It is 5am and your smart clock alarm sounds earlier than usual. Has it malfunctioned? No, it scanned your schedule and adjusted itself for your 8am flight today. It’s time to get up. The coffee machine starts making your cappuccino. The shower automatically turns on and warms to your preferred 37 degrees. A drone delivers an unexpected package – some medicine. The health sensors around your home detected an impending cold or flu and placed an automatic order. The electric car is ready to go, charged by the solar panels on your roof. As you set off you see a family of flying robots land on top of your apartment block; they have come to clear the leaves blown into the guttering overnight.

Smart Homes

Whether this is your idea of a future utopia or dystopia, the evolution of the home is already underway (albeit a little slower than we expected). Where are we today? According to a new report from the IoT analyst firm Berg Insight, there was a total of 53.7 million smart homes in Europe at the end of 2021. The installed base in the region is forecasted to reach about 100 million homes at the end of 2026, representing a market penetration of 42%.

What does ‘smart home’ actually mean? It can be interpreted in many different ways, but essentially a smart home today is about ubiquitous connectivity. It doesn’t mean the world has to look like a scene out of a Jetsons cartoon, but rather about making optimal use of all the interconnected information available to us, allowing for better understanding and control of our lives.

The most popular products thus far tend to include smart thermostats, light bulbs, security cameras, door locks and pet cameras (my favourite). Most of these are centred around convenience, increasing safety, and boosting energy efficiency.

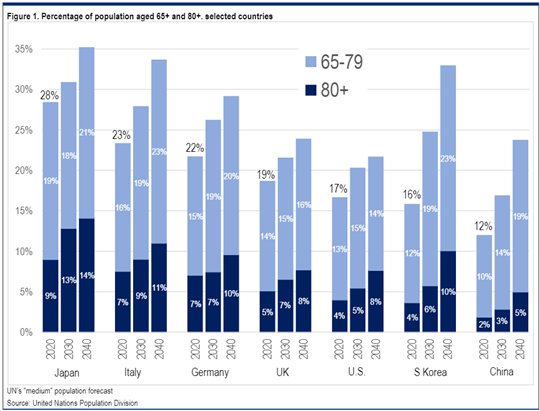

One interesting area of smart home products is AgeTech. This is a new realm of products intended for older adults. The changing demographic towards an ageing population is nothing new. Around one in ten people globally were over 60 years old in 1950 – this is expected to increase to more than one in 5 by 2050.

A major implication of this change is that it significantly decreases the percentage of caregivers available for each elderly person in need of assistance. There is a multitude of AgeTech products available for the home that can improve the health and quality of life of elderly adults, potentially allowing them to live safely at home for longer and reducing the need for caregivers. It involves the convergence of the health, consumer and tech sectors in producing products such as companion robots, wearables to encourage better health monitoring and preventative care, fall detection sensors, and an activity feed so family members can see if someone has been less active than usual. Investment opportunities today remain limited, but could this be the next frontier market for technology disruption?

Beyond the energy crisis

The continued rise in energy bills across Europe has brought an increased focus on the energy efficiency (or lack thereof) of our homes. The IEA reports that if the world were to implement the cost-effective energy efficiency opportunities available today, in 2040 households globally could save $201 billion in avoided expenditure on fuels such as electricity and gas. Governments must lead the planning and incentivising of the massive infrastructure investment needed to improve energy efficiency, and to reduce our reliance on fossil fuels within the home.

