London – There is a lot to like about the global high-yield market. The global developed economy is on a resurgent trajectory, corporate fundamentals have improved dramatically and central bank policy remains accommodative. That said, there are also critical factors that could weigh on the market: tight average valuations, the changing impulse of liquidity, the threat of persistent inflation, and COVID variant uncertainty.

Average valuations look to have priced in a lot of the good news. For example, in the U.S. high-yield market, as represented by the ICE BofA U.S. High Yield Index, the average spread to worst (STW) reached a 14-year tight (318 basis points) as of June 30, 2021, widening only modestly, to 345 basis points (bps), as at July 31. Thus far in August, it has been hovering around 350 bps. To put these figures into context, the long-term average STW for the US market is 551 bps.

Putting all that together, we believe it prudent at this juncture to reduce risk on the margin, edge up the capital structure, lower duration exposure, and adopt a very selective, watchful approach to the market.

So where do we still see investment opportunities? Here are five key areas.

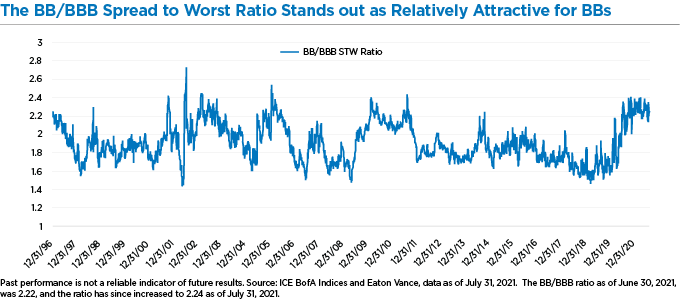

- Rising stars”. These are select names that are on a clear path toward an investment grade rating, some of which were downgraded during the height of the COVID-19 pandemic in 2020. In stark contrast to 2020, the first half of 2021 witnessed U.S. $19.5 billion in rising stars relative to only U.S.$2.6 billion in “fallen angels”. Indicative of this investment opportunity, the chart above shows the spread differential between BB and BBB-rated bonds remains wide of the long-term average, indicating room for attractive spread compression for “rising stars”.

- The reopening trade. We still see some value among select radio broadcasters, cruise lines and other players in the leisure industry, homebuilders, and entertainment & film companies. Caution is warranted, however. If concern over the Delta variant lessens, some of the bonds in these names will experience material spread compression, but if concern over Delta, or a newer variant, grows, this cohort will be in investors’ crosshairs.

- Take-out targets benefiting from the pent-up demand for M&A. Potential targets include names in the managed care, environmental and exploration & production sectors. We anticipate acquisition financing will account for a heavy percentage of primary volume in our market for the balance of the year, which we think could provide an opportunity if priced appropriately.

- Term loans. Loan issuance remains robust and we see select floating-rate loans offering compelling relative value. Climbing up in the capital structure and moving from fixed to floating with little, if any, reduction in yield appears attractive amidst the potential for emerging variants and inflation uncertainty.

- Certain segments of the energy continuum. Near term, we see relative value opportunities in certain energy producers with quality assets. We have little faith OPEC+ will maintain supply discipline should the price of oil climb or even stabilize near current levels. However, we believe the oil supply response in the United States is likely to be muted in view of domestic public policy, shareholder activism, calls for capital conservatism and the growing “fossil-free” trend among large public pension plans.

Bottom line: The outlook for the high-yield market remains positive. However, with average valuations now tight and market volatility likely to increase in the second half of 2021, we believe a very selective investment approach is required in order to capture remaining spread-tightening opportunities and limit downside risk.

Sources of data: Eaton Vance, J.P. Morgan, ICE BofA Indices, as of July 31, 2021, unless otherwise specified.