Key Takeaways

- The energy transition is bringing structural demand shifts for commodities associated with low carbon technology value chains

- Price signals and policy goals have brought strong supply-side reactions that are leading to short-term oversupplies in the lithium and nickel markets, amongst others

- This blog highlights the interplay between the short-term supply stimulus, resulting surplus and long-term demand drivers and deficits that inform expectations of energy transition metal and commodity markets

- Related ProductsWisdomTree Energy Transition Metals and Rare Earths Miners UCITS ETF – USD Acc, WisdomTree Energy Transition MetalsFind out more

A structural demand shift

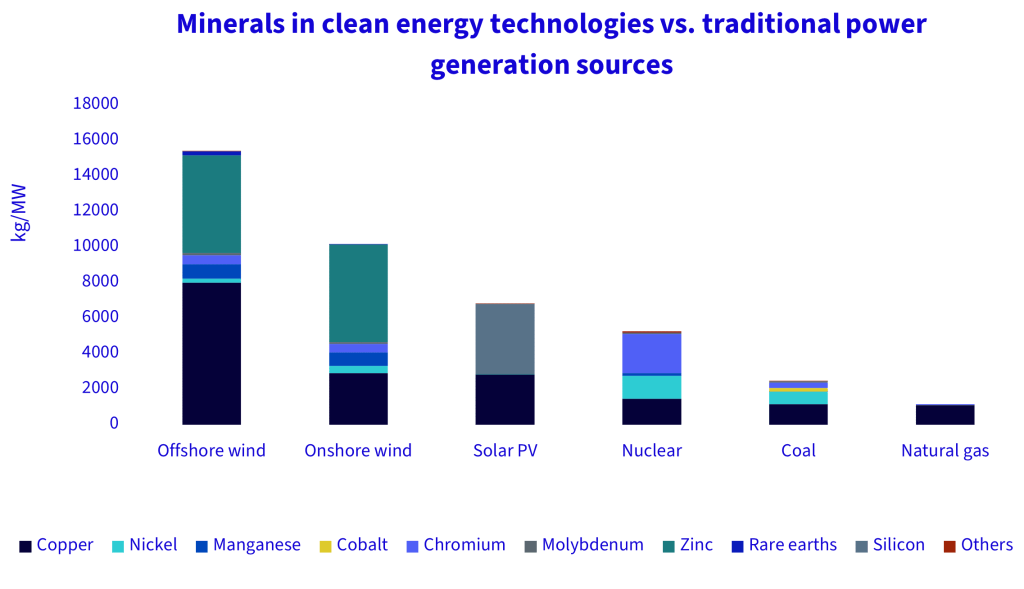

A striking feature of the energy transition is just how much more mineral inputs the low carbon energy technologies in power and transport call for. Renewables like off- and onshore wind and solar photovoltaic, and electric vehicles (EVs) are relatively more mineral-intense than traditional sources of power and transport. As a result, the worldwide push to improve climate and energy security through new low-carbon energy systems brings with it a structural increase in the demand for certain metals and mined commodities.

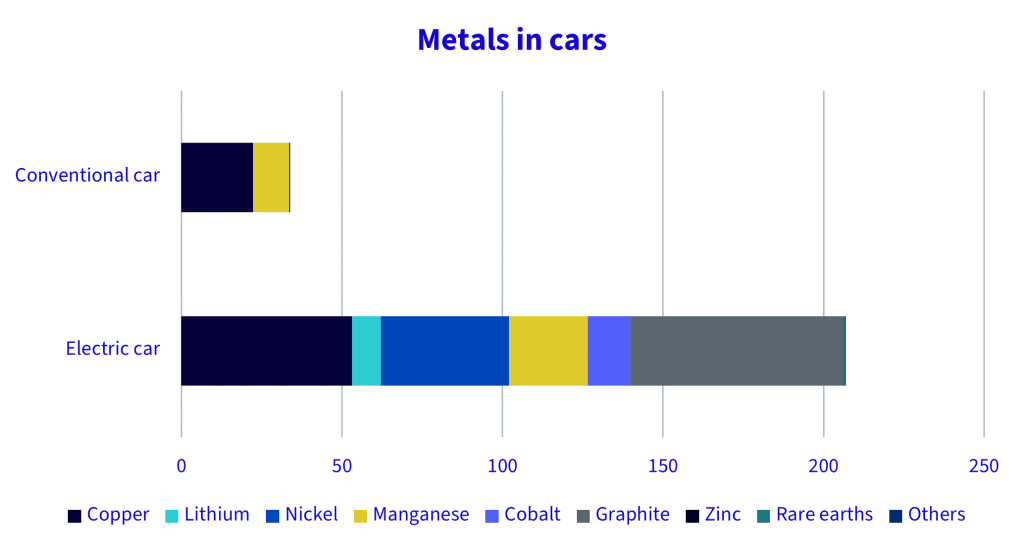

The grounds for this relative intensity are many. For example, the widespread push to expand wind and solar generation capacity and the associated electrification of final energy use will require more zinc, more silicon, and more copper for wiring, transmission and distribution cabling. Likwise, even though the technologies within the battery space are constantly shifting, it’s clear that EVs use more lithium and copper than conventional cars.

So, although the pace of change in this energy transition remains uncertain, particularly in the wake of recent inflationary trends, the means of realising the change is not in doubt and that buoys expectations of future mined commodity demand.

