Inflation in Switzerland surged in 2021-22, although to levels far below those of other economies. In this Macro Flash Note, EFG Chief Economist, Stefan Gerlach, and Senior Economist, GianLuigi Mandruzzato, look at recent developments and consider the near-term outlook for Swiss inflation.

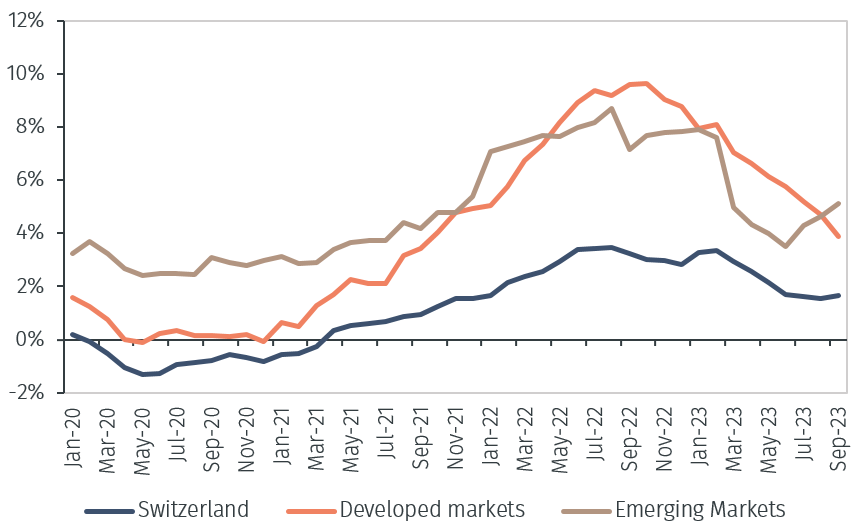

Much like in other economies, inflation in Switzerland rose sharply between 2021 and 23 (see Chart 1). However, the peak was much lower in comparison, at merely 3.4% year-on-year (YoY) in February 2023. Subsequently, inflation subsided, rising 1.6% YoY in July and August, before increasing 1.7% YoY in September. While this represents a positive outcome relative to other economies, an important explanatory factor is that Switzerland uses much less natural gas than other countries to generate electricity. In addition, administered prices have an unusually large weight in the Swiss CPI, accounting for 25% of the CPI basket.1

Chart 1. Headline inflation (% change YoY)

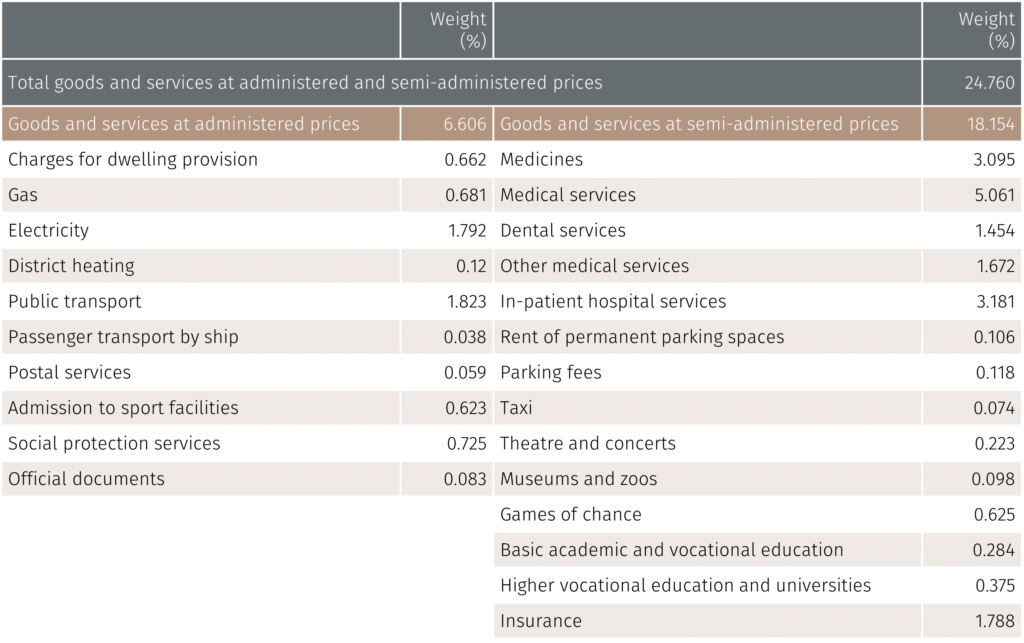

As the table below shows, administered prices are divided into two groups: Prices that are fully administered, which have a weight of almost 7%, and prices that are semi-administered, which have a weight slightly above 18%. Among the fully administered prices, public transport (1.8%) and electricity (1.8%) are the two most important components. Among the semi-administered goods and services, health is the most important category with a weight above 14%.2

