After a strong performance in 2023, Brazilian assets had a weak first half of the year. Despite investors’ concerns and a hawkish turn by the central bank, macroeconomic fundamentals remain strong. In this Macro Flash Note, Economist Joaquin Thul explains why Brazilian assets could surprise on the upside in the second half of 2024.

After a strong 2023, Brazilian equities had a weak first half of the year. The Bovespa equity index was down almost 8%, underperforming markets in both emerging and advanced economies. In addition, the Brazilian real depreciated by almost 15% against the US dollar, suffering the largest depreciation across all emerging currencies year-to-date.

The underperformance of Brazilian stocks can be explained by a combination of external and domestic factors.

On the external side, US interest rates remaining elevated this year has contributed to the strength of the US dollar, to the detriment of emerging economies. Weak demand from China for Brazilian exports and a decline of over 30% in iron ore prices in mid-March impacted Q1 earnings.

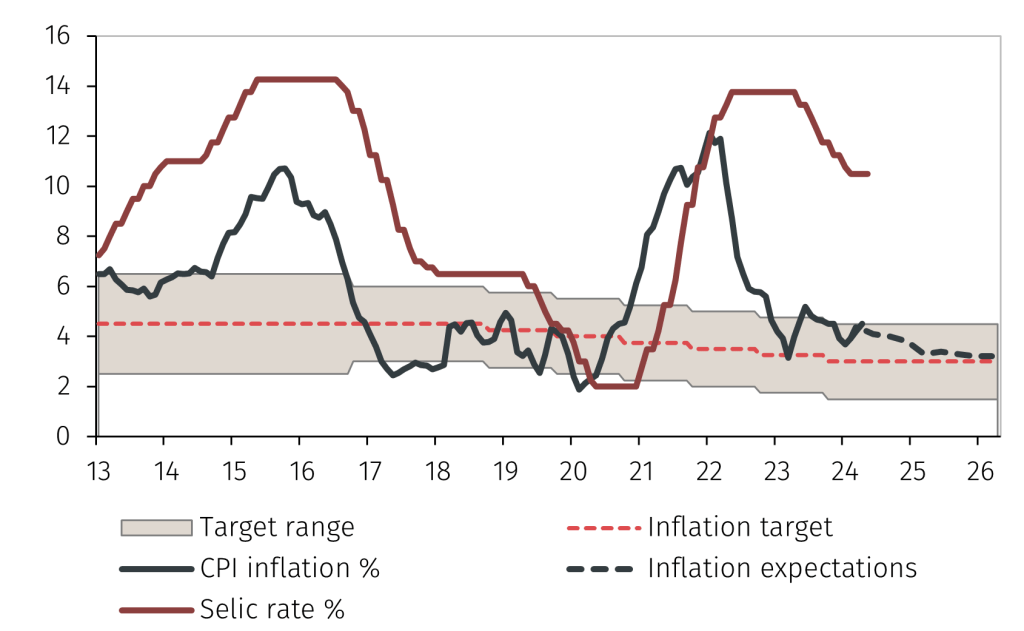

On the domestic side, market sentiment was negatively affected in the first quarter by President Lula’s attempted intervention in Petrobras’ dividend policy.1 Additionally, in April Brazilian authorities announced a plan to downgrade the 2025 fiscal target to a zero-deficit goal, following an increase in government spending that would prevent them from achieving the primary surplus commitment of 0.5% of GDP. Moreover, In May the Brazilian Central Bank (BCB), following six consecutive 50 basis points (bps) interest rate cuts, voted in favour of reducing the pace of monetary easing to 25bps. This came after concerns over rising price pressures from a stronger services sector leading to a de-anchoring of inflation expectations. The Selic rate was kept on hold at 10.50% at the last two monetary policy meetings in June and July (see Chart 1). These decisions were interpreted by markets as a sign that the BCB may have eased policy prematurely and could be forced to raise interest rates later in the year.

Chart 1. Monetary policy and inflation

Finally, floods in the southern state of Rio Grande Do Sul increased fears of weaker agricultural production that could result in higher food prices and impact Q2 GDP. However, it is still difficult to assess the likely magnitude of the drag on economic activity. Reports show that harvests of agricultural products this year have been good. This, together with the recovery of iron ore prices and strong oil production suggest the impact of floods on exports could be less severe than originally feared.

