Most investors will have heard the phrase ‘time in the market, not timing the market’ over the years and logged it as another in a long list of financial aphorisms. And yet this short phrase embodies perhaps the most fundamental lesson of successful wealth generation: patient long-term compounding delivers results.

Staying the course when investing is at once the easiest lesson to understand and, for many, the hardest to apply, with a whole library’s worth of books on behavioural economics explaining why people are so often driven to buy and sell at precisely the worst time. Without denigrating all this academic work, the twin forces of fear and greed can usually be found at the root of this behaviour and, as long-term investors, they are exactly what we want to avoid. Across all our Multi-Asset funds and portfolios, we are always looking to prepare for any eventualities as best we can rather than having to react to them if they occur.

We have written about the potentially damaging impact of FOMO (fear of missing out) investing in recent years and the market psychology cycle shows how quickly hope and euphoria can turn into denial and panic, or fear becomes greed and vice versa.

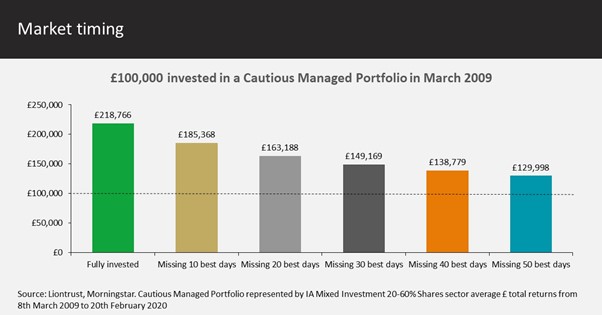

A few numbers show the potentially devastating impact of poorly timed decisions and reacting to short-term market noise: missing the best 50 days in markets over the 11 years from March 2009 to February 2020, which are just 1% of trading days, would have reduced the return from £100,000 invested in an average Cautious Managed fund from £218,700 to just under £130,000 – which equates to 75% lower returns.

Despite such stark figures, however, many investors still attempt to time their entry into and exit from markets and there remains plenty of cash on the sidelines after people divested at the height of the initial Covid panic last year. With the swiftest bear market decline in history giving way to a rapid bull recovery, many might still be waiting for a correction to get back in, attempting the dreaded ‘buy the dip’, but history shows even the most successful investors have struggled to get these calls right with consistency.

One of our favourite pieces of data shows that over rolling three-month periods in the last 25 years, the FTSE 100 has been down 30% of the time and up 70% of the time; if you extend this period to rolling 10 years, the ratio shifts to 98% of the time being positive periods. Making decisions based on short-term data rarely produces good results.

We believe in what we call noise-cancelling investment as far as possible: staying the course in a well-diversified portfolio and ignoring market fluctuations. Where investors have been unable to do this, however, it is typically better to be too early into markets than too late, particularly when it comes to more bearish periods. This is clear from our own experience in the Multi-Asset funds and portfolios, where we were admittedly too early into small caps and value last year and suffered on a relative basis as momentum continued its strong run until vaccine news in November 2020 turned everything on its head. More recently, those positions have started to bear fruit amid the market’s rotation into value and cyclicals; again, we wanted to prepare rather than react and to use a simple anecdote, it is better to be sitting on a train for a few minutes before it departs than try to chase it down as it pulls out of the station.

Looking over history, there are clear lessons to take from market recoveries and last year’s pandemic followed this pattern, albeit in turbo-charged fashion. As a basic rule – which supports the compounding argument – bear markets have been relatively short compared with recoveries and have also had a relatively modest impact on returns compared with the long-term power of bull markets.

According to figures from Capital Group, the average bear market going back to 1950 has lasted 14 months with a return of around -30% – the events of last year bucked that trend – while the average bull period has lasted five times longer, with total returns of close to 280%. This overall return has come against periods of negative headlines, significant volatility and market declines but that is exactly why we prefer noise-cancelling investment, focusing on returns slowly moving from the bottom left corner of a chart to the top right and ignoring up and downs along the way.

Markets have also tended to recover fast after steep downturns, with Capital Group numbers showing that in the 18 biggest market declines since the Great Depression, the S&P 500 was higher five years later and returns over the period averaged more than 18% a year. Returns were often strongest after the steepest declines, with the first year after the five biggest bear markets over the last 90 years seeing an average return of 71%.

These stats clearly show the benefits of staying the course and not being panicked into selling but are also a stark example of why too early beats too late, especially when it comes to market recoveries and rotations.

Key Risks

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital. The majority of the Liontrust Sustainable Future Funds have holdings which are denominated in currencies other than Sterling and may be affected by movements in exchange rates. Some of these funds invest in emerging markets which may involve a higher element of risk due to less well-regulated markets and political and economic instability. Consequently the value of an investment may rise or fall in line with the exchange rates. Liontrust UK Ethical Fund, Liontrust SF European Growth Fund and Liontrust SF UK Growth Fund invest geographically in a narrow range and has a concentrated portfolio of securities, there is an increased risk of volatility which may result in frequent rises and falls in the Fund’s share price. Liontrust SF Managed Fund, Liontrust SF Corporate Bond Fund, Liontrust SF Cautious Managed Fund, Liontrust SF Defensive Managed Fund and Liontrust Monthly Income Bond Fund invest in bonds and other fixed-interest securities – fluctuations in interest rates are likely to affect the value of these financial instruments. If long-term interest rates rise, the value of your shares is likely to fall. If you need to access your money quickly it is possible that, in difficult market conditions, it could be hard to sell holdings in corporate bond funds. This is because there is low trading activity in the markets for many of the bonds held by these funds. Mentioned above five funds can also invest in derivatives. Derivatives are used to protect against currencies, credit and interests rates move or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions.

Disclaimer

The information and opinions provided should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Always research your own investments and (if you are not a professional or a financial adviser) consult suitability with a regulated financial adviser before investing.