Table 1. Distribution of forecast uncertainty around global GDP growth (%)

Source: Swiss Federal Statistical Office. Data as of 24 October 2023.

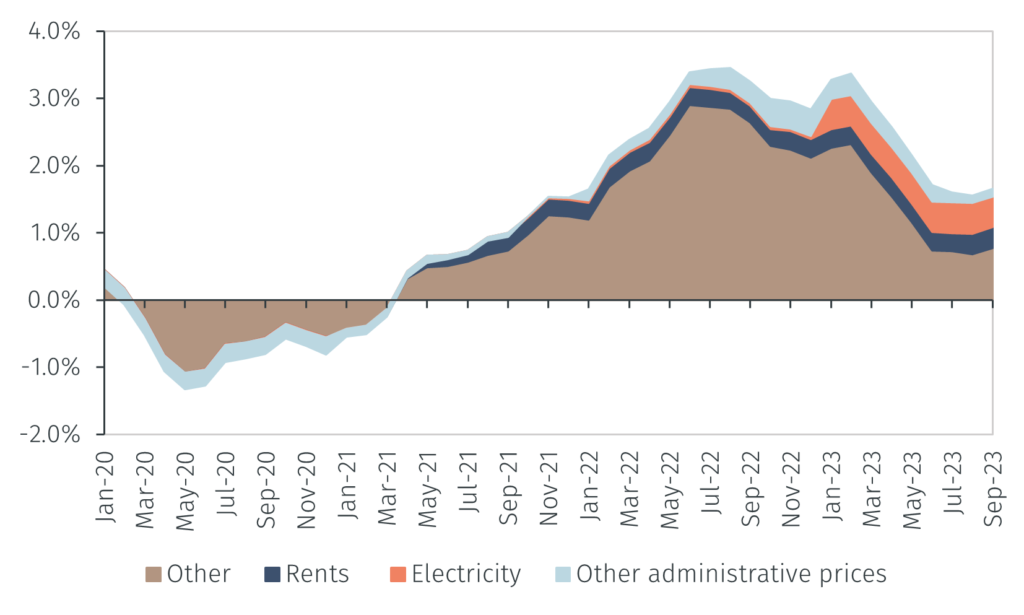

In analysing the surge in inflation, it is of interest to distinguish between rents, electricity prices (which are fully administered prices and have recently risen very sharply), other administered prices, and other prices.

The graph below shows Swiss headline inflation, deconstructed into these components. A large part of the rise in inflation is undoubtedly due to a generalised increase in prices. Nonetheless, rents, other administered prices and, in particular, electricity prices, have all played an important role in boosting inflation in recent years. That raises the issue of how these prices will evolve over the coming months.

Chart 2. Swiss inflation breakdown (YoY)

Source: Swiss Federal Statistical Office and EFGAM calculations. Data as of 24 October 2023.

For instance, the base effect stemming from electricity prices – which rose very sharply in January 2023 and contributed 0.5 percentage points to inflation in September – will lower inflation in January 2024. According to already-announced increases by Swiss utilities, electricity prices will rise around 18% in January 2024 as opposed to 25.5% in January 2023, reducing the contribution of electricity prices to overall inflation by 0.13 percentage points.

Other factors also point to a decline in Swiss inflation. Natural gas prices rose about 22% between October 2022 and February 2023, reflecting the surge in prices on the European wholesale market. This year, despite the recent rebound in the European benchmark price of natural gas, prices charged to Swiss households should rise much less than last winter. This could reduce the contribution of energy prices to total inflation by another 0.1 percentage points by the end of Q1 2024.

