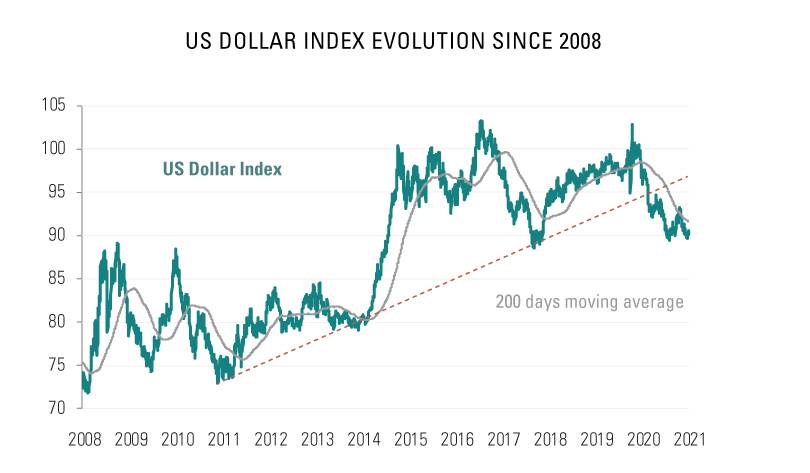

After appreciating steadily over a several-year period, the US dollar is facing a growing number of factors that might just tip the scales in the opposite direction. Market movements over the last eight weeks underscore the need to examine that eventuality.

Desynchronised Global Growth

Disparities in how governments have handled the Covid-19 pandemic and in their fiscal policies suggest that the various economic blocs will recover at differing paces.

The United States stands out on all counts. No less than 60% of the adult population has been vaccinated to date, the economy has snapped back and fiscal and monetary policy stimulus is impressively large. Yet since the end of the first quarter, nominal interest rates have held fairly steady, the equity-market rally has slowed and the dollar has depreciated to the point that it now stands roughly where it was at the start of the year. This paradox is less surprising than it looks at first blush, however.

Plans to Drive Federal Spending and National Debt to Record Heights

Both macroeconomic data and corporate earnings releases in the country bear witness to a sharp economic upswing1. Moreover, the Biden administration’s proposed budget – with spending plans to the tune of $6 trillion dollars in 2022 – suggests the US economy will still be growing at a solid pace beyond this year of recovery.

Though such high economic growth, both in absolute terms and relative to the rest of the world, typically goes hand in hand with a rising currency, the greenback has already surrendered most of its first-quarter gains.

This is partly down to the problem that how Congress ultimately votes is often at odds with what the President wants2 . But more importantly, Biden’s leaning towards transfer payments, which would tend to support consumer spending rather than capital expenditure leads us to believe that the return on investment will likely be lower than in the past. And that will make dollar-denominated assets less attractive.

How Well is Central-Bank Credibility Holding Up?

Federal Reserve officials have in recent weeks reiterated their intention to maintain an accommodative policy. In doing so, they have outmanoeuvred financial-market participants who thought they could force the Fed to tighten3 . A clear sign of this renewed credibility is that fixed-income markets have barely reacted to the latest inflation readings4. Investors have apparently bought into the Fed’s narrative that the current bout of inflation will be short-lived, or at least they are willing to wait to find out whether at the Jackson Hole symposium this summer the Fed might discuss a possible slowing of the pace of its asset purchases (which would in turn signal a rate-hike cycle that would kick in a year later). A further implication of the current state of play is that each central bank will be charting its own course. The Fed’s decision-makers seem to have adopted a patient, or even wait-and-see stance, leaving it to their British, Canadian, Norwegian and other peers to pursue more orthodox policies.

A Dollar will be Worth Less Tomorrow than it is Today

This changed reaction function at the Fed, which boils down to letting inflation pick up steam before intervening, has an impact on the greenback.

It should be recalled that inflation erodes the time value of a currency, and therefore in this case the demand for US dollars: rising prices mean that you’ll get more goods and services for one dollar today than you will tomorrow. And ever since the US exited the gold standard in 1971, currencies are sustained primarily by the degree of confidence the corresponding central bank commands. Janet Yellen’s appointment at the head of the Treasury thus heightens the existing doubts as to how fully independent the Fed actually is. The US central bank’s plan to finance a sizeable share of the country’s record fiscal deficit may raise some eyebrows5 . To make matters worse, part of the shortfall will have to be paid for with higher taxes. And the deteriorating current account will likely fuel consumer spending rather than capital investment. That is bound to undermine a currency already weakened by a combination of fiscal and trade deficits and by the pandemic-induced erosion of an interest-rate differential that has worked to the advantage of the United States for so long.

