Key takeaways

- Growth headwinds: two well-known factors, one unpredicted

- The next important perspective: corporates fundamentals

- Fund flows in April: more of the same for EM bonds

Excessive goods consumption “explains” the US 22Q1 GDP contraction

As expected, investors’ attention is now focusing on growth: will commodity prices and inflation, tightening financial conditions, China’s zero-Covid policy, and the Asian slowdown, trigger a global recession?

While the latest deteriorated data from China – a sharp drop in PMIs last week, from 48.8 last month to 42.7 for the composite in April – or the continued decline in consumer confidence in Europe in April should come as no surprise, the 1.4% contraction in US GDP was not anticipated at all (consensus +1%).

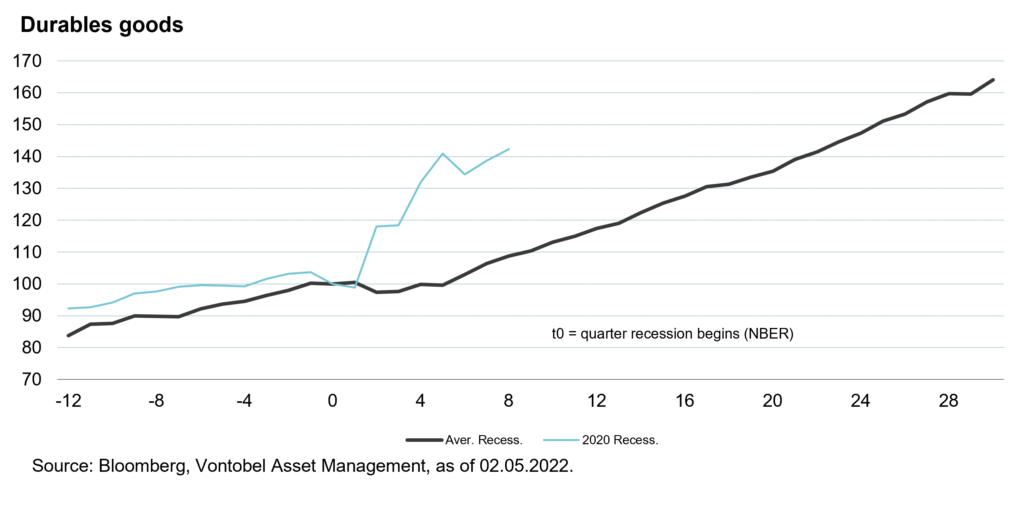

The negative foreign trade contribution of 3.2% in Q1 explains the latter bad surprise. The exploding US trade deficit is the counterpart of a strong household consumption – which also adds 2.5% to inflation. The above graph compares durable good consumption around recessions.

With the slowdown in consumption but also the shift to services, the phenomenon should not be repeated. The probability of a US recession in the next 12 months remains very low – the probability becomes higher but not yet determinant for the next 18–24 months.

Despite the current risks to growth, central banks will continue to tighten monetary conditions, raising rates and reducing balance sheets. The ECB could raise rates as early as this summer. On Wednesday, the Fed will accelerate its rate hikes – 50 basis points are expected – announce the start of its balance sheet reduction, but also probably deliver a hawkish message.

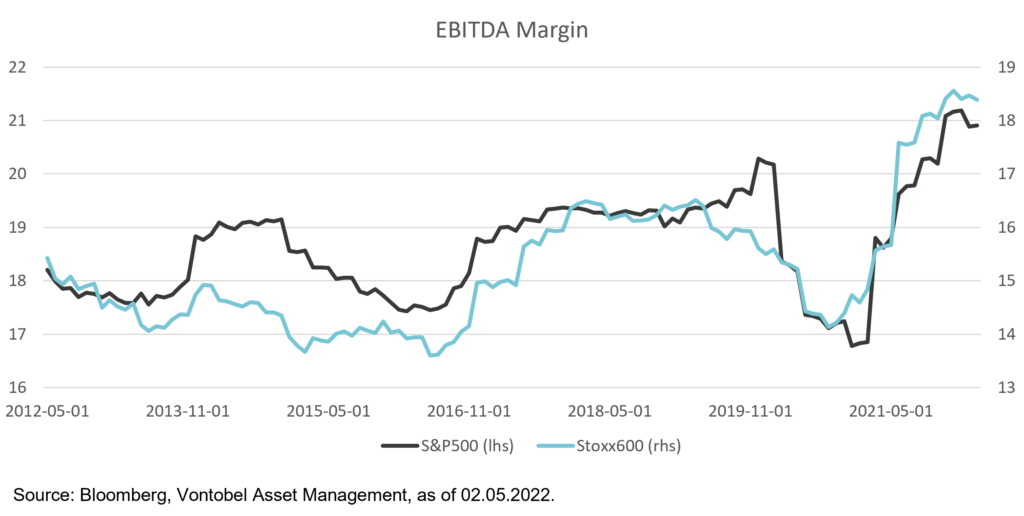

Corporate margins: what went up might come down

In our previous issue of the Tribune , we indicated that a significant part of the corporate credit’s poor performance was due to higher sovereign yields, and less to a deterioration in credit risk.

First, growth is slowing everywhere. Secondly, costs are still rising, especially labor costs. Last week, the Employment Cost Index, one of the Fed’s favorite gauges, came out at +1.4% in the first quarter, a level not seen for decades. Finally, the rise in financial costs and the tightening of financing conditions will also increasingly weight on corporates balance sheets’ health.

Currently, corporate defaults remain very low, including in the high-yield segment. However, corporate fundamentals will be increasingly at risk. Consequently, so will credit risk and spreads.

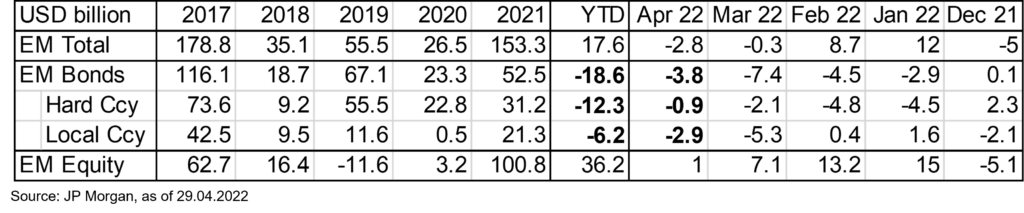

EM Bonds – some further outflows in April

Since the beginning of the year, EM bond debt has recorded net outflows (in bold, year-to-date column). April was no exception, with almost USD 4 billion divested, bringing the year-to-date total to USD 18.5 billion. These flows explain a significant part of the asset class poor performance since the beginning of the year, despite relatively low issuance.

A few observations: First, the 2022 outflows only represent approximately 7% of the net (positive) investments recorded over the previous five years. Second, local and hard-currency debts suffer roughly in the same proportions of outflows. Local-currency flows are dwarfed by regional markets, particularly China. Finally, almost all outflows came from retail funds, not institutional funds.

The current context of accelerating price rises, tightening monetary conditions for most emerging countries, including the strengthening of the dollar, and risks to growth, do not suggest a high probability that flows will turn around quickly.