Traditionally a safe haven, the past decade has seen a dearth of CHF issuance. This is changing. Issuers and investors are seeing opportunities and diversification.

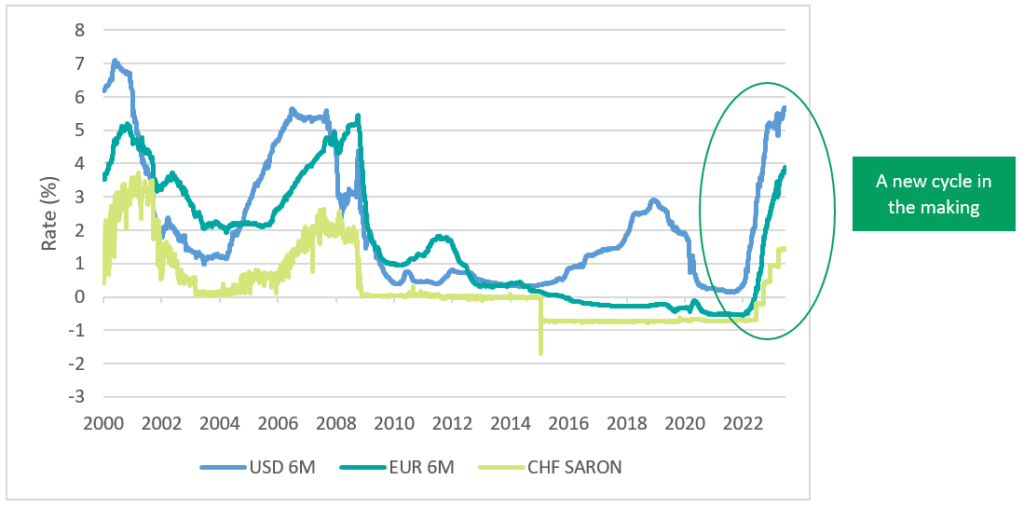

The end of Quantitative Easing (QE), the exit from the COVID-19 pandemic and ongoing geopolitical jitters have resulted in inflation escalating to higher levels in the US, the Eurozone, and across major developed markets. While this has translated into concerted central bank action on interest rates in major developed markets, Switzerland’s low-inflation economy and strong currency have contained domestic inflationary pressures. The result has been a divergence of speed in monetary policy hiking between the Federal Reserve (FED), European Central Bank (ECB) and the Swiss National Bank (SNB). To put this into context, SNB has cumulatively raised 250bps, compared to the 400bps from the ECB or even higher (500bps) from the Fed. Nevertheless, recent quarters’ catch-up in interest rate hikes and increasingly hawkish tone by SNB Governor Thomas Jordan, have opened up opportunities.

Breaking away from the CHF ice age

Source: Bloomberg, BNP Paribas CIB

Historical US 6-month LIBOR reference rate used for comparison purposes

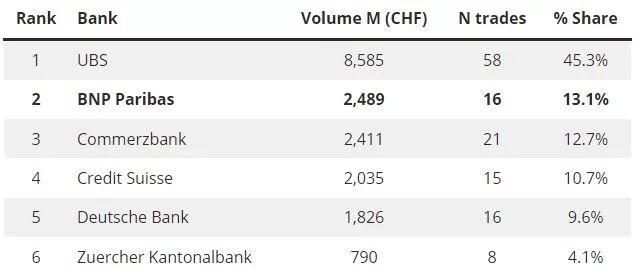

According to Fred Zorzi, Global Head of Primary Markets, “BNP Paribas Global Markets has maintained a commitment to the Swiss franc market for many years given our belief that clients require consistency and support. This strategy has been rewarded as our ability to advise clients and provide financing packages enabled us to gain significant market share as we positioned ourselves at the forefront of the Swiss franc revival. Investors and issuers have looked to BNP Paribas to play a larger role in the market going forward. The professionalism and expertise of our experienced colleagues across legal, trading, sales, syndicate and DCM has helped clients navigate their return to the market and we look forward to developing our franchise further in the coming months.”

Diversification and safety

With higher interest rates, Swiss franc (CHF) investors have been able to move from higher beta names to lower beta names, increasing the demand for high quality paper. CHF investors have historically preferred better rated names offering attractive yields. The positive yield environment and recent events in the Swiss banking sector, have seen investors return to lower beta names searching for safety and diversification of covered bonds.

The swap-spread has been a historical measure for interbank risk. This was showcased with the recent volatility in the US and Swiss banking sectors which led to a tightening in Swiss government yields, while mid-swap rates widened, resulting in a significant widening of Swiss Government/SARON swap spreads. The widening of swap-spreads makes fixed income products which are priced versus mid-swap rates, more attractive on a relative value.

