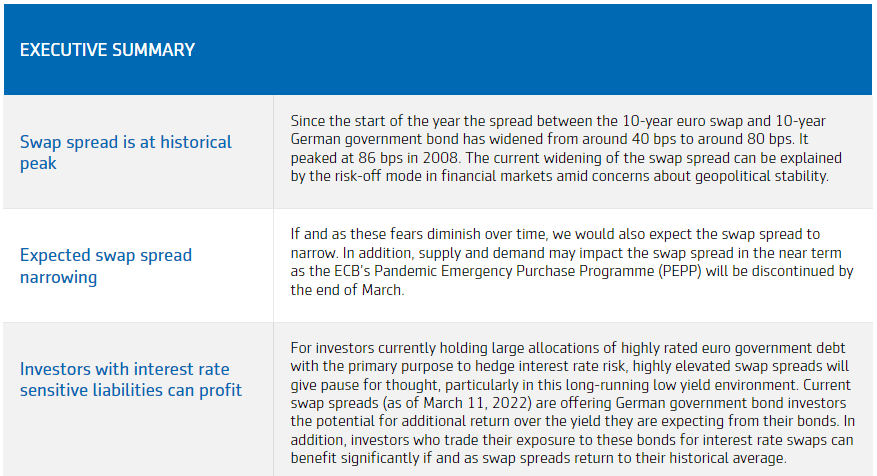

Swap spreads, the difference between the yield on daily collateralized swaps and benchmark sovereign debt, are observed for many reasons: amongst others as an economic risk indicator; a measure of investor preferences over time; and an important consideration in setting Liability Driven Investment (LDI) strategies.

This article summarises swap spread developments and considers the implications for pension funds and their interest rate hedging strategies. We examine what pension funds can do to their interest rate hedge to take advantage of this market development.