An excerpt of the China fixed income session at the China Forum 2022

Looking back at the first 10 months of the year, global fixed income market has been very volatile with rising interest rates and wider credit spreads. However, China fixed income market has performed differently, and this could be encapsulated by what we call the two extremes: the outperformance of China sovereign bonds and the prolonged weakness in the China real estate high yield sector. What has led to this dichotomy in performance?

One of the factors is the divergent interest rate environment. China has been in a different interest rate cycle from major developed markets (DMs) over the past three years. Although inflation in developed markets soared and their central banks hiked interest rates this year, inflation pressure in China has been much less, partly because of its net exporter and net creditor nation status. On a year-to-date basis, China is the only major economy that has cut its interest rates and bank reserve ratio. This environment has cultivated lower yields for China sovereign bonds in sharp contrast to DM sovereign bond yields which have spiked dramatically so far this year.

China onshore sovereign bonds outperformed global peers

Thanks to the onshore bond rally, China sovereign bonds have delivered positive gains year-to-date in local currency terms, compared to losses of major DM sovereign bonds. Even if we take the strong US dollar (USD) appreciation against most major currencies into account, helped by the lower volatility of Chinese yuan, China sovereign bonds still beat major DM sovereign bonds in USD terms.

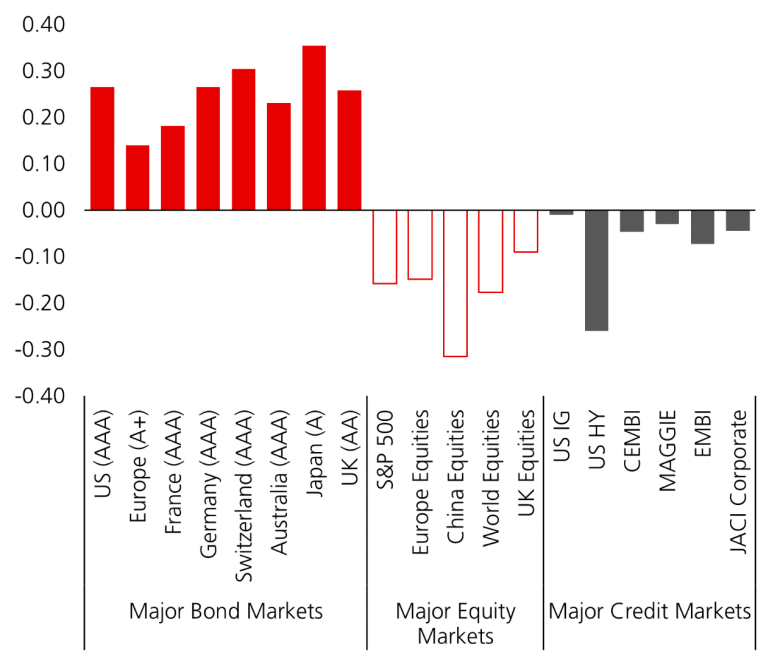

In the long run, there are several reasons to be constructive about China sovereign bonds. Firstly, China sovereign bonds could provide good diversification benefit for investors’ global fixed income portfolios due to their low correlation with global sovereign bonds (see the chart below). Secondly, because of China’s relatively low inflation environment, China sovereign bonds have also offered positive nominal and real yield with low volatility—characteristics we consider to be more strategic in nature than just tactical allocations. Thirdly, the incremental increase of China’s weight in global bond indices will also serve as a tailwind over the medium term as investors allocate more in-line with these indices.

Diversification benefits through low correlations (5 years)

1. Correlations are made to the China bond market, represented by Bloomberg China Agg Index.

2. Major equity markets are represented by: S&P 500, EURO STOXX 50 Index, Shanghai Stock Exchange Composite Index, MSCI World Index and FTSE 100 Index. Based on monthly return data.

3. Major bond markets are represented by: J.P. Morgan GBI US, J.P. Morgan GBI EMU, J.P. Morgan GBI France, J.P. Morgan GBI Germany, Swiss Bond Index (SBI), J.P. Morgan GBI Australia, J.P. Morgan GBI Japan, J.P. Morgan GBI UK. Indices used are in local currency.

This chart shows the correlation of the China bond market to major equity, bond and credit markets.

Continuing weakness in high yield market

In contrast, the correction of the China real estate sector since May 2021 continued to weigh on the performance of the China USD-denominated high yield bond market this year. Up to now, weak property sales are still the major factor constraining the valuation of the China real estate sector. On the other hand, there have been two notable changes from the previous year. Since the second quarter of this year, policies toward the sector have taken a more supportive turn, marked by the release of home purchase controls in a number of cities, mortgage rate cuts, and a bond guarantee program for select large property developers. In addition, after the correction, valuations of the sector are already at the distressed level.

More recently, other parts of the China USD-denominated high yield market have also softened alongside global high yield markets due to the overall global risk-off sentiment. At this point, we believe that there is a need for patience, and we are cautiously optimistic about China high yield considering both fundamentals and valuations. We are managing risk prudently against high global inflation and recession fears.

Party Congress and quality of growth

From China’s 20th party congress, China will continue to focus on the quality of growth, which suggests that in the future, growth in China will be more driven by consumption and high-end manufacturing, rather than by further growth of debt. It could create more credit investment opportunities in sectors such as consumer, manufacturing and financials. This focus on the quality of economic growth will also further enhance the credibility of China’s sovereign debts.

As global markets could continue to face high volatility due to inflation and recession concerns in the short run, diversification will play a more important role than ever. We continue to see Chinese fixed income as a good diversifier and an essential part of a global fixed income portfolio.