Since board diversity has been found to be a source of financial outperformance and can help create sustainable value,[1] we focus on increasing gender diversity through our voting and engagement. A recent study we commissioned encouragingly found an increase in the number of women on boards, although notable regional differences remain.

Published ahead of this year’s International Women’s Day on 8 March, the study compared more than 3 000 companies in which BNP Paribas Asset Management invests with around 17 800 listed companies included in the Institutional Shareholder Services[2] database. Here are the main findings (data as at the end of December 2022):

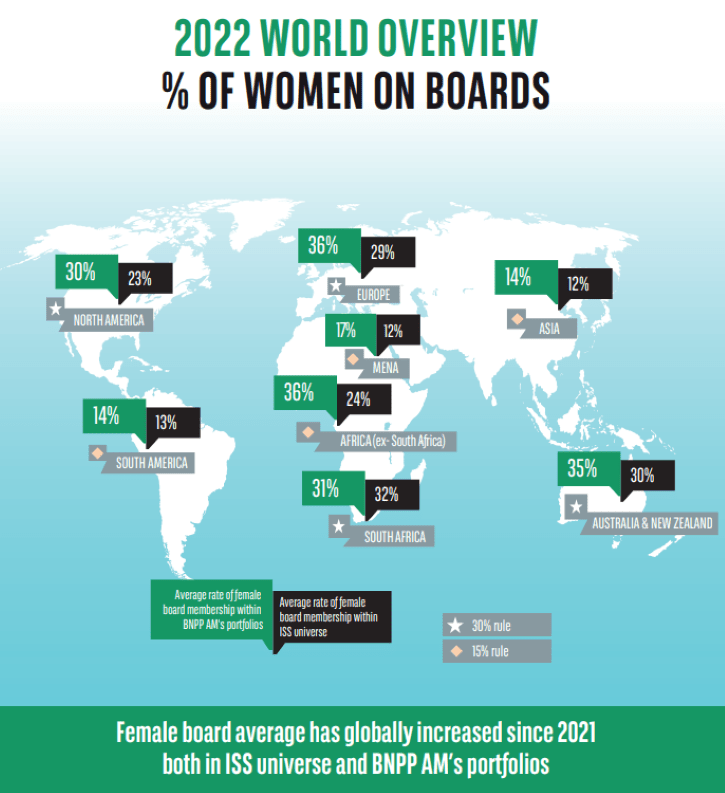

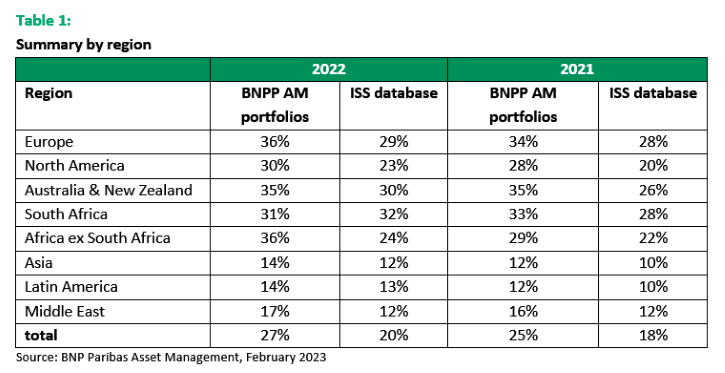

- On average, women hold 27% of board seats at companies in which BNPP AM invests; this is up two percentage points from 2021’s figure of 25% and exceeds the 20% average for companies in the ISS database

- Geographic differences are marked: Europe, South Africa and Australia are the most advanced in terms of board parity; all regions are improving.

Again, more women on boards

Between 2021 and 2022, female board membership has increased overall, with a two percentage point rise for both the ISS universe and BNPP AM investee companies.

Within BNPP AM portfolios, the most notable changes were in Asia and Latin America as well as in North America and Europe (see table).[3] In the ISS universe, the most significant increases were in South Africa and Australia & New Zealand.

National disparities remain. In France, an average of 44% of board members are women at investee companies, compared to 40% for the ISS universe. In North America, investee company female representation levels in Canada and the US are substantially higher than for the ISS universe. Investee company rates in Asia are generally lower.

Michael Herskovich, Global Head of Stewardship at BNP Paribas Asset Management, comments:

“Geographic differences should be viewed in the context of economic, socio-cultural and regulatory factors. Companies with large market capitalisations tend to integrate diversity issues more easily than smaller companies. Similarly, the existence – or absence – of legally imposed quotas impacts the growth of female board membership.”

The EU directive of November 2022[4] requires all large companies listed on EU stock exchanges to take measures to increase the presence of women in leadership roles and at board level by July 2026, so that at least 40% of non-executive director posts are occupied by women.

Strengthening our voting policy

Since 2019, BNPP AM has applied specific voting criteria on gender diversity regarding the election of directors at annual general meetings. We have gradually reinforced the requirements, depending on the degree of maturity of the different countries on diversity issues. This year, we are again enhancing our voting policy and increasing its minimum threshold for women on boards by 5%.

- In Europe, North America, Australia, South Africa and New Zealand, we now require a minimum level of female board membership of 35%

- In Latin America, Asia, the Middle East and Africa (excluding South Africa), we now require a minimum level of 20%.

Under our voting policy, we will oppose the election of all male directors at AGMs in all markets if these requirements are not met. In addition to voting at AGMs, we encourage investee companies to align with our diversity requirements through engagement.

Exceptions may apply if the percentage of female directors is respectively 20-35% and 10-20% and the company has made significant recent efforts to improve diversity, has a small board, has recently gone public or has a satisfactory ethnic diversity of the board,[5] is committed to reaching the required threshold in a short period of time, or has a female chief executive officer or president.

This strengthening marks another step towards our goal of a 40% threshold for female board membership at all investee companies by 2025.

View the study’s findings by clicking the infographic below.

References

1 “Companies whose boards are in the top quartile of gender diversity are 28% more likely than their peers to outperform financially.” McKinsey & Company study, ‘Diversity wins: How inclusion matters’, May 2020

2 Institutional Shareholder Services Inc. (ISS) is a company specialising in corporate governance solutions serving the international financial community, whose services are used by BNPP AM

3 Africa, where female board membership rose from 29% to 36%, was not counted as a significant progression due to the low number of companies covered. Similarly, the evolution of South Africa was not suitably representative.

4 Directive to promote board director equality: https://www.europarl.europa.eu/news/en/press

5 For North America, the UK and Ireland

Disclaimer

![]()