As it becomes increasingly difficult to make smaller transistors, chip design will play an even more important role in driving chip performance. Taiwan’s chip design industry, ranked number two in the world, provides investors a diversified exposure to the exciting growth that is taking place across Artificial Intelligence, 5G network infrastructure, self-driving cars and the Internet of Things.

Taiwan’s Integrated Circuit (IC) design industry ranks number two globally, accounting for 19.3% of the world’s IC design revenues1.

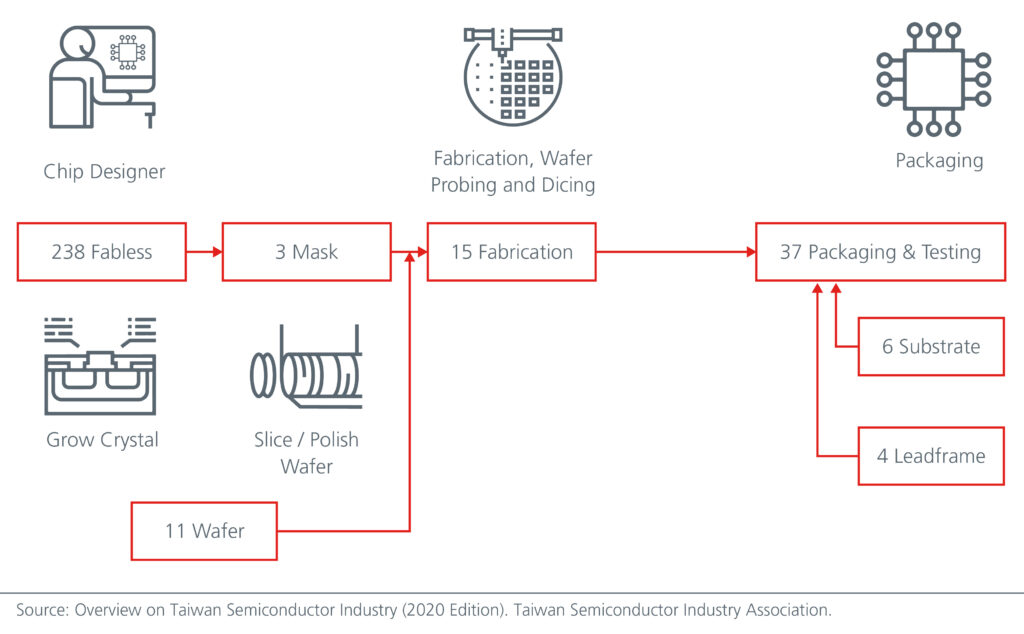

Being part of Taiwan’s unique semiconductor eco-system is key in Taiwan’s IC design success. At the end of 2019, Taiwan had 238 IC fabless design houses, 15 fabrication companies, 37 packaging and testing houses, 6 substrate suppliers, 11 wafer suppliers, 3 mask makers and 4 lead frame companies2. See Fig. 1.

Fig. 1. Taiwan IC ecosystem

The top-3 world leading foundry businesses are all in Taiwan. Being in the same geographical location as one’s key customers and suppliers makes supply chain management more efficient. It increases the ease of working with customers and bringing their ideas to fruition. As companies move away from discrete chips and towards integrated chip design, where components are etched directly into layers of silicon instead of being mounted independently, closer collaboration between IC design companies, manufacturers and packaging companies becomes even more important.