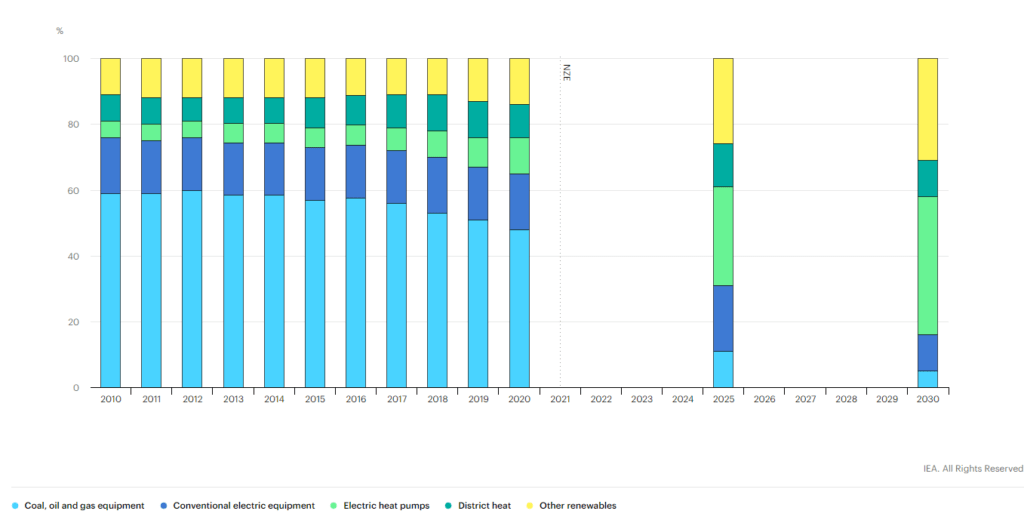

Heating technologies sold globally for residential and service buildings in the Net Zero Scenario, 2010-2030

The IEA stresses that no new gas boilers should be sold after 2025 if Net Zero targets are to be achieved by 2050. Heat pumps are one example of a better, low-carbon alternative. In recent years, we have seen a slight uptick in the adoption of electric heat pumps, albeit slower than required.

In the EU, the heat pump market is expanding quickly, with around 1.8 million households purchasing one in 2020 (12% annual average growth since 2015, and 7.5% growth relative to 2019, despite the pandemic). In 2020, Germany replaced Spain as one of the top three markets. Together with France and Italy, Germany was responsible for nearly half of all sales in the EU, while Sweden, Estonia, Finland and Norway have the highest market penetration rates (more than 25 heat pumps sold per 1000 households each year).

In many countries today, heat pumps register the highest market share of all heating technologies in newly built houses. In the United States, for example, the share of heat pump sales for newly constructed buildings exceeds 40% for single-family dwellings and reaches nearly 50% for new multi-family buildings. A step in the right direction, but progress is still needed across the globe to boost uptake in existing buildings. https://www.iea.org/reports/heat-pumps

Heat pumps form only part of the solution, and there are many other levers we can pull to increase energy efficiency and reduce our reliance on fossil fuels. Solar panels, better insulation, draught-proofing, smart home applications, smart meters − these can all have a significant positive impact on energy efficiency. Whilst most of the incoming regulation relates to new builds, we will need continued strong government policies and financial mechanisms to help citizens retrofit existing homes.

Energy efficient design and construction

Residential properties are responsible for 17-21% of energy-related carbon emissions globally. That figure covers everything from the electricity we use to power appliances to the fuel we use to heat our water and cook. The majority goes on heating. But let’s take one step back − what about before they are occupied? The buildings and construction sector accounted for 39% of energy and process-related carbon dioxide (CO2) emissions in 2018, 11% of which resulted from manufacturing building materials and products such as steel, cement and glass.

Most companies have a good handle on how to reduce emissions from the use of houses, but progress on reducing emissions from the construction phase is more difficult. Modular design construction appears to be a promising (and realistic) solution here. This is the process by which a building is constructed off-site in modules to later be assembled on site, under controlled conditions, using the same materials and designing to the same codes and standards as conventionally built facilities – but in about half the time.

It reduces emissions from the processing of raw materials into building products as it is done away from construction sites and at scale, and it reduces waste. According to recent UK studies, waste reduction of up to 90% can be achieved with off-site modular building, and can produce 41-45% less carbon dioxide emissions than the traditional methods of building homes (Cambridge & Napier Universities). Furthermore, when paired with building materials that have validated low emissions across their lifecycle via Environmental Product Disclosures (EPD), they could lead to a big decrease in the embodied carbon of homes. Think 3D printed houses, which have a similar aim, but are a much more experimental technique that has proven difficult to scale.

These are just a few of many of the ways our homes could evolve, both inside and out, in the years to come. As the statistics show, the ability to scale technology and enable new solutions for sustainable building practices will be key to the success of the transition. And who knows, if we miss our targets, we always have Mars!