The start of monetary easing by the Fed is always a global event. Firstly, because of its impact on the global cycle. With more than 30% of world consumption (in dollars), US demand clearly steers the development of global demand.

Secondly, because of the Fed’s influence on global financial conditions. This is particularly true for emerging countries. Here, the Fed exports part of its monetary policy: explicit or partial exchange rate pegs (which allow central banks to ease rates when the local currency appreciates against the dollar), impact on capital markets, distribution channels for international credit in dollars, reduction in the dollar value of foreign debt, etc.

This is particularly evident today in the major Asian central banks.

But this is also the case for the major central banks of the rich world, which are being forced to follow (or anticipate) the Fed’s moves via the appreciation of their exchange rates, or quite simply because the changes in US monetary policy imply that the economic slowdown is bound to spread.

The Fed had not tightened monetary policy since July 2023. And the decision to ease monetary policy was expected in 2024. The major central banks had already begun their downward cycle (ECB, BoE, BoC, SNB in particular). The only exception is the BoJ, which is moving in the opposite direction (gradual normalisation against a turbulent macro-financial backdrop, with the yen rising sharply last July).

