The global composite Purchasing Managers’ Index (PMI) rose slightly in August, reassuring markets about economic growth. However, central banks should take note of weakening manufacturing activity, employment, and inflationary pressures. In this Macro Flash Note, Senior Economist GianLuigi Mandruzzato looks at the details of the PMI survey.

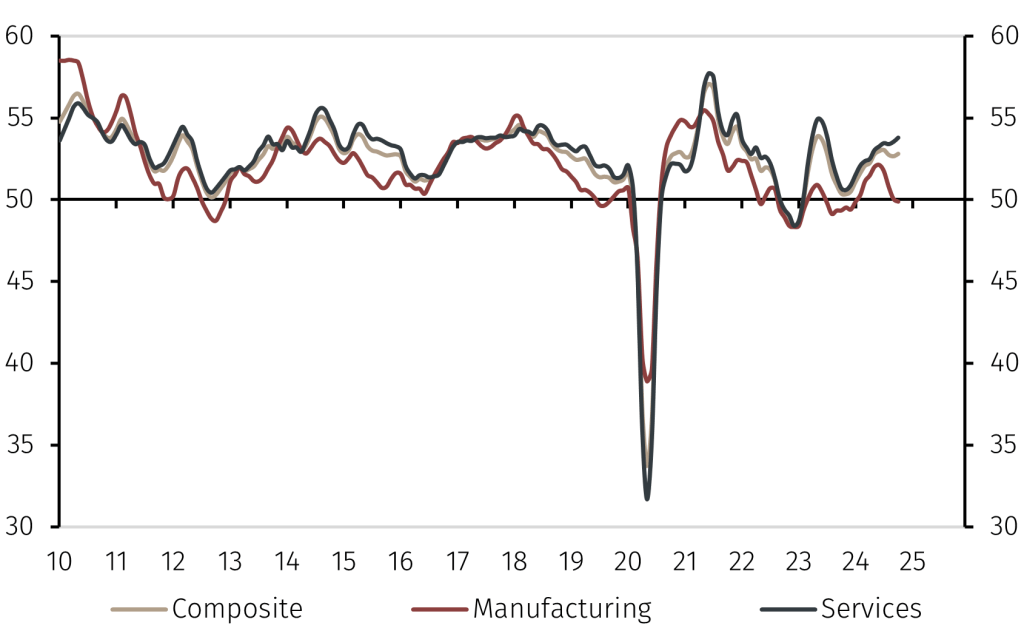

At face value, the 0.3-point increase to 52.8 in the composite PMI in August is reassuring (see Chart 1).1 This level is close to the average since 2011 and is consistent with global GDP growth around 3%.

Chart 1. Global composite PMI and sector breakdown

Source: LSEG Data & Analytics and EFGAM calculations. Data as at 09 September 2024.

Warning signs emerging

However, the details of the survey are not so reassuring. The increase in the August composite PMI is entirely due to the services sector. The manufacturing output index fell below the critical threshold of 50 that separates contraction and expansion, albeit only marginally (see Chart 1). The decline in new orders and orders backlog components points to enduring weakness in the manufacturing sector.

Although manufacturing only accounts for about a fifth of global value added, the signal should not be overlooked. That is because for the last 25 years the manufacturing sector has led the rest of the economy (see Chart 1). If this historical pattern repeats itself, the services sector will lose steam in the coming months and global growth will slow accordingly.

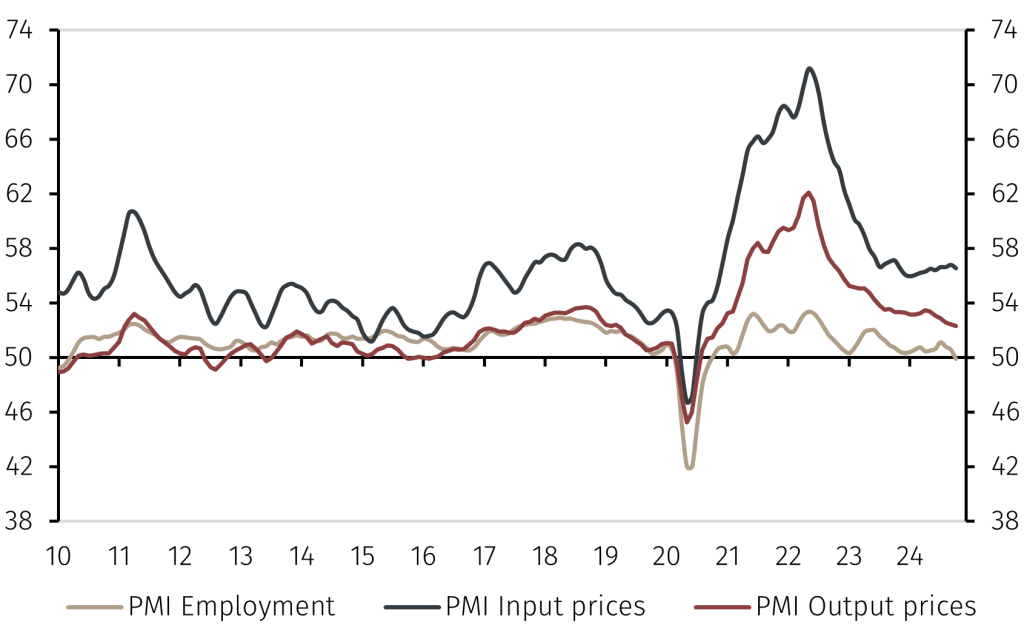

Another warning sign from the PMI survey is the worsening employment outlook (see Chart 2). Although the August survey points only to a marginal decline, the index level is one of the lowest since 2011, except for the pandemic period. Employment lags the business cycle and its weakening will weigh on households’ disposable income and expenditure, potentially reinforcing the downturn.

Chart 2. Employment and price pressures

Source: LSEG Data & Analytics and EFGAM calculations. Data as at 09 September 2024.

Finally, global inflationary pressures have almost completely normalised after the shocks of recent years (see Chart 2). Global input costs and prices charged by companies have returned within the range that prevailed before the pandemic, a period when inflation was often too low in developed economies. This, and the recent decline in commodity prices, including energy, industrial metals and agricultural goods, points to inflation moderating further in the coming quarters.

Conclusion

In conclusion, beyond the marginal improvement in aggregate activity, three signals in the August global composite PMI survey should be heeded by central banks when setting monetary policy. First, the manufacturing sector, which over the last quarter-century has tended to lead developments in the rest of the economy, is weak and looks set to weaken further. Second, firms’ dwindling demand for labour risks reinforcing the global growth slowdown. Third, inflationary pressures have largely normalised after the shocks of 2020-22.

Against this backdrop, the current restrictive stance of monetary policy seems inappropriate. Regardless of how much interest rates are reduced in the coming weeks, markets will react positively if central banks show openness to adjust monetary policy as needed without constraints on the timing or size of the interventions.

1 The global composite Purchasing Managers’ Index summarises the results of surveys run by S&P Global among firms in the manufacturing and services sectors in more than 40 countries, accounting for 89% of global GDP.