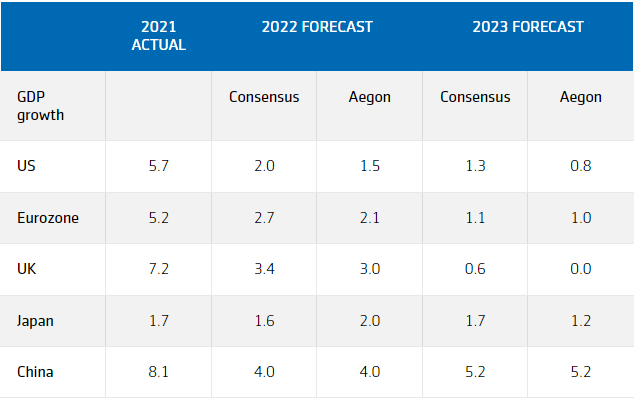

We continue to be more bearish than the consensus and expect growth will be well below trend in all major regions next year as a result of restrictive monetary policy taking effect.

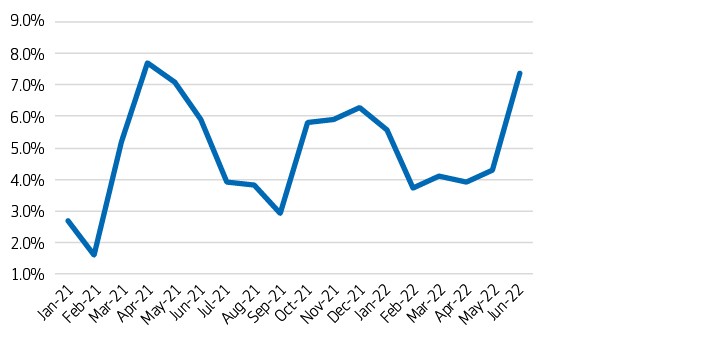

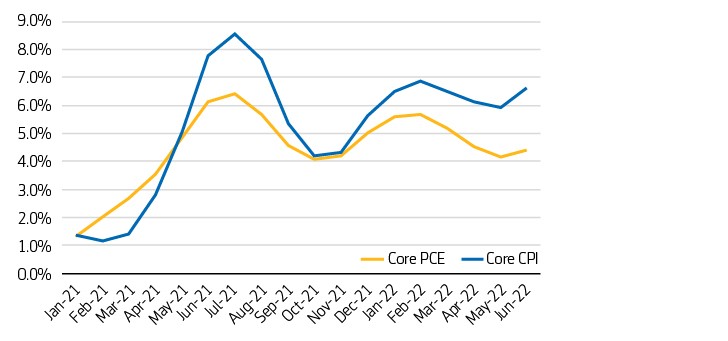

Frankly, we are quite astounded by the market’s emerging narrative that Federal Reserve Chairman Jerome Powell made a dovish pivot on Wednesday, July 27, 2022. It seems they are confusing a sentiment-fueled bear market rally with a perceived telegraphing of a policy change. To the latter, we saw nothing of the sort. Not only is the federal funds rate likely going another 100 basis points higher from here (as both Aegon Asset Management and the markets have forecast), but Powell’s rhetoric was very focused on fighting inflation at the expense of growth. Merge that with a core PCE that came out Friday, July 29 showing an acceleration in core inflation, and we believe a true pivot may be a wee bit off. Rather, our base case is still a 3.5% fed funds rate by year end. But it will take time to get inflation down below 2.5%, which means the actual pivot to a rate cut is unlikely until next summer at the earliest.

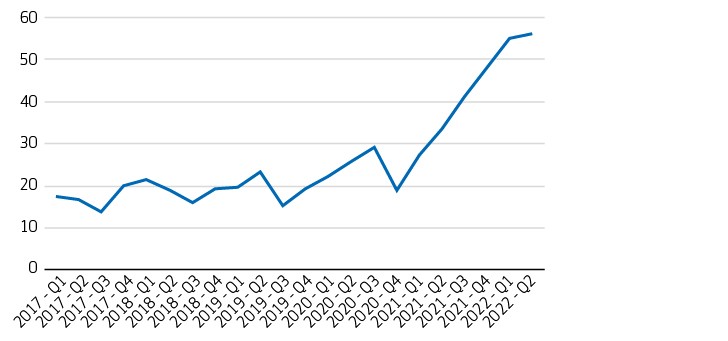

For a Fed “strongly committed to returning inflation to 2% objective,” inflation momentum is going the wrong way for a dovish pivot, as the charts on this page show.

Exhibit 1: Core PCE – 1m AR

Exhibit 2: Core inflation momentum—3-month annualized rates

Exhibit 3: Dallas Fed trim mean: Percentage items with price growth > 5% annualized

As for recession, despite the technical definition being met (two consecutive quarters of GDP contraction), we believe that the US is not currently in a recession … yet. We also note that without the massive pandemic-related inventory swing, GDP would likely have been +1.1%. Plus, the labor market, while slowing, still grew at +3.5% annualized pace in the second quarter—definitely not recessionary.