Source: International Energy Agency The Role of Critical Minerals in Clean Energy Transitions, 2021. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

Suppliers respond to the call

Mineral supply chains have to expand rapidly to meet the shift in energy transition commodity demand. This expansion has already begun. Wood Mackenzie tracks a basket of refined metals associated with energy transition applications primarily in power and transport. It includes aluminium, cobalt, copper, gold, lead, lithium, nickel, platinum, silver, tin and zinc.

Looking across that basket as a whole, the average growth in the production of those metals from 2020 to 2023 was roughly one third. According to Wood Mackenzie’s Q4 2023 base metal and electric vehicle battery supply chain outlooks, the top line growth was driven by notable expansions in the production of nickel (36%), cobalt (48%) and lithium (124%). A boost to the prospects of meeting the goals of the energy transition, the pace of observed change on the supply side has outstripped the pace of change in demand, reshaping established fundamentals and leaving short-term market balances notably loose in some commodity markets.

Two notable trends have driven the pace of supply growth: public sector stimulus and market-based responses to price signals. Each has made supply-side considerations ever more important to assessments of transition metals.

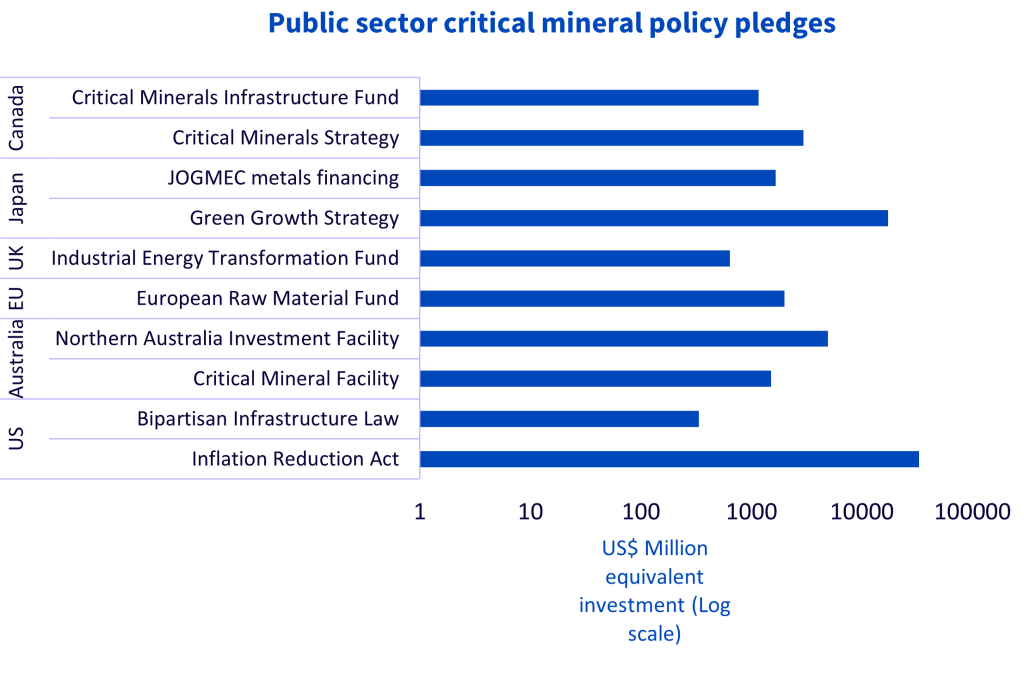

On the one hand, governments have played a part by incentivising critical mineral supply. North American, European and Asian economies from the Organisation for Economic Co-operation and Development (OECD) membership have been notably active in establishing new strategies, funds and facilities since 2022. Diverse in commodity focus, form and level of incentivisation, they are nonetheless united by the aim of energy transition self-sufficiency through improved domestic (or friend-shored) critical mineral supply capacity and reduced dependence on the supply chain governed by China. At a global level, they’ve contributed to positive market sentiment around the availability of key minerals to support the energy transition.

Price signals have also stimulated new supply streams. Since 2020, the markets for energy transition minerals have seen record prices. With the demand case associated with renewable power and EVs backed by ever more ambitious policies and measures associated with climate change action towards a net zero greenhouse gas emissions future, the scarcity implied by the limits of established supply chains sent spot and long-term prices for base and precious metals and other mined commodities linked to the transition soaring. Profit-taking and questions over the resilience of low carbon demand have seen prices drop off from those highs, contributing to notable degrees of volatility for equities across energy transition metal value chains and the price formation around the minerals themselves.

Striking a balance

These conditions are expected to persist for the foreseeable future. The longer-term incremental demand associated with renewable power capacity additions and the electrification of transport in the name of climate policy goals is a clear signal for investors. Metal deficits are likely to arise in any net zero scenario, and every step taken towards a lower carbon future calls forth increased metal and mineral consumption relative to the features of the high carbon economy.

And yet, the remaking of the power and transport sectors takes time. Project lead times and the scale of increased demand have been surpassed by rapid, aggressive supply-side expansions in nickel, cobalt, and lithium production, in particular. Prices have pointed the way, and policy interventions to onshore or friend-shore the value chain only serve to reinforce expectations of surplus in the short term. This makes it critical for investors to consider supply alongside demand when considering their energy transition position.