Both President Biden and Congressional leaders expressed guarded optimism that a potential deal could be reached by the end of this week after Treasury Secretary Yellen reaffirmed the “X-date”—1 June—as the expected default deadline when the US Treasury may begin to fail on its obligations based on the latest tax receipts. If Yellen is correct, there are fewer than 15 days until the US Treasury Department defaults.

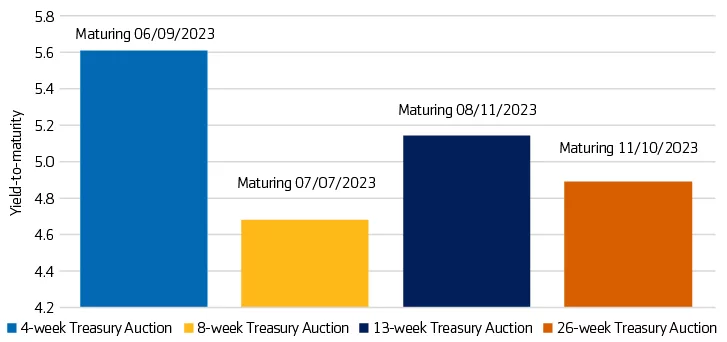

Although stocks have gained on brief bouts of optimism, the market is sensitive to the waning confidence that lawmakers will reach an agreement in time. Investor concerns over the debt ceiling are reflected in the latest four-week Treasury auction (maturing on 9 June), with yields notably above those of longer-dated Treasurys (exhibit 1).

Exhibit 1: The latest Treasury auctions

Against this backdrop, details about what a final deal may look like are beginning to take shape. While House Democrats seek to collect signatures to launch a discharge petition that would force a clean debt ceiling vote, this is likely a long-shot bid. We believe a final deal will ultimately be a two-track process:

- A clean debt ceiling increase through at least the 2024 election coupled with,

- Comprehensive policy agreements on four main areas:

- Budget caps

While Republicans are pushing for nearly a decade’s worth of budget caps, Democrats are only seeking two years’ worth of caps. We believe the final deal will likely land somewhere in between—not unlike those made in 2011 which avoid naming specific departments and programs - Covid-19 relief claw-backs

Both parties seem willing to rescind unspent Covid-19 relief money—some estimates peg this as high as $60 billion. - Tougher work requirements for certain federal programs (excluding Medicaid)

President Biden indicated he may be willing to toughen work requirements for certain federal aid programs (excluding Medicaid), therefore, stricter requirements may be included in any final deal. - Permitting reform has also been included in debt ceiling talks with both parties looking to speed up the approval process for energy projects and reduce unnecessary delays.

- Budget caps

We continue to estimate a 33%-50% chance of a selective default where the US Treasury Department continues to make interest and principal payments on its existing debt but withholds other payments such as Social Security benefit payments, Medicare/Medicaid payments, wages to government employees (including members of Congress, TSA employees, members of the armed forces, etc.), tax refunds, and payments to government contractors. The political pressure in such a crisis scenario will likely serve as the impetus to any bipartisan agreement.

Important Disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon Asset Management is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon Asset Management nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers.

Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2023 Aegon Asset Management or its affiliates. All rights reserved.