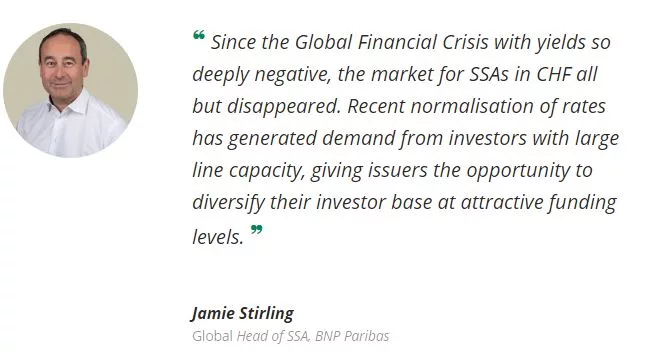

All of the above has created a favourable environment for issuers and investors, leading to a strong rally in credit spreads. While the two most frequent domestic covered bond issuers funded at around SARON MS+8 to 9bps in January, the latest issues by these same names priced at much tighter levels, around SARON MS-7bps. This, combined with the more attractive cross currency basis to major currencies, has brought CHF funding within issuers target levels, and allowed the return to CHF funding not only for cost-savings, but also for strategic purposes. Primary issuance has been strong at CHF44.1 billion year-to-date, +13.1% year-on-year, with BNP Paribas Suisse taking a lead. According to Jamie Stirling, Head of SSA, BNP Paribas, “Since the Global Financial Crisis with yields so deeply negative, the market for sovereign, supranational, agency (SSA) in CHF all but disappeared. However the recent normalisation of rates has generated demand from investors with large line capacity given the lack of issuance, aligning with strong issuer willing given their opportunity to diversify their investor base at attractive funding levels.”

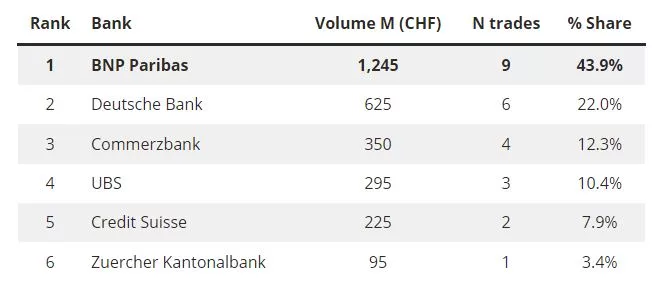

BNP Paribas dominates the sovereign, supranational, agency (SSA) market

CHF Foreign SSA League Table 2023YTD (as of 30 June 2023)

SSAs riding the wave

The return of the European Investment Bank (EIB) this week was an important signal to the market. Issuing a 10-year benchmark transaction raising CHF200 million at SARON MS-27bps, marks the first time the issuer has returned to the market since February 2014. Having monitored the market for a while, the team at EIB decided to proceed on the back of a risk-on market tone and an improved cross-currency basis. Meeting investor demand for duration and high quality, the new issue was well received by the market. In terms of pricing, it is the tightest reoffer spread since the revival of the CHF market for foreign SSA issuers this year, and also the longest maturity versus peers. BNP Paribas acted as sole lead and Bookrunner. This was BNP Paribas’ ninth CHF syndicated SSA transaction year-to-date among which four were sole led by BNP Paribas.

Observing the tightening of spreads in the market, the Nordic Investment Bank returned to the CHF market at the beginning of June for the first time since 2009, raising CHF150 million at a very attractive 24bps below SARON mid-swaps, which translated into the tightest print on a spread basis until EIB’s new issuance. BNP Paribas acted as sole Bookrunner.

According to Eliya Grinman, Fixed Income Syndicate Manager, BNP Paribas Suisse SA, “It has been a very interesting first half in the Swiss franc market as we were able to witness a surge in primary market activity including a fair amount of long awaited international supply. The strong market backdrop of the past months has enabled us to bring several international issuers back to the Swiss franc market centre stage, allowing them to achieve excellent outcomes in terms of both size and price.”

Rising supply from both domestic and foreign issuers

The corporate space has been active at a very similar level as issuers – both domestic and foreign – have been successfully tapping the CHF-market. Domestic issuers have a natural appetite for the currency on the back of their funding needs, while foreign issuers are looking for investor diversification as well as attractive pricing opportunities. According to Delf Egge, co-Head of DACH Corporate DCM, BNP Paribas, “The strong reception to corporate CHF transactions in the first half of the year puts the CHF-Market clearly back on the map when it comes to raising liquidity at currently attractive funding costs and diversifying the investor base.”

Nestlé S.A. raised CHF1.15 billion via a triple-tranche 6-year, 10-year and 15-year transaction. The quality of the order book was exceptionally high and underlines the current investor appetite for long-term debt especially for high quality names. BNP Paribas acted as Joint Lead Bookrunner on this highly successful transaction.

Toyota Motor Finance (Netherlands) B.V. issued its first public CHF bond under this entity. The CHF500 million deal size represents the largest non-domestic single-tranche offering in the CHF corporate primary market since 2018. The issuance was very well received by the broadest Swiss investor base, enabling Toyota to set the spread at SARON MS+40bps – a level highly attractive versus other currencies.

CHF issuance for international issuers league table 2023 YTD (as of 30 June 2023)