Households are about to experience the biggest hit to disposable income in a long time. Rising inflation, continued supply chain constraints and now the Russia-Ukraine war have piled on seemingly all at once. The swelling piggybanks from stashing away cash during the pandemic may not last long under these conditions. Here is our outlook for the consumer, broken down by region because we see each having similar, but varied hurdles to overcome in the months ahead.

The UK consumer

UK consumers are likely going to be squeezed to an extent that is quite unprecedented in recent years. Energy prices are having a significant effect on UK consumers, as well as spiking food prices. The UK government’s recent energy cap rise is projected to cause the typical domestic energy bill to rise by £700 per year to £2000. On top of this, some recent estimates suggest that implications of the Russia-Ukraine war could add another £1000 a year to the typical UK family energy bill.

Unlike the US and EU counterparts, tax hikes in April will likely add further pain. The new health and social care levy will cost the average taxpayer an extra £180 per year with a higher income taxpayers spending an extra £700 or more.

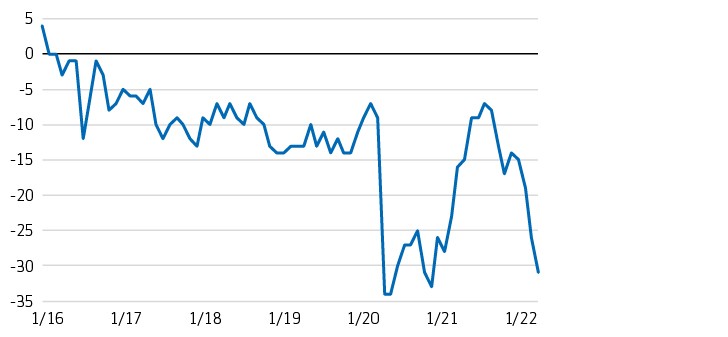

Our outlook for the UK consumer is not as bleak as headlines would suggest. Unemployment has fallen to pre-pandemic levels and employment is growing. Wages are rising, although likely not enough to fully offset inflation. Savings remain at historically high levels and house prices are holding up well despite the removal of tax incentives. However, rising prices and taxes are considerable hurdles to overcome and could require consumers to drawdown on excess savings or increase borrowing to maintain current expenditure levels (exhibit 1).

Exhibit 1: GfK Consumer Confidence Index

The European consumer

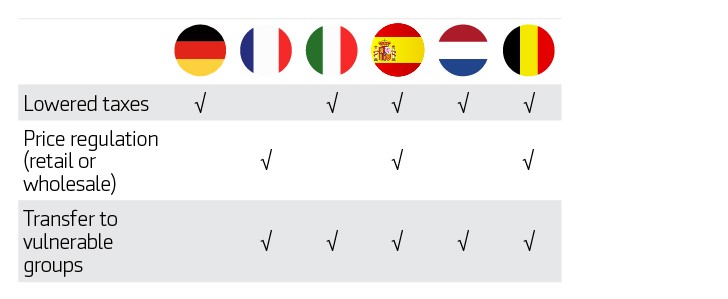

The European consumer faces a sharp rise in living costs due to the rise in energy and food prices. Many European governments have stepped in to partially offset the higher energy prices to protect consumers (exhibit 2). Despite this, higher energy bills are likely to result in some cutting in discretionary spending. Luckily there are some positive factors, which might offset part of the negative impact. Employment in the Eurozone is high, and the labor market is tight. Savings are still elevated due to lower spending over the last two years.

Exhibit 2: EU government assistance has helped consumers weather rising prices

We believe inflation will remain elevated for a longer period due to commodity prices moving much higher in recent weeks—notably in energy. Wage growth is relatively low (lower than in the US) and real wage growth is negative. High commodity prices, especially gas, are a major headwind to consumers’ purchasing power and business input costs. This is likely to weigh on growth going forward. The magnitude of which depends on how long energy prices remain at elevated levels and/or how much further it rises. However, the adverse effects are partially reduced by government support and high savings levels.