Then again, we could be in for something much worse: “stagflation”. This portmanteau was coined when the golden age of Keynesian economic policy in the mid-1960s, based on fiscal largesse pursued in cahoots with central bankers, was on its way out. (Needless to say, any resemblance to recent events is “purely coincidental”.) Those who harbour stagflation fears can indeed point to the latest US non-farm payroll reports, which surprised to the downside6. A probable explanation for this hiccup is that, flush with generous benefits, some of the unemployed seem to be in no hurry to look for a job at this stage. This could result in an upward drift in wages as companies struggle to attract workers – even though that struggle may not reflect a more robust economy. Rising pay levels are among the key possible drivers of more lasting inflation and could also rekindle fears of a wage-price spiral. Both monetary policy and fiscal policy are fairly ill-suited to overcoming such a predicament. What makes this a Catch-22 situation is that efforts to boost GDP growth tend to fuel inflation, whereas orthodox policies aimed at keeping inflation in check tend to stifle growth. The upshot is an unpalatable cocktail for a country’s currency and economy.

These various forces are likely to weigh on the dollar in the medium term.

When it comes to investing, what distinguishes foreign exchange strategies is that they revolve by definition round a currency pair, and identifying the right counter currency is always a tough call.

Europe is Still in the Running

Although Europe has been more severely affected by the Covid-induced downturn and has less impressive stimulus policies than the US, the region has become more attractive to international investors, not only because political cooperation has strengthened, but also because a large number of issuers here are poised to cash in on an economic recovery7. This is the first time in quite a while that European equities have outperformed their US counterparts without being hindered by euro appreciation. Moreover, this trend stands a good chance of continuing. Eurozone inflation expectations have risen8 but are still far below the ECB’s target rate (contrary to the situation in the US), and they could be further buoyed by the region’s comparatively more favourable growth momentum, as economic re-opening has only just begun.

Furthermore, European interest rates have been climbing noticeably this spring. In fact, investors even appear to be pricing in monetary policy tightening over the next two years and possible tapering of the ECB’s extraordinary asset purchase programme. We feel these investors are jumping the gun, however. At this point, inflation is primarily a US issue, and we expect both the ECB’s policy timetable and the future statements by its members to remain dovish. European interest rates can therefore be expected to stall.

Asia in the Vanguard of the Fourth Industrial Revolution

China has handled the pandemic much better than the United States. But the country is also rendered attractive by the improving long-term economic and technological outlook for the region as a whole. China has continued to invest in the technologies shaping the future. The yuan has risen significantly, reflecting both good macroeconomic news and the interest-rate oasis that China offers in an otherwise yield-starved desert. And for the time being, Beijing seems to have adopted a somewhat permissive stance on such movements – sensibly, as a stronger currency is an effective way to limit the extent to which the US inflation fuelled by Fed policy will be imported. Even so, the Chinese central bank is likely to stick with its dovish stance to prevent the currency from appreciating too sharply against the dollar, and that should keep the country’s equity and bond markets humming. The simmering tensions with the United States are the main potential source of disorder.

The Currencies of Commodity-Exporting Countries are Lagging Behind

Commodity prices have returned to levels seen five years ago, leading some pundits to wager that another “supercycle” is in the offing. Now, we consider it risky to get direct exposure to that trend in this period of temporary supply disruptions, high inventory buffers and large-scale speculative positioning. Yet quite a few currencies of countries exporting commodities that are essential to the unfolding economic upturn and green infrastructure seem to be stalled.

Investors are likely still smarting from the “taper tantrum”, when capital flowed massively out of what were still vulnerable emerging markets after the Fed signalled its intention to normalise monetary policy and interest rates went up in response.

But things are very different today. Central banks enjoy greater credibility and, contrary to the situation in 2013, many nations boast current-account surpluses today. We can therefore look forward to currency appreciation in countries with sound economic fundamentals and disciplined central banks. We have accordingly opted for a highly selective approach to our exposure to commodity-producing economies.

We are maintaining a balanced portfolio combining long-term and short-term convictions. Desynchronised growth has the advantage of allowing for more diversification.

Those performance drivers are being supported by key strategic hedges. As described in our recent Notes, interest-rate risk is one key focus of that approach. And as we’ve hinted at in this paper, currency risk is the second. Though it may seem counterintuitive, a weaker US dollar is not antithetical to higher interest rates. And just as with interest-rate risk, managing currency risk calls for an active approach. The dollar itself is highly sensitive to changes in risk appetite (both upward and downward) and, due to its global role, it is a particularly complex instrument that is prone to short-term movements.

1In the first quarter, US GDP growth came in at 6.4% on an annualised basis. Corporate earnings per share were up 50% year-on-year, overshooting what were already quite bullish forecasts.

2Given how slim the Democrats’ majority in Congress is, getting laws passed will hardly be a stroll in the park for Biden.

3Chairman Powell and his Board of Governors have managed to convince investors that they won’t be shifting gears any time soon, that the current price increases are transitory and that there is therefore no compelling reason to start tightening policy yet.

4At over 4% year-on-year, the inflation rate currently exceeds consensus forecasts and stands higher than at any time in the past decade.

5The Fed will be hoovering up some 25% of all new Treasury issuance this year.

6The April report showed 278,000 jobs created, versus a median estimate of over 1 million. The figure for May was 559,000, compared to an estimated 675,000.

7These issuers include consumer-goods and travel-related companies, along with “old economy” businesses in manufacturing, banking and commodities.

8Average expected inflation for the next 10 weeks is 1.4% for the eurozone, versus 2.4% for the United States (or one percentage-point higher for the next 10 weeks, year-on-year).