In addition, the increase in food prices has eased since early 2023 and the developments of wholesale prices in Europe, the source of most Swiss food imports, point to a further moderation in the months ahead. This could reduce the contribution of food prices to Swiss inflation by about 0.5 percentage points by mid-2024. Furthermore, from January 2024, Switzerland will abolish import duties on most industrial goods (excluding agricultural products). The Federal Council calculates that the complete passthrough of lower import and administrative costs to Swiss consumer prices will reduce the level of the CPI by about 1 percentage point, and part of this will be felt as soon as 2024.

Importantly, the Swiss franc has appreciated about 7% from a year ago. This will dampen the pass-through of high prices abroad to the Swiss CPI.

On the other hand, Swiss inflation will be subject to upward pressure due to several factors:

- In December 2023, Swiss train fares will rise by an average of 3.7%, adding slightly less than 0.1 percentage points to overall inflation.

- In January 2024, the VAT rate will rise from 7.7% to 8.1% to fund the reform of the public pension system.

- Rents, which represent almost 20% of the Swiss CPI basket, could rise to reflect the increase in mortgage rates, which itself is a consequence of Swiss National Bank’s (SNB) policy tightening. If, at the end of December, the reference mortgage rate is increased to 1.75% from the current 1.50%, landlords will be permitted to raise rents by up to 3% during Q1 2024.

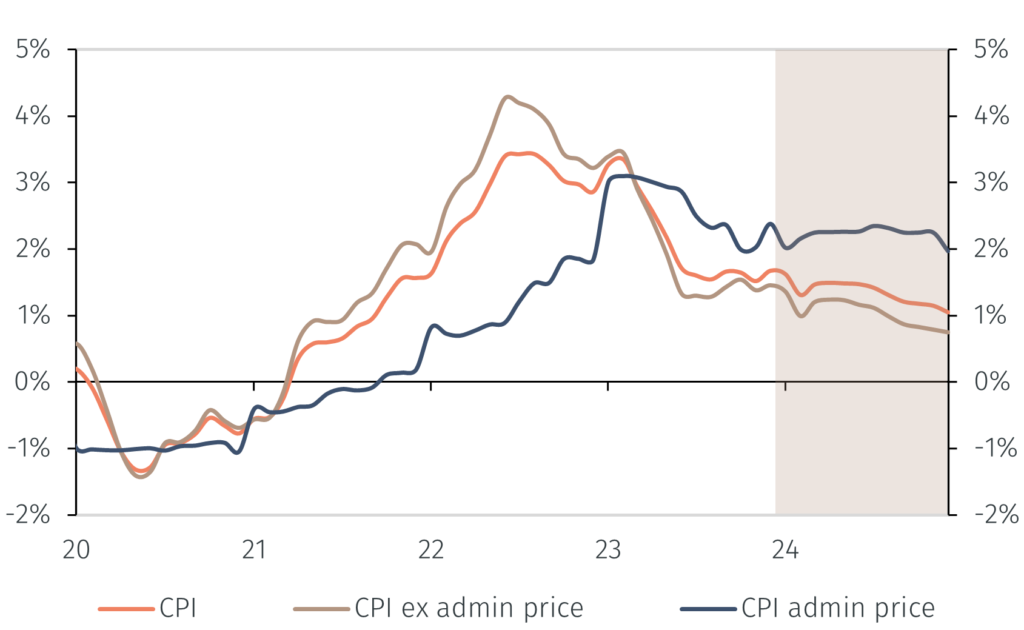

These forces will likely increase the volatility of Swiss inflation in the coming months, making it harder to identify the underlying trend. However, in the absence of new shocks, consumer prices are likely to continue moderating and this trend should become increasingly evident as 2024 progresses (see Chart 3).

Chart 3. Swiss inflation outlook (YoY)

To conclude, Swiss inflation peaked at a much lower level than in other economies, due to the limited use of fossil fuels for electricity production and the unusually large weight of administered prices in the CPI basket. Headline inflation returned within the SNB’s 0-2% target range in June 2023 and further moderation is expected in the months ahead. If this projection materialises, Swiss monetary policy may become more accommodative sooner than markets expect.

2 Health consists of medicines, medical services, dental services, other medical services, and in-patient hospital services.