The dramatic drop in hedging costs increases attractiveness of onshore China bonds for USD-based investors.

Concerns with the yield differential narrowing between US Treasuries and China government bonds, recurring and economically restrictive COVID related lockdowns, property market crisis worsened by pockets of mortgage boycotts, and rising geopolitical tensions have impacted investor appetite for onshore Chinese yuan (CNY) denominated China bonds.

As a result, from an asset allocation perspective, many investors have chosen to curb their China exposure as a whole. Foreign investment in the China bond market has dropped for five consecutive months at the end of June, according to data from China Central Depository & Clearing Co.—a reversal from years of growing international interest and investment in this asset class.

We believe it is also important to look beyond the news headlines. Did you know that onshore China bonds are the only major bond market to deliver a positive return in local currency terms in the first seven months of 2022 (according to data from Bloomberg Finance L.P.)?

In fact, onshore Chinese bonds have delivered the best performance year to date and over the trailing year, outperforming other world bond markets as of the end of July. Their low volatility and low correlation with other major asset classes have shown that onshore China bonds can be an effective portfolio diversifier as clients benefited from such returns.

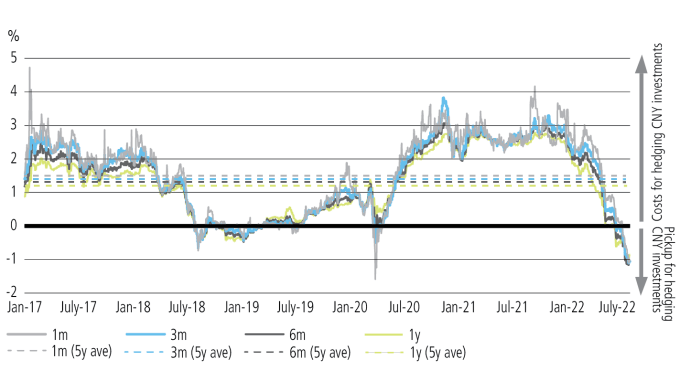

We still see Chinese bonds as a key standalone strategic allocation in a portfolio, especially for investors looking for attractive nominal yields and real yields. As long-term investors, we often advise to look past the immediate—short-term events and market mood—and focus on your goals for the long run. That continues to be tried and true, but we believe that there is one short-term development that is creating an advantage for onshore China bonds in the current climate: a dramatic drop in CNY hedging costs. Hedging the CNY against the US dollar (USD) turned net positive for USD-based investors in early June for the first time in two years, and it stayed positive as of the end of July.

Hedge for a currency gain

International investors buying foreign bonds denominated in foreign currencies sometimes use currency hedging to reduce risk and uncertainty from foreign exchange (FX) fluctuations that are oftentimes volatile.

Prior to 2018, the only option for offshore investors to hedge their CNY exposure was via CNH deliverable forwards (CNH DF), or CNY non-deliverable forwards (CNY NDF). CNH is the Chinese yuan that is traded offshore.

In 2018, China announced the introduction of the CNY deliverable forwards (CNY DF) made available to foreign investors as a FX forward hedging tool—a typical plain vanilla hedging instrument commonly used in other developed bond markets around the world. Hedging costs for CNY against hard currencies came down significantly on that 2018 announcement, and it’s part of the reason why Chinese bonds were subsequently included in global indices. To this day the CNY DF is accessed via China InterBank Bond Market (CIBM) direct and Bond Connect schemes. And in 2020, hedging costs dropped to an even lower level due to aggressive interest rate cuts by the People’s Bank of China (PBOC) at the onset of the COVID pandemic.

Currency hedging rates are mainly based on the difference between the short-term interest rates of two countries. If you look at China and the United States, one of the reasons that hedging costs today are low is that the Federal Reserve is raising interest rates while the PBOC stays accommodative. With a stronger US dollar, the Chinese yuan has depreciated around 5.8% year-to-date as of the end of July.1 On a hedged basis, the current USD-CNY forward premium offers a forward discount—or a pickup to hedge (see chart below), and hedging costs now favor CNY investors.

Pickup from hedging at the end of July using USD-CNY FX forwards (annualized)1:

- 1-month: 1.05%

- 3-month: 1.06%

- 6-month: 1.06%

- 12-month: 0.86%

A discount on hedging costs mean current USD-based investors who hedge CNY investments will achieve a pickup or additional income from hedging using USD-CNY FX forwards. Currently the discount is material for USD-based investors, particularly when compared to the five-year average. Take the three-month number above as an example: there is a forward discount of 1.06% (pickup) when hedging CNY against USD, compared to the five-year average of 1.04% (cost) as of the end of July. In simple terms, instead of paying a hedging markup, USD-based investors now receive an income gain from currency hedging.

