The last few weeks have brought plenty of new data and events, justifying a bit of a refresh of my central forecasts.

Building on my in-depth Q2 report (Not so Many Cuts?), in my central case, major economies avoid further recessions, inflation data gradually reassures central banks and we get more but gradual and relatively limited rate cuts from major central banks (with the exception of Japan where I still expect rate hikes). This remains a central case that requires activity growth to be neither too hot nor too cold and for services inflation, in particular, to cool significantly.

Moderate growth: I am still assuming that positive real pay growth (wage growth now running higher than headline inflation which is well off its highs) and at least some rate cuts support activity. But drags on growth include past rate hikes, past tightening in bank lending conditions (and less supportive fiscal policy in some economies). I assume that against that backdrop, labour markets loosen a little further on average, but unemployment rates don’t rise much, partly reflecting demographics looking beyond the next couple of years.

Inflation to reassure (but not in a straight line): In the central forecast, domestically driven inflation moderates from current levels, but not in a straight line and that on average, this remains on the high side of ‘comfortable’ from a central bank perspective. I am expecting headline inflation to prove bumpy over the next 12 months, reflecting base effects. More generally, I am not assuming that goods inflation sinks sustainably into deflation. It seems likely too that inflation shows a stronger tendency to ‘spike’ than pre-pandemic too, partly reflecting climate change. I have assumed that demographic strains end up constraining potential growth and pushing up on inflation in Europe. By the end of my forecast horizon (2029/30), headline inflation is generally running a touch above central bank targets.

Rates – gradual moves: Against that backdrop, my forecasts pencil in gradual and limited rate cuts in the US and in Europe. In the central case, across major economies, the activity and labour market data don’t give central banks a reason to cut interest rates with urgency. Progress on lowering domestically driven inflation is not straight line or especially quick in the central case. Too much uncertainty also remains around how restrictive current policy current settings are, and where neutral rates are for central banks to cut rates rapidly in my view (in the absence of significant recessions and job losses). While I am expecting a number of rate cuts to materialise, there is certainly a plausible risk scenario where they don’t. By the end of the forecast horizon, interest rates are close to, but not below, (my estimates of) neutral rates.

On the UK, in the near term, if the Bank of England don’t cut rates in August, I would be inclined to push a first rate cut to November, the next occasion after August when the Bank will publish new economic forecasts and schedule a press conference, and push out the rest of the rate cut profile accordingly. My central case sees China cutting rates further to support growth and Japan raising interest rates modestly from very low levels towards a very tentative estimate of a longer-run neutral rate at around 1.5-2.0%.

Fiscal policy meets election risk: Fiscal policy feels trickier to pin down a central case for, especially in the US given the upcoming presidential election. In the UK, the new government has also yet to publish its first Budget. In the central case at least, fiscal policy generally becomes somewhat less supportive of growth in Europe and the US. Worries about potential bond market reactions help provide some policymaker discipline, I assume, as does a return to application of the fiscal rules post-Covid in the EU, while UK policymakers are opting to stay within the guardrails of orthodox fiscal rules.

In the US, a ‘clean sweep’ (i.e. the same party win the presidency, House and Congress) in the 2024 election would increase the risk of looser fiscal policy in the US compared to the central case. Increased tariffs on US imports and looser fiscal policy would also likely imply higher US inflation than in the central case. I continue to think that there is a risk of fiscal sustainability returning as more of a market theme, not least given the starting point of already relatively high government debt to GDP levels, let alone the impact of ageing populations on government spending requirements and the apparent swing towards populism in some parts of the world.

Risk refresh: My conviction levels aren’t especially low for my central forecast but, as always, there are several places where this forecast could veer off track. It is still plausible that (among other things):

- We get another leg of downturn with interest rates as high as they are. I am still not willing to declare that we are fully ‘out of the woods’ on that risk.

- The US economy, sensitive to longer bond yields, could respond negatively to changes in policy post-election that result in sharp changes in market interest rates, e.g. if a clean sweep result led to significantly looser than expected fiscal policy settings or in the event that a President Trump, for example, were to challenge Federal Reserve independence.

- Services inflation may not decline as I expect. In the UK, for example, with growth in the labour force still relatively lacklustre, it may not take much of a pick-up in activity growth to see the labour market tighten again with stronger pay and inflation than I have pencilled into my central case.

- As for Japan, there is a potential sea change taking place in terms of economic backdrop – a real chance that Japan transitions to a higher inflation, higher nominal interest rate norm. For now, my forecasts for Japan are still something of a halfway house where interest rates rise very gradually, but where inflation still struggles not to slip back below the central bank’s 2% target.

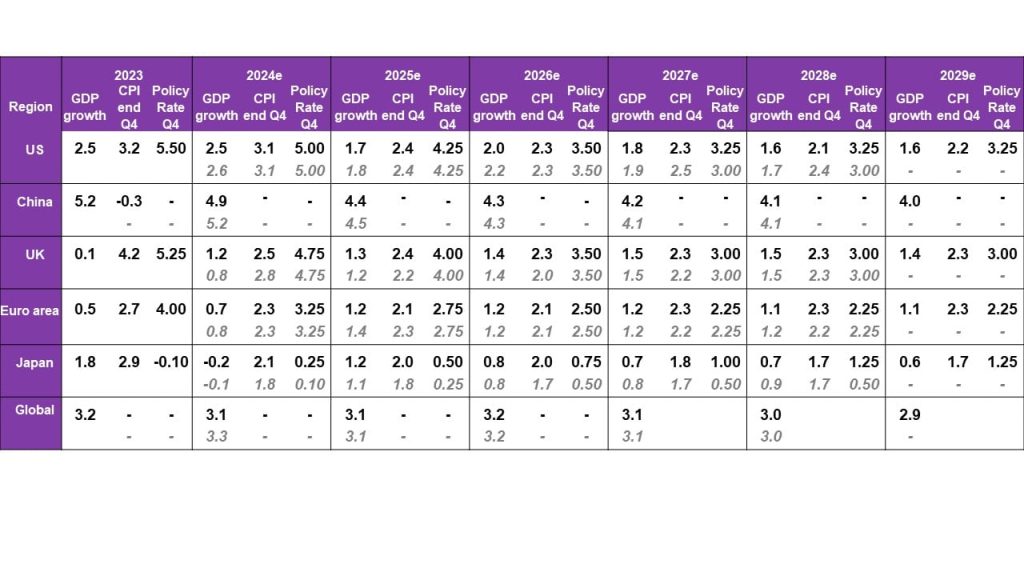

July 2024 base case

Source: LSEG DataStream, national statistics offices, Bloomberg Finance L.P. for past actual data. All forecasts (e) are RLAM. Current data and forecasts are in black. Forecasts from the May 2024 forecast update are grey and in italics. 2023 figures are past actuals. Note: US policy rate is the upper end of the Fed Funds target range. Euro area policy rate is the deposit rate.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.