMENT, 7 July 2023

3 UMAS, An overview of the discussions from IMO MEPC 80 and Frequently Asked Questions, 7 July 2023

4 Global Maritime Forum, Energy Transition, Getting to Zero Coalition