However, we still think a recession is very likely next year under the current path of policy. Private domestic demand (86% of the economy) is rapidly slowing, combine that with real disposable incomes falling for five straight quarters and you have a recipe for demand destruction (which is what Powell is hoping for to bring down inflation).

Here is the worst-case scenario for the Fed: If an actual recession/anemic growth occurs, but inflation is stubborn in coming down. This is the scenario that the market isn’t thinking about at all and would require a substantial repricing of risk assets.

We continue to believe that markets (especially equities) have priced a slowdown, but not a recession. There has never been a recession where corporate earnings haven’t contracted, yet earnings are forecasted to accelerate from here into a 9% year-over-year rate in 2023 and multiples are at average levels.

Furthermore, the strong revenue gains companies are reporting for the second quarter are directly correlated to the strong nominal GDP growth (while real GDP was at a -0.9% annualized rate, nominal GDP was at a +7.8% annualized rate). But that is mostly price related, not unit growth and thus aggregate margins peaked in the third quarter of 2021. We continue to like 10-year Treasuries above 3%, though are not too excited down here at 2.6%. Typically, this late in the cycle is not good for assets, so we still favor up in quality for now. We expect there will come a time to overload risk for the strategic horizon, but now is too soon.

Important disclosures

Disclosures

This material is provided by Aegon Asset Management (Aegon AM) as general information and is intended exclusively for institutional, qualified, and wholesale investors, as well as professional clients (as defined by local laws and regulation) and other Aegon AM stakeholders.

This document is for informational purposes only in connection with the marketing and advertising of products and services, and is not investment research, advice or a recommendation. It shall not constitute an offer to sell or the solicitation to buy any investment nor shall any offer of products or services be made to any person in any jurisdiction where unlawful or unauthorized. Any opinions, estimates, or forecasts expressed are the current views of the author(s) at the time of publication and are subject to change without notice. The research taken into account in this document may or may not have been used for or be consistent with all Aegon AM investment strategies. References to securities, asset classes and financial markets are included for illustrative purposes only and should not be relied upon to assist or inform the making of any investment decisions. It has not been prepared in accordance with any legal requirements designed to promote the independence of investment research, and may have been acted upon by Aegon AM and Aegon AM staff for their own purposes.

The information contained in this material does not take into account any investor’s investment objectives, particular needs, or financial situation. It should not be considered a comprehensive statement on any matter and should not be relied upon as such. Nothing in this material constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate to any particular investor. Reliance upon information in this material is at the sole discretion of the recipient. Investors should consult their investment professional prior to making an investment decision. Aegon AM is under no obligation, expressed or implied, to update the information contained herein. Neither Aegon AM nor any of its affiliated entities are undertaking to provide impartial investment advice or give advice in a fiduciary capacity for purposes of any applicable US federal or state law or regulation. By receiving this communication, you agree with the intended purpose described above.

Past performance is not a guide to future performance. All investments contain risk and may lose value. This document contains “forward-looking statements” which are based on Aegon AM’s beliefs, as well as on a number of assumptions concerning future events, based on information currently available. These statements involve certain risks, uncertainties and assumptions which are difficult to predict. Consequently, such statements cannot be guarantees of future performance, and actual outcomes and returns may differ materially from statements set forth herein.

The following Aegon affiliates are collectively referred to herein as Aegon Asset Management: Aegon USA Investment Management, LLC (Aegon AM US), Aegon USA Realty Advisors, LLC (Aegon RA), Aegon Asset Management UK plc (Aegon AM UK), and Aegon Investment Management B.V. (Aegon AM NL). Each of these Aegon Asset Management entities is a wholly owned subsidiary of Aegon N.V. In addition, Aegon Private Fund Management (Shanghai) Co., a partially owned affiliate, may also conduct certain business activities under the Aegon Asset Management brand.

Aegon AM UK is authorised and regulated by the Financial Conduct Authority (FRN: 144267) and is additionally a registered investment adviser with the United States (US) Securities and Exchange Commission (SEC). Aegon AM US and Aegon RA are both US SEC registered investment advisers. Aegon AM US is also registered as a Commodity Trading Advisor (CTA) with the Commodity Figures Trading Commission (CFTC) and is a member of the National Futures Association (NFA). Aegon AM NL is registered with the Netherlands Authority for the Financial Markets as a licensed fund management company and on the basis of its fund management license is also authorized to provide individual portfolio management and advisory services in certain jurisdictions. Aegon AM NL has also entered into a participating affiliate arrangement with Aegon AM US. Aegon Private Fund Management (Shanghai) Co., Ltd is regulated by the China Securities Regulatory Commission (CSRC) and the Asset Management Association of China (AMAC) for Qualified Investors only; ©2022 Aegon Asset Management or its affiliates. All rights reserved.

AdTrax 4881519.1GBL

Exp Date: August 31, 2024