Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

We are in an extremely challenging period for markets, with the vast majority of asset classes struggling.

If you take the IA sectors as a proxy for investment markets, all the equity categories bar Latin America and all the fixed sectors were down over the first four months of 2022. Giving a clue to the Latin American outperformance, one of the few areas able to produce a positive return was crude oil as energy prices surged because of the Ukraine conflict.

Taking a broad view, amid a wide equity sell-off, value has outperformed growth and quality as a style, and losses were most pronounced in January. If we look at the FTSE World Index, those sectors that have benefited from the relatively better value performance are tobacco, defence and energy, which are in positive territory, while growth areas have struggled. All these outperformers are parts of the market where our Sustainable Future (SF) funds have never invested.

Needless to say, these are short-term phenomena and performance looks very different over five years, where quality and growth have significantly outperformed value overall and technology has far outstripped those lagging value sectors.

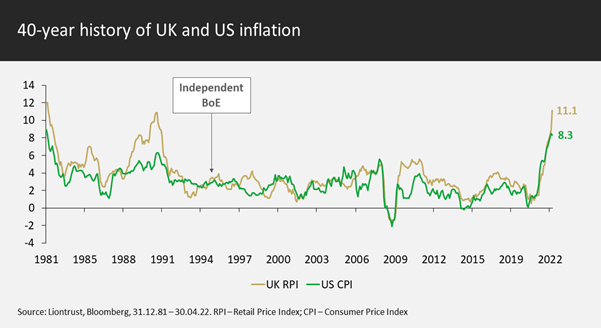

On the macro front, we have seen a significant change in approach from many central banks, moving more hawkish on interest rates as they look to bring soaring inflation under control. This rising inflation is a consequence of loose monetary policies designed to boost economies after Covid lockdowns, as well as supply issues caused by the latter, and the war in Ukraine has exacerbated some of these economic maladies. Given this backdrop, there is growing talk of potential recession and slowing global growth.

How has this impacted our Sustainable Future funds?

Since we launched the SF funds back in 2001, our proposition to clients has been to deliver superior returns by investing in sustainable companies whose products and services help make our world cleaner, healthier and safer. This focuses our funds on businesses we believe will see profitability grow strongly over the coming years.

Generally, our strategies have made good on this ambition, outperforming the average of our peers and conventional benchmarks over five, 10, 15 and 20 years where relevant. More recently, however, the picture is one of marked underperformance, a trend that began in September last year. The trigger for this change has been this backdrop of higher inflation and rising interest rates, which has led to share price falls in the growth stocks that comprise the bulk of our portfolios.

For companies where the market expects strong growth for years to come, a large proportion of the valuation is attributed to cashflows in the future (so these are known as long duration); conversely, for stocks with lower expectations, little value is ascribed to future growth and the bulk of the value is in near-term cashflows. Companies with strong growth expectations, therefore, have a higher sensitivity to interest rate changes relative to those with lower growth prospects, and this shift in markets has hit our funds.

On a relative basis, our funds have fallen more than their benchmarks but, to reiterate, these indices contain many currently outperforming ‘value’ companies in oil, tobacco and defence sectors, where we have never invested. We believe sell-offs in markets have not discriminated between companies that are significantly affected by this changed environment and those whose prospects remain strong. Our focus is on finding businesses that will deliver strong returns on a five-year view and we have strong conviction that trends towards resource efficiency, innovation in healthcare and cyber security, for example, are intact for the longer term.

In the face of a more challenging backdrop for our SF investment process, it is worth reiterating exactly what we mean by a sustainable company and why we continue to believe there is alignment between doing good things and business success. If you examine how positive change happens, there tend to be three actors at work. First, an understanding is developed of the issue and likely ways to resolve it are discovered (air pollution is harmful to health, for example); second, society/government lays the groundwork for action – via new regulations, taxes and other incentives; and third, companies take advantage of the opportunity to develop, commercialise and distribute solutions.

What is interesting from an investment point of view is that the businesses involved in this triangle tend to experience strong and persistent demand growth and face less competition due to the novelty of the product or service they are delivering.

Going back to our investment process, we focus on four stages in our analysis of companies: theme, overall sustainability, fundamentals and valuation. When it comes to innovation, our 20 sustainable themes harness societal and environmental necessity, identifying companies that are expanding addressable markets with obvious demand and reinvestment opportunities. This typically involves backing innovators: firms tackling challenges by investing in Research and Development, products and customer services, protecting and growing their return on capital and proactively managing environmental, social and governance (ESG) impacts.

This is why we remain confident despite fears around slowing growth and continue to focus on our core competence: identifying businesses exposed to strong sustainability trends that will endure and grow their value, for the most part, independent of economic backdrop. Nevertheless, we acknowledge that, during periods of stress, time horizons typically shorten; it is therefore crucial for us to retain our focus on the long term – and we are acutely aware this would be impossible without our clients continuing to support us in doing so.

Opportunities after recent sell-offs?

We have recently reviewed each of our holdings to ensure that, in this new higher interest rate and inflation world, our conviction remains strong. And, in almost all cases, it does. We have therefore not altered our portfolios significantly; this may sound as if we are not managing the assets actively but it has never been our approach to trade our portfolios rapidly, only when necessary.

Experience has also shown that indiscriminate sell-offs provide opportunities to add to our highest-conviction companies at more attractive valuations, as well as starting positions in names we have long admired but, prior to now, were fairly valued by the market. In our global portfolios, for example, a new addition over Q1 was Masimo, under our Enabling innovation in healthcare theme. Headquartered in the US, Masimo’s core product is pulse oximetry sensors, which enable a patient’s vital signs to be monitored. The company places circuit boards (referred to as drivers) into bedside monitor machines and then sells the hospital sensors to pair with these devices.

Based on our fundamental analysis, the company has a five-year average return on equity of 19% and a five-year revenue compound annual growth rate of 12%; most significantly, with the shares having derated around 60% over the last six months, we see upside in the region of 120% over the next five years.

Looking forward, we cannot say exactly when the qualities of the businesses we own will become evident in their share prices; what we can say is that we have used the same approach for more than 20 years and it has served our clients well. There have been weaker periods of performance as a consequence of value rallies – notably in 2003, 2009 and 2016 – but by sticking to our investment process, we have more than compensated for these over the last 21 years and are confident that backing sustainable businesses is the path to making good recent underperformance once again.

By their nature, value stocks tend to re-rate relatively rapidly, and then it is done; our preference is for companies that can maintain high earnings growth and our belief is that the market will continue to reward these with higher share prices over the long term.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Sustainable Future team involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. Investment in Funds managed by the Sustainable Future team involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Some Funds may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative’s underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The decision to invest in a fund should take into account all the characteristics and objectives of the fund (inclusive of sustainability features) as described in the prospectus.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.