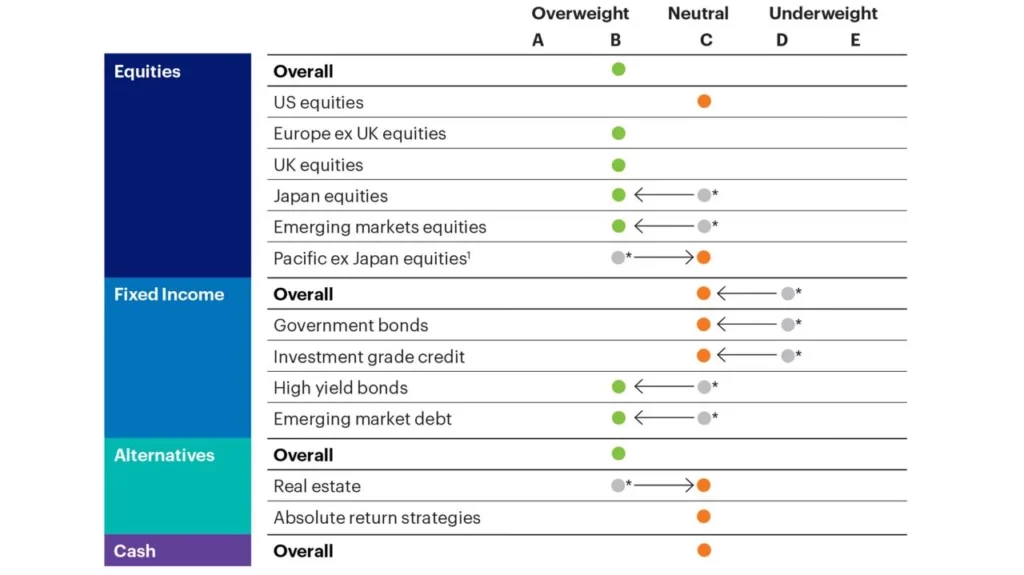

Each quarter, the Multi Asset Team shares its fundamental tactical asset allocation views, providing an A-E rating for each asset class over a 1–3-year investment horizon.

Read the team’s latest views below.

Our overall preference for equities over bonds remains

We still believe that equities are better placed than many asset classes to handle the current inflationary environment, should it persist.

We are mindful that this environment is one of slowing (albeit robust) growth; high inflation that will be countered by rising central bank interest rates; and an uncertain geo-political backdrop.

However, we think growth is likely to remain robust enough to be supportive of risk assets over our tactical timeframe.

We upgrade our view of fixed income to neutral

We upgrade our view of fixed income to neutral now that yields are significantly higher across the fixed income spectrum.

As such, within fixed income, we have upgraded our view of government bonds (led by US treasuries) and global investment grade credit to neutral.

We also upgrade high yield credit and emerging market debt from neutral to overweight given the attractive absolute yields available.

There are upgrades and downgrades within equity markets

Within the equity space, we have upgraded emerging market equities on an improving policy backdrop in China and potential for an improved earnings outlook for those markets that tend to benefit from higher commodity prices.

We also upgrade Japanese equities – which are seemingly unloved – to overweight given improved valuations. Currency has been a headwind for Sterling investors in Japan over the last year and that may now subside.

We downgrade Pacific ex Japan equities to neutral due to a worsening policy backdrop, and also downgrade real estate to neutral.

Tactical asset allocation