This summer, UK gilt markets have outwardly been remarkably calm. Ten-year gilts have traded within a narrow range, defying the persistent narrative of fragility that has lingered since last year’s volatility. At first glance, stability appears to have returned. But beneath the surface, the story is more complex—and it carries important lessons for Liability-Driven Investment (LDI) strategies.

Lesson 1: Understand the curve’s quiet transformation

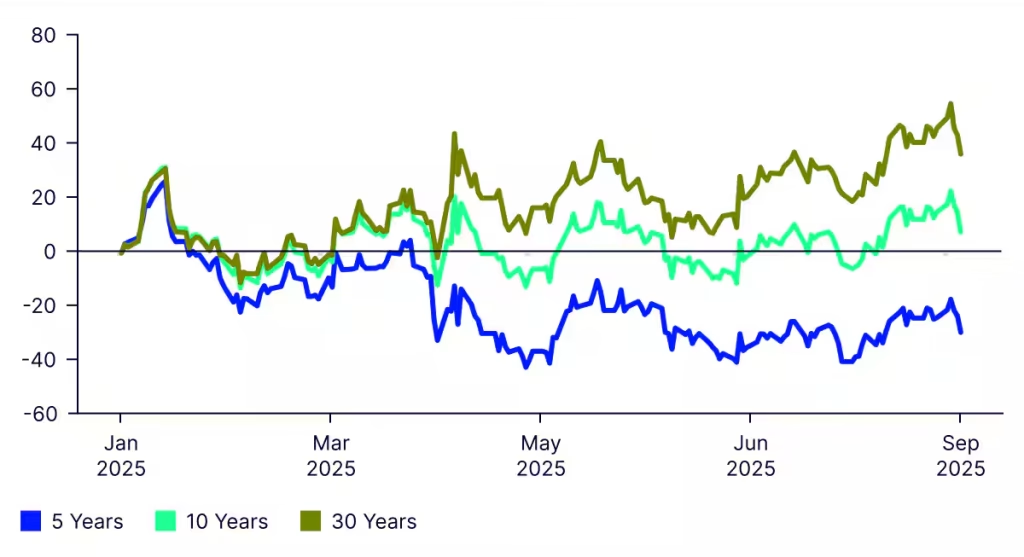

While headline yields suggest calm, the yield curve has undergone a notable twist steepening. Here’s why:

- Short-end relief: Five-year yields have declined, reflecting the Bank of England’s recent rate cuts and expectations of a more accommodative stance.

- Long-end pressure: Longer maturities have moved higher, driven by fiscal concerns and the prospect of sustained gilt issuance.

- Anchored middle: Ten-year yields have remained relatively steady, as these opposing forces have largely offset each other.

Figure 1: Year-to-date changes in yields (basis points)

Source: Bloomberg as of 5 September 2025. Past performance is not a reliable indicator of future performance.

This structural shift matters. For LDI portfolios, ensuring hedge accuracy across the yield curve is more important than ever.

Lesson 2: fiscal risk does not necessarily mean inflation risk

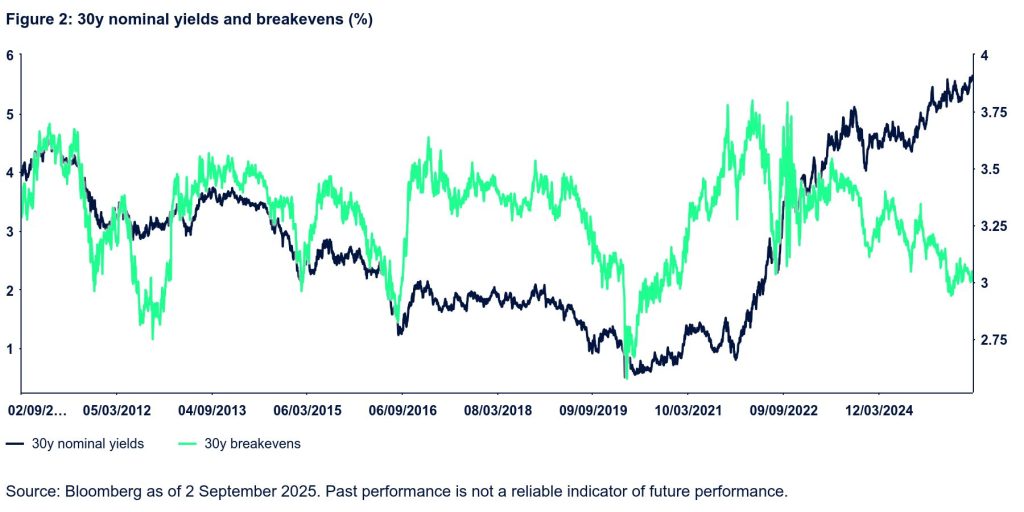

What’s striking is what hasn’t happened: inflation expectations have remained anchored. Breakevens have been subdued, suggesting markets are not pricing in a surge in inflation risk, even as fiscal worries persist. Historically, fiscal risk and inflation expectations tend to move in tandem. Their current divergence is unusual—and worth monitoring closely.

LDI investors will need to consider the appropriate hedge ratios for both interest rates and inflation, recognising that the historical correlations between the two may no longer apply. The chart below shows how 30-year yields are at 15-year highs, whilst 30-year inflation breakevens are close to historical lows.

Lesson 3: prepare for policy and fiscal crosscurrents

As summer draws to a close, two events loom large:

- The Bank of England’s QT decision: While the Bank has been reducing its balance sheet, expectations point to a slower pace of quantitative tightening ahead. This reflects a desire to avoid unnecessary market disruption, particularly given the heavy gilt supply backdrop.

- The Autumn Budget (26th November): Fiscal credibility remains a sensitive topic. Any surprises could reshape the curve and reignite volatility.

The takeaways

LDI investors should maintain a high level of curve and volatility awareness, positioning portfolios to handle potential dislocations from upcoming policy and fiscal events. In short, LDI investors should remain vigilant —what looks calm today could mask the next big move tomorrow.