EU votes to cut car emissions

The EU has finalised a voted to cut emissions from all new cars sold from 2035 onwards by 100%.

Originally interpreted as prioritising the sale of new electric vehicles (EVs) from 2035, a group of car-friendly countries including Germany, Italy, and Poland, argued successfully for the inclusion of “carbon neutral” synthetic e-fuels which can power internal combustion engine vehicles.

It is unlikely to make much of a difference, however, to the roll-out of EVs – both Audi and Volkswagen executives have re-affirmed commitments to EVs, and Hyundai aims to be one of the world’s top three EV manufacturers by 2030.

Additionally, synthetic fuels are complicated and expensive to produce, with limited technological progress on the horizon. The NGO, Transport & Environment found that EVs can travel six times further than synthetic e-fuel cars on the same amount of renewable energy, and by 2035 there will only be enough synthetic e-fuel production for just 2% of Europe’s cars.

With many car manufacturers focused on being competitive in the EV market, the discussion around automobile synthetic e-fuels looks to have been nothing more than a distraction.

Banks funding fossil fuel

The 2023 edition of Banking on Climate Chaos has been released, which is a great tool for tracking major banks’ lending to the fossil fuel industry.

One highlight from this year is that Canada’s major banks have sunk $1 trillion into fossil fuels since 2016 — and risk becoming ‘overexposed’ in the energy transition, despite pledging to reach net-zero greenhouse gas emissions.

The world’s 60 largest banks provided $7.4 trillion over the same period, meaning Canada’s largest banks are responsible for approximately 15 per cent of global investment in fossil fuels since 2016. As a reminder, greenhouse gas emissions from fossil fuels are the primary driver of climate change. Canadian banks are financing the oil sands as foreign banks divest from the region. In 2022, oilsands companies received $28 billion from banks, with nearly 90 per cent of those funds coming from Canada’s Big five.

Feeding us Greenwashing

The food sector has come under scrutiny from the NGO, Changing Markets Foundations.

Its research, Feeding Us Greenwashing, found that greenwashing in the food sector is ‘rampant’. It states that companies are making misleading claims about their carbon emissions and sustainability, and that it is “urgent that regulators start taking a closer look at food products and companies, regulate green claims, and ensure rules are properly enforced across different markets”.

Meat and dairy companies, such as JBS, Nestlé, Arla, Danone and Fonterra, were found to be some of the worst offenders and responsible for high greenhouse gas emissions. Amazon was also found guilty of greenwashing by including meat and dairy products in their ‘Climate Pledge Friendly’ range, despite scientific assessments showing them to be the most carbon-intensive food products. Additionally, ‘significant greenwashing’ was discovered in dairy products, with misleading claims like ‘carbon neutral’ being made only in reference to packaging, and vague claims such as ‘planet-friendly’ and ‘sustainable future’ being unsubstantiated in most cases.

Findings from the research highlights that consumer behaviour is significantly influenced by green claims on labels. In the UK, 42% of consumers were found to be more likely to purchase products with a ‘carbon neutral’ label, with 29% willing to pay slightly – or much more – for these products. In Germany the picture is much the same, with 35% of consumers more likely to buy a meat or dairy product labelled ‘carbon neutral’ and 36% more likely to buy meat or dairy labelled ‘climate positive’, with 32% and 36% willing to pay more for these labels respectively. Whilst it’s positive that consumers are considering the environment while shopping, the risk of greenwashing is becoming ever more likely.

Australia walking the walk?

Australia has passed tougher laws that will force its largest emitters to reduce or offset their emissions in line with the country’s national decarbonisation targets.

The “Safeguard Mechanism” will require over 200 oil, gas, mining and manufacturing facilities that annually emit more than 100,000 tonnes of carbon dioxide-equivalent to cut their emissions by 30% over the next seven years.

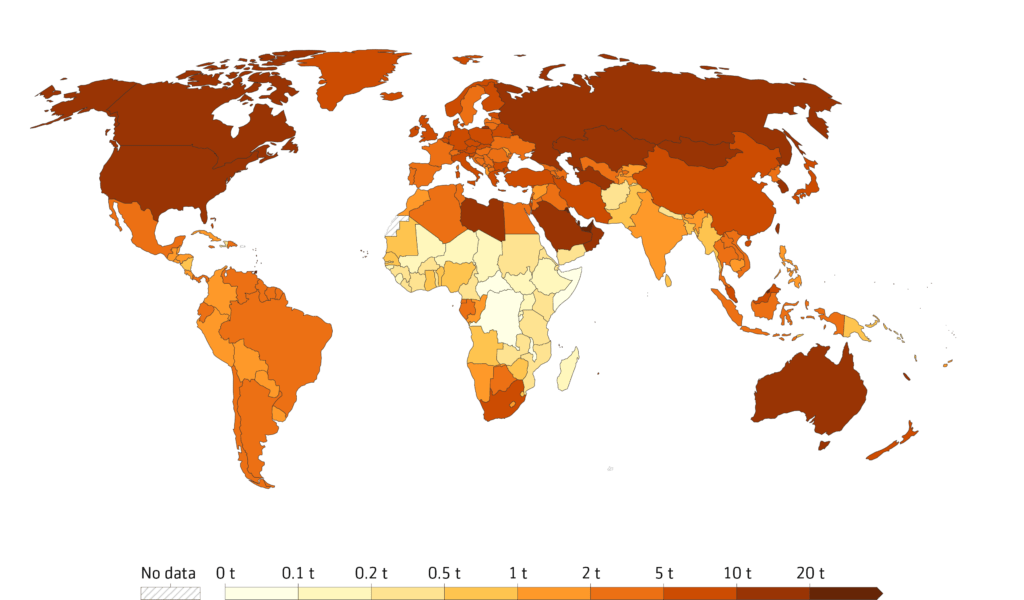

Per capita CO₂ emissions, 2021

As a result of these limits, producers will require strong abatement solutions to achieve net zero emissions. This will result in greater costs for companies and is expected to boost carbon capture and storage projects across Australia (controversial as they currently may be…).

Whilst it has a relatively low population, Australia has one of the highest levels of total emissions and is particularly vulnerable to the effects of global warming. For a country that has seen significant protests, climate-related shareholder resolutions at Company AGMs, and an increasing frequency of extreme weather events, the introduction of stronger climate regulation is a welcome move.

Important Disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2022 Aegon Asset Management or its affiliates. All rights reserved.