This advantage is a function of various market factors and won’t last forever. In contrast, CNY appreciated around 2.7% back in 2021, giving unhedged CNY investments a positive foreign exchange advantage.1

CNY/USD Hedging Costs, 2017-2022

The more negative hedging costs are, the larger the forward discounts.

Chart 1: This chart shows the costs of hedging the Chinese yuan against the US dollar in the past five years. Hedging the CNY against the USD turned net positive for USD-based investors in early June for the first time in two years.

Outperform global peers

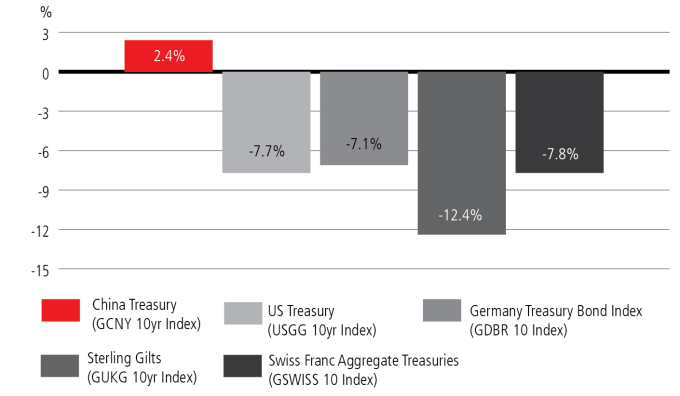

Low hedging costs aside, don’t forget that onshore China bonds performed relatively well in the first seven months of the year. The Bloomberg China Aggregate Index that tracks the performance of the CNY-denominated fixed income market containing mostly Treasuries and government related securities returned +2.55% (local currency terms) during that period. That performance is strong compared to the US investment grade, US high yield, EUR investment grade and EUR high yield indices with high corporate exposure, which turned in losses of 9-19%. Even the US Aggregate Government-Related and the Euro-Aggregate Treasury indices returned between -7.7% and -8.6% (local currency terms). Data is from Bloomberg Finance L.P.

We see a similar story on the sovereign bond side, reflecting the strength of China bonds, as well as their benefits as a portfolio diversifier (see chart below).

Sovereign bond performance YTD July 2022 (in local currency)

Please note that past performance is not a guide to the future.

Chart 2: This chart shows the performance of different sovereign bond markets year-to-date. Onshore China bonds outperformed global peers in the first seven months of the year.

Some help from Beijing

To turn our focus back on the long term, we believe that there are plenty of elements that make China bonds attractive to global investors.

Coming off the worst quarterly economic growth performance since 2020 in the second quarter, China has ramped up fiscal and monetary policy support in an effort to reach its annual growth target while acknowledging recently it’d be a tall order this year. A stimulus driven recovery is on the cards and when it does accelerate, it will have commodity, rates, growth and FX reverberations around the world. However, today there is a distinct lack of demand for the new credit supply, as domestic confidence is severely dented. This has resulted in government stimulus remaining trapped in the financial markets, evident by the overnight repo rates or cash rates hovering around 1%, when they should be closer to 2.5% on average in our opinion.

In terms of the domestic bond market, the largest investors are the domestic banks (60-70%), who continue to plough excess reverses back into buying bonds. From a monetary perspective, we believe that this extremely weak macro backdrop makes the PBOC more likely to cut rates than to hike, with little chance of policy reversal until maybe late 2023. This stands in stark contrast to most of the other economies, where they are hiking and reversing excessive quantitative easing measures to fight elevated inflation concerns.

Even though diverging monetary policies between China and the rest of the developed market world have narrowed the previously wide yield differential, China is not suffering from high inflation like the US and Europe, and onshore China bonds continue to offer high nominal and real yields. We see China inflation at around 3% till the end of the year. When compared to other large economies facing headline consumer price indexes (CPIs) of around 6-10%, China looks calm in terms of inflation risks. As the world searches for safe nominal and real yields rather than exposures with high inflation risks, we believe investor appetite will return in earnest in time to come.

More than that, some of the recently announced and rumored plans from the government are encouraging in our view. Efforts to drive further opening of the onshore bond market include a cut to trading fees, streamlined process for opening accounts, and easier access to the primary bond market via cross-border subscriptions. These steps point to the Chinese government’s strong commitment to continue opening their capital markets, which encourages more global investment both in the equity and debt markets. Beijing’s longer term objective is to encourage other countries to embrace CNY more in traded commodities and goods transactions, which reduces their reliance on the USD as the key settlement currency.

To sum up, we encourage investors to consider diversifying your bond allocations with onshore Chinese bonds. They currently exhibit negative correlation with major risk assets (equity and credit) while delivering low volatility and offering nominal and real income—characteristics we consider to be more strategic in nature than just tactical allocations. But their attractiveness is particularly acute at the current juncture from the perspective of foreign investors, who have the opportunity to generate incremental returns just by hedging the currency exposure.