The US consumer

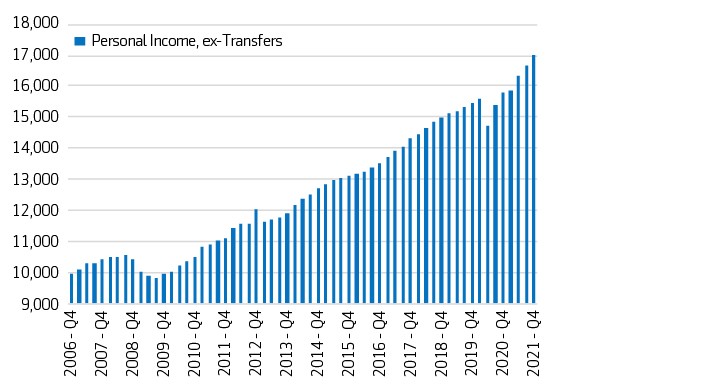

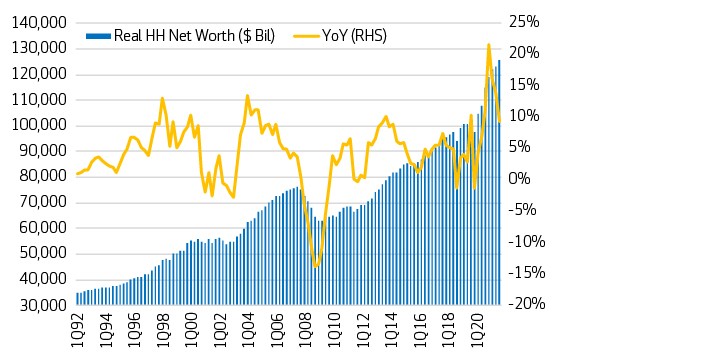

We believe the US consumer remains in a strong position. We have seen an ongoing increase in personal income and household wealth over the last several years (exhibits 3 and 4). Although energy prices are also rising in the US, gas and fuel has become an increasingly smaller portion of total consumption. Therefore, when energy prices rise, it affects the US consumer but more like an additional tax rather than a notable hardship. Lower-income consumers, while benefiting from the largest pay increase among the income brackets in 2021, will likely pay the price for the increasing costs as they have less discretionary income and savings.

Rising interest rates paired with higher prices on essential goods and services will reduce affordability and negatively impact purchasing power. This could temper demand for more discretionary purchases. We will continue to monitor employment trends, personal income and savings, and consumer sentiment, as well as for a rise in borrowings and delinquencies.

Exhibit 3: Personal income ex-transfer (USD) payments

Exhibit 4: Accumulation of real household net worth

Important disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, the following wholly or partially owned affiliates may also conduct certain business activities under the Aegon Asset Management brand: Aegon Asset Management (Asia) Limited (Aegon AM Asia), Aegon Private Fund Management (Shanghai) Co., Ltd.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM US is also registered as a Commodity Trading Advisor (CTA) with the Commodity Figures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon AM Asia is regulated in Hong Kong by the Securities and Futures Commission of Hong Kong for Professional Investors only (under SFC Ordinance Cap 571); in China, Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; In Taiwan Neither Aegon Asset Management nor any of its affiliates are registered and may not sell, issue, or offer any products or services while in Taiwan. Marketing is intended to Professional Investors only has not been reviewed or endorsed by any regulatory authority in Taiwan; In Korea, Aegon USA Investment Management (AUIM) is registered as a CB-DIM and delegates Aegon Asset Management (Asia) Ltd to provide marketing and client services in Korea. Intended for Qualified Professional Investors only and contents have not been reviewed or endorsed by any regulatory authority in Korea; In Japan, neither Aegon Asset Management nor any of its affiliates carry on investment business. Intended for accredited, expert or institutional investors only and contents have not been reviewed by the Financial Services Agency of Japan.