Overall strong macroeconomic environment

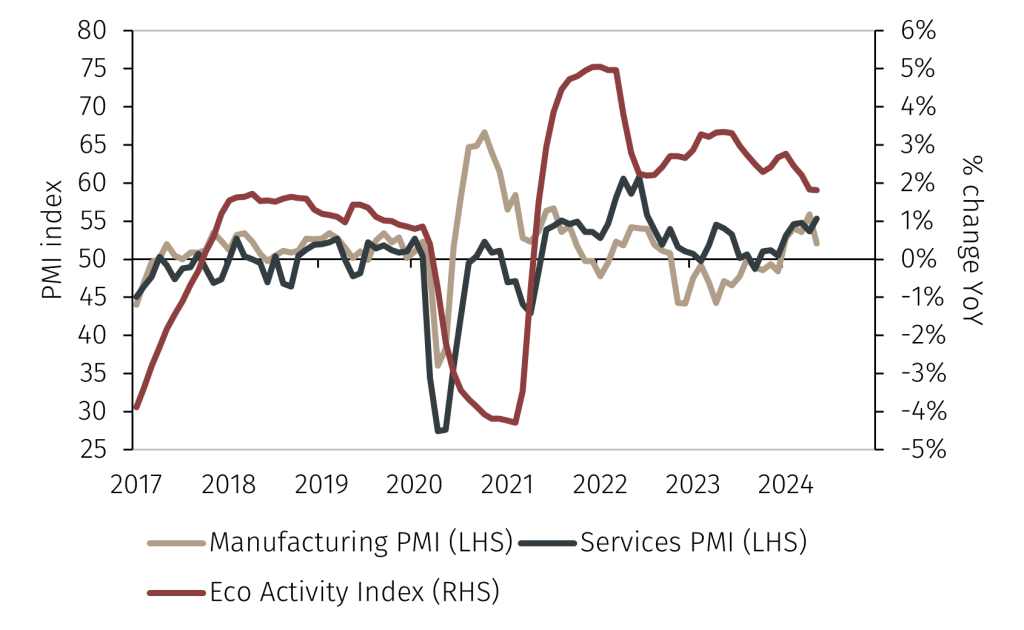

Despite these negative shocks, macroeconomic fundamentals remain strong. The economic activity index has showed signs of growth slowing, but remains positive, supported by the resilience of the services sector, as reflected by the services Purchasing Managers’ Index (PMI) (see Chart 2).2

Chart 2. Manufacturing and Services PMI indices

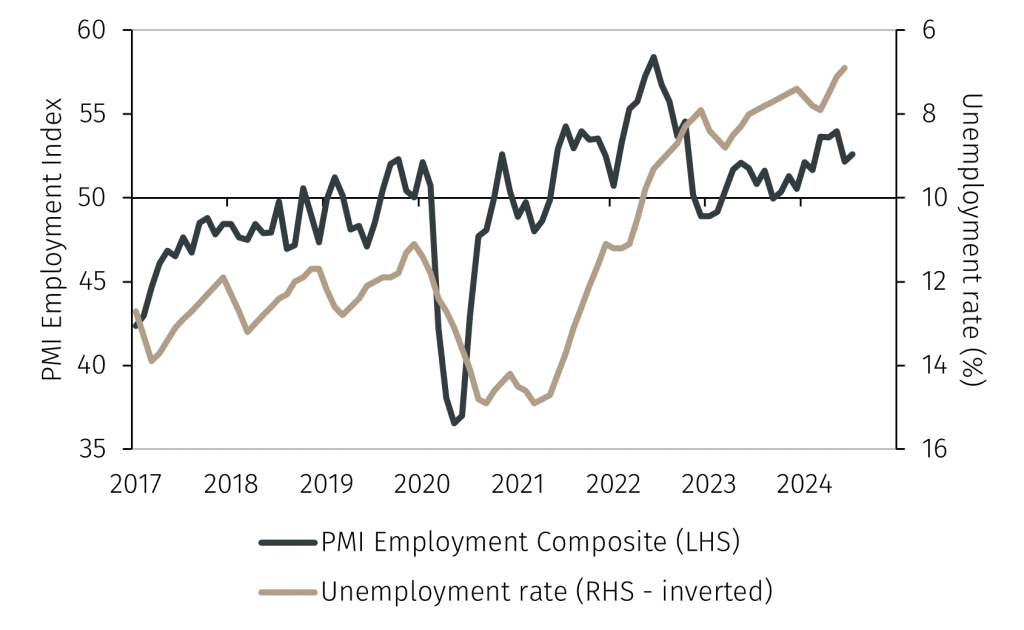

The strength of the services sector can be explained by strong consumption levels, supported by a tight labour market. Employment indicators have been robust, with the unemployment rate consistently declining over the last three months from close to 8% to under 7% in June (see Chart 3).

Chart 3. Labour market indicators

Outlook for the rest of the year

The IMF projects GDP growth in Brazil to moderate from 2.9% in 2023 to 2.1% in 2024 as a result of a still-restrictive monetary policy, and a lower fiscal impulse from the expected cuts to government spending to meet fiscal targets. Expectations that Congress will finalise details of the long-awaited VAT reform, could provide a tailwind to the private sector, as efficiency gains from a simpler tax system could favour investment.

The underperformance of Brazilian stocks has been notable this year and uncertainty will undoubtedly persist through the rest of the year as negative sentiment continues to weigh on domestic assets. The BCB is expected to maintain the Selic rate unchanged for the rest of the year, given inflationary pressures, which could pose an additional headwind for stocks as borrowing will remain expensive. However, a strong macroeconomic backdrop combined with some clear signals on fiscal policy consolidation from government authorities will provide some stabilisation to Brazilian assets in the second half of the year. This has already been reflected by the strong performance in Q3, as stocks have bounced back by almost 7% in the quarter.3

From a Brazilian equity positioning perspective, Fund Manager Fergus Argyle has a much more constructive view than one quarter ago. The central bank is finally talking tough on inflation, as evidenced in the latest minutes, which has put a floor under the currency and turned investors’ gaze back to domestic companies which are delivering solidly in a robust economic environment. The headwind of local investors facing redemptions in an elevated Selic environment remains, but international investors are coming back – more so given the relatively calm performance of markets during the recent yen carry unwind and artificial intelligence correction. There is a clear distinction in earnings growth from less leveraged companies versus those peers struggling to cover interest costs in a higher-for-longer environment. One additional potential benefit for Brazilian FX and thus equities would be the Federal Reserve easing cycle: if we see cuts into H1 2025 then Brazilian equities look set to be in a leading position.

1 https://www.reuters.com/business/energy/petrobras-dividend-spat-ceo-navigates-lulas-divided-cabinet-2024-03-13/#:~:text=Lula%20called%20again%20in%20a,and%20on%20the%20Petrobras%20board.

2 The Economic Activity index is compiled monthly by the Banco Central do Brasil and reflects the evolution of industrial activity, the services sector and agricultural production. Given differences in methodology, it cannot be considered as a direct proxy for GDP.

3 Performance measured using the Bovespa index. Data as of 13 August 2024.