A smokeless future?

There have been a few studies in the news recently. The first, on the level of vaping in children aged 11-17, comes mostly in response to the government consultation on how to reduce the use of vaping in children.

Action on Smoking and Health (ASH) released their results that showed nearly 7.5% of kids are vaping in comparison to around 3.5% who are smoking but the number of kids trying it out has risen by 50% in the past year to 11.5%. It would appear that these are mostly the single use vape kits rather than the refillable, which obviously has an environmental impact as well.

A much smaller investigation in Liverpool found that there were high levels of lead, nickel and chromium contained in a lot of these kits, which can have long term health effects. We can expect there to be a lot more news filtering in about this as the government consultation progresses – and possibly more of a clamp down on the imported products that are clearly marketed for children and flavoured in a range of sweets to improve appeal.

SBTN Framework

Last month, the Science Based Targets Network (SBTN) unveiled the first release of nature-focused science-based targets for corporations. These targets provide a framework for companies to evaluate and prioritise their ecological footprints, while also establishing a benchmark for addressing these concerns.

This initiative expands upon the progress made by the emissionsfocused Science Based Targets initiative (SBTi), allowing companies to set targets that go beyond addressing climate-related issues. The SBTN say that these new targets will complement existing climate targets, “allowing companies to take holistic action to address their impact in the face of mounting environmental and social crises.”

As part of its initial release, the SBTN is unveiling targets that focus on freshwater and land, providing companies with the means to evaluate their impacts and establish objectives related to freshwater quality and quantity, as well as the protection and restoration of terrestrial ecosystems.The release forms part of a multi-year plan, with future coverage including biodiversity and ocean targets.

The SBTN has revealed that 17 companies have been selected to pilot the validation process for the newly introduced targets. The validation process for companies outside the pilot group is expected to commence in early 2024.

The participating companies in the pilot phase include AB InBev, Alpro (a division of Danone), Bel, Carrefour, Corbion, GSK, H&M Group, Hindustan Zinc, Holcim, Kering, L’OCCITANE Group, LVMH, Nestlé, Neste, Suntory, Tesco, and UPM.

“Safe and Just” Earth System Boundaries (ESBs)

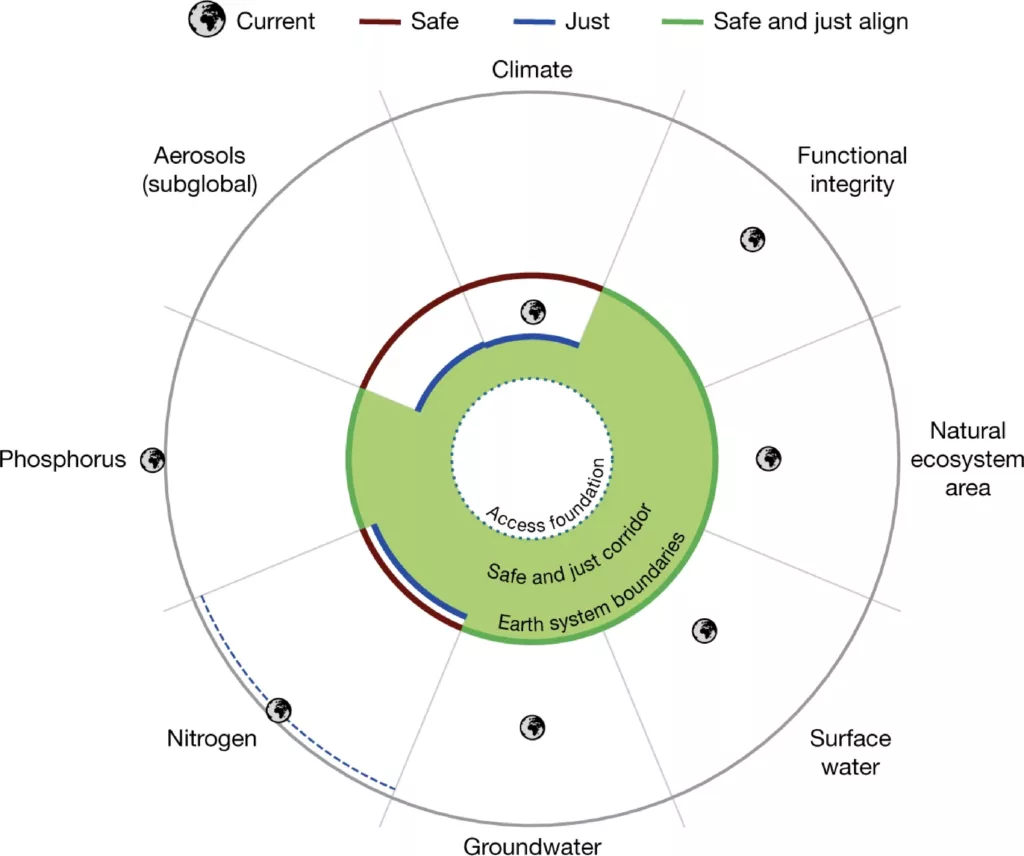

The Earth Commission, an international team of leading natural and social scientists, has published the first study quantifying Earth System Boundaries (“ESBs”).

ESBs define safe and just limits for a range of biophysical processes and systems which regulate the Earth system, including climate, freshwater use, the biospshere, nutrients and aerosols. The report makes for grim reading with the authors concluding that human activity has already led to 7 out of the 8 ESBs breaching their safe and just corridor, risking the stability and resilience of the entire planet.

The ESBs will also be used as the basis for a new set of sciencebased targets for businesses, cities and governments to help address these crises.

Earth’s planetary boundaries

Biofuels

The aviation industry is responsible for around 3% of global emissions and one way the EU are trying to decarbonise the sector is using animal fats in jet fuel. EU rules classify three types of animal fats depending on their quality. Categories 1 and 2 should be used in heating applications, such as biofuel, whereas category 3 has wider uses including in pet food and cosmetics.

But with the burning of animal fat biofuels set to triple by 2030, there will not be enough to scale it up sustainably and using animal fat to power planes could force other industries to rely on substitute materials, such as palm oil.

A study by Cerulogy for the Transport and Environment agency found that the subsidies introduced by the EU have created a financial incentive to mislabel the higher quality category 3 fats. The increased demand for category 1 and 2 and potential mislabelling of category 3 animal fats, has led to pressure on the entire supply chain, driving up prices for the likes of pet food and cosmetics manufacturers.

The worry is that competition to secure feedstock for biofuels will indirectly increase the amount of palm oil being used throughout European supply chains.

Meet the gummy squirrel

And over 5000 other weird and wonderful species living in deep-sea habitats – nearly all of them previously unknown to science. The new species were discovered by remote-controlled vehicles sent to the bottom of the seabed in a region known as the Clarion-Clipperton Zone (CCZ), an area targeted for mining in the coming years.

The UN body responsible for regulating deep-ocean mining will soon consider whether to permit the first project to move forward. Proponents of deep-sea mining argue it will be essential in order to secure the minerals necessary for EV batteries and renewable energy technologies. But many, from countries to companies, are pushing back until the implications for biodiversity are better understood.

Important disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2022 Aegon Asset Management or its affiliates. All rights reserved.