Why small company ESG investing presents an opportunity, and how ESG analysis helps investors become better stewards of client capital.

Lead Portfolio Manager Steve Raineri and ESG Lead John Chow of the Franklin Small-Cap Value Team within Franklin Mutual Series discuss small company ESG investing, why it presents an opportunity and how ESG analysis helps investors become better stewards of client capital.

Small capitalization (small-cap) companies, and many teams that analyze them, are behind the curve when it comes to the implementation of environmental, social and governance (ESG)-friendly practices and analysis, making it largely uncharted territory. A company’s ESG practices, in our view, are intrinsically linked to long-term performance and business sustainability. As more small companies utilize ESG business practices and investors become more adept at evaluating them, these benefits may become a standard component of company returns. However, like the emerging markets investment landscape in the 1980s, the first investors to plant their flag as ESG pioneers may gain early access to the creation of additional shareholder value as the ESG landscape develops.

Navigating the unknown

We view ESG analysis as a set of tools that allows investment managers to improve their portfolio risk management practices and become better stewards of investor capital. An investment is a vote of confidence in a company, and misplaced confidence can lead to a loss of capital and poor management of client funds. Examples of suboptimal corporate practices regularly end up in the news, and these shortcomings can damage corporate reputations, people or the environment. Punctuated by infamous events like oil spills and account fraud scandals that illuminate the need, integrating ESG analysis into investing has been gaining traction in the large-cap space for many years. Avoiding companies with gaps in their operations or policies that would allow for negative events such as these to occur can lead to a smoother ride for investors. Identifying companies that foster ESG-friendly practices can reinforce a culture of responsibility and innovation. Unfortunately, many small-cap companies are behind the curve with implementation of these elements which, over the longer term, may boost a company’s stock price and reduce downside risk.

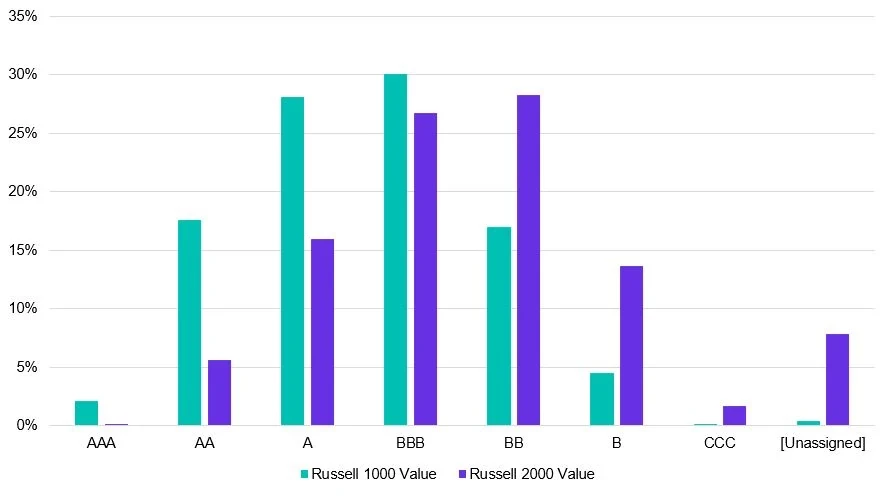

We think the slow integration of ESG standards in the small-cap space is due to a wide range of factors, including small companies having fewer resources than their large-cap counterparts to devote to ESG practices and reporting. Development and implementation of ESG business practices takes time and resources, which are two things many small companies do not have to spare. We believe underdeveloped reporting of ESG metrics plays a significant role in poor MSCI ESG ratings, with 51% of the US small-cap benchmark Russell 2000 Value Index rated BB/below or unassigned, while only 22% of the US large-cap benchmark Russell 1000 Value Index scores this poorly.1 This discrepancy reflects a lack of coverage and in our view, an opportunity to have a significant impact.

MSCI ESG Ratings Russell 1000 Value Index Vs. Russell 2000 Value Index

As of December 31, 2021

For teams that have the knowledge and bandwidth to partner with these companies, there is a chance to influence the direction and impact of ESG integration within small-cap investing and to help corporate practices improve. We believe actively engaging with portfolio companies to discuss how they can best upgrade their practices is an important first step.

Shaping the landscape

Building a relationship with company management is key to helping them implement an ESG-focused framework. An analyst team needs to include this in their process and devote the resources needed to maintain consistent communication with subject companies. We believe there are key questions that should be addressed when partnering with management to assess their progress in implementing ESG policy:

- Have there been previous discussions about ESG practices with company management?

- Does the company publish a Corporate Social Responsibility report or ESG metrics?

- Has the company established defined ESG targets?

- Is management compensation tied to ESG initiatives?

- Does the company have an ESG website or dedicated ESG personnel?

Identifying an area where a company is falling short can lead to a conversation about how they should begin to approach it and what type of assistance they may need to do so. It’s helpful to have additional ESG subject matter experts available to the analyst team who can lend their experience working with other companies that have already gone through the process of establishing ESG best practices, such as creating ESG metrics, hiring personnel to oversee adherence to ESG policies, aligning employee compensation with ESG-friendly practices and producing reports relating to ESG activities. Since many small companies do not yet have this structure in place, we see significant opportunities to partner and create value for both companies and investors.

A path forward

We believe implementing robust ESG analysis is a natural fit for investors like us who have a history of partnering with companies and actively engaging with management. Established trust and an open line of communication can make the difference between a company listening to the advice or not. It is also helpful to have a thorough working knowledge of the industry in which the company operates, so the possible ESG pitfalls and other business risks can be thoroughly assessed. Familiarity with the corporate financial situation and business operations are also essential. We believe these pieces fit together to inform what ESG-related issues the company should work to improve when it develops and adopts its new practices.

It is our opinion that a bias toward quality businesses, long a hallmark of our approach, is also helpful for maintaining a focus on ESG investing. We think companies that have a track record of growth, less leverage than their peers and higher profit margins display discipline, which can stem from tight governance standards. In turn, well-developed governance standards can lead to alignment of corporate interests with business sustainability, which we view as a key ingredient for long-term value creation.

We think the lack of ESG policy adoption by small companies is a significant opportunity to not only have a positive impact on corporate practices but to also create value for shareholders by leading companies toward more sustainable long-term goals. We take pride in being ahead of the curve when it comes to ESG focus and hope additional companies and investors will join the effort to give small-company ESG a prominent place on the map.

ENDNOTES

- Sources: FactSet, MSCI, as of 12/31/21. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. MSCI makes no warranties and shall have no liability with respect to any MSCI data reproduced herein. No further redistribution or use is permitted. This report is not prepared or endorsed by MSCI. Past performance is not an indicator or a guarantee of future results.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Generally, those offering potential for higher returns are accompanied by a higher degree of risk. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in smaller-company stocks carry special risks as such stocks have historically exhibited greater price volatility than larger-company stocks, particularly over the short term. Value securities may not increase in price as anticipated or may decline further in value. Additionally, smaller companies often have relatively small revenues, limited product lines and a small market share. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets.

Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values-based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating.

The managers’ environmental social and governance (ESG) investment strategies may limit the types and number of investment opportunities available and, as a result, may underperform strategies that are not subject to such criteria. ESG factors or criteria are subjective and qualitative, and the analysis by the manager may not always accurately assess ESG practices of a security or issuer, or reflect the opinions of other investors or advisors.

For actively managed ETFs, there is no guarantee that the manager’s investment decisions will produce the desired results.