Breadth and depth

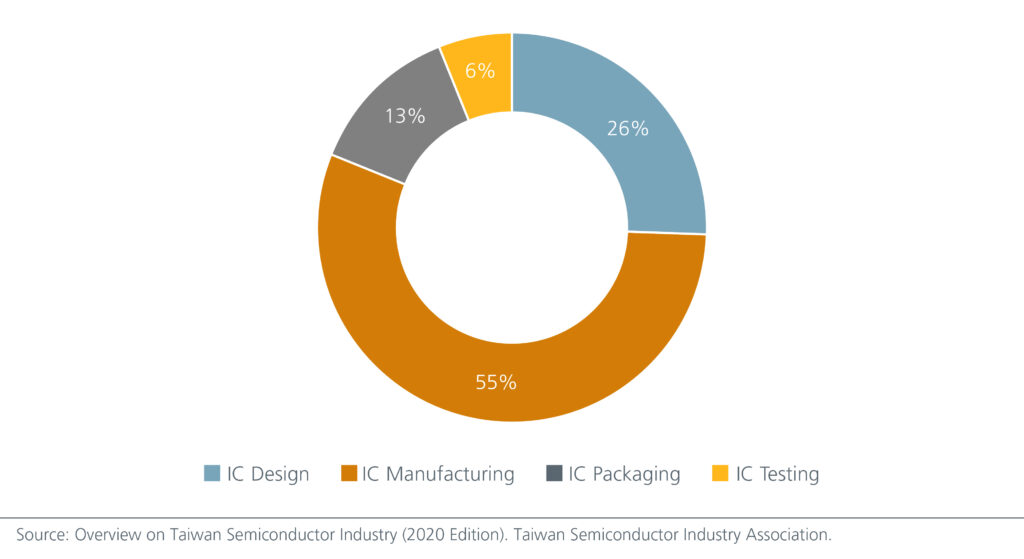

Taiwan’s IC design industry offers investors both breadth and depth. Within Taiwan’s domestic semiconductor Industry, IC design makes up the second largest share of the industry’s revenue (Fig. 2), with the industry employing more than 41,000 employees as of end 2020. Many of Taiwan’s IC design companies are top ranked in multiple IC design sub-sectors including 5G, power management, server baseboard management controller, audio, radio frequency, high speed interfaces and display drivers. This means that Taiwan’s IC sector offers investors diversified exposure to the exciting growth that is taking place across Artificial Intelligence (AI), cloud computing, 5G network infrastructure, data centres, storage devices, self-driving cars, personal computers and Internet of Things (IoT).

Fig. 2. Composition of Taiwan’s semiconductor industry revenues (2020)

The sales of semiconductor chips is expected to grow at a compounded average growth rate (CAGR) of 10.7% p.a. over 2020-2023, driven by structural drivers including 5G, AI, Advanced Driver-Assistance Systems (ADAS), Electric Vehicles (EV) and IoT. This growth rate is almost double its CAGR of 5.5% during 2015-2020. Taiwan’s leading IC design industry will be a key beneficiary as it provides the designs needed by the different domains.

An evolving design landscape

Over the last five decades, Moore’s law, which is the observation that the number of transistors in an IC doubles about every two years, has helped launch smaller, more powerful electronic devices and made computing more affordable. However, it is becoming harder and harder to make smaller transistors. Going forward, innovative IC designs will increasingly drive IC performance and play a key role in the success of emerging technologies.

The data-driven era we are in also brings about new design challenges. ICs may need to process large volumes of data and re-use the data while maintaining power efficiency. Designs are becoming more complex, and design engineers often need to consider trade-offs between components to manage the volume and speed of data that is flowing through the circuits, as well as the need to integrate greater security into the designs.

As higher end applications demand more complex designs, a number of companies are moving away from inhouse IC design. Yet at the same time, the desire for higher performing chips have led other companies (e.g. Apple and Amazon) to design their own chips which are used in the iPhone, Mac computers and Amazon’s data centres. These cross currents create both opportunities and challenges for Taiwan’s leading IC design companies.

US-China geopolitical tensions have also strengthened the resolve of Chinese companies to reduce their technological reliance on the US. As Beijing seeks to identify and replace risky parts and suppliers, some of Taiwan’s IC design companies have benefitted from China’s move away from US suppliers, while others who count Huawei amongst their key clients have suffered in the face of US sanctions on the company.

Not surprisingly, the attractive prospects of the industry have attracted M&A activity. Nvidia Corporation, a US semiconductor company that manufactures accelerator chips largely for the gaming market, is bidding USD40 bn for Arm, a Britain-based chip designer that designs blueprints for general-purpose chips. This could be a gamechanger on many fronts. A successful deal could expand Nvidia’s reach into other markets, potentially increasing competition for some of Taiwan’s IC design companies. It could also mean that Arm, which is an important supplier to many Chinese semiconductor companies, comes under American control, at a time when US-China geopolitical tensions remain high. This could add further impetus to the current trend where China is looking for alternatives to US suppliers, thus benefitting Taiwan’s IC design industry.

Meanwhile, the emergence of RISC-V, a new open source approach to designing chips could lead to more innovation, opportunities as well as challenges. Some of Taiwan’s IC design companies have joined the RISC-V Taiwan Alliance and are positioned for the potential opportunities that could come from the RISC-V open architecture.

Staying ahead

Taiwan’s IC design companies invest significantly in Research & Development (R&D) to stay ahead of competitors. In 2020, Taiwan’s IC design industry invested 17.7% of its revenues in R&D. In comparison, the global semiconductor industry’s R&D expenses as a percentage of worldwide industry sales was 14.2% in the same year3. Meanwhile, Taiwan’s IC design industry’s value add has increased from 25.1% in 2016 to 31.2% in 2020.4

The diversity of Taiwan’s IC industry implies that investors need to stay abreast of developments within the various sub-sectors. A flexible and active approach helps us in identifying IC design companies that can best supply fast-growing technology sectors and work with companies to bring their ideas to fruition. We monitor companies’ technology roadmap, design capabilities, product mix and earnings trend. We also assess their customer portfolio, their ability to secure sufficient foundry support and their potential for market share gains. Just as the top IC design companies stay vigilant in honing their expertise and solutions, we are equally diligent in ensuring that we capture the most attractive opportunities within an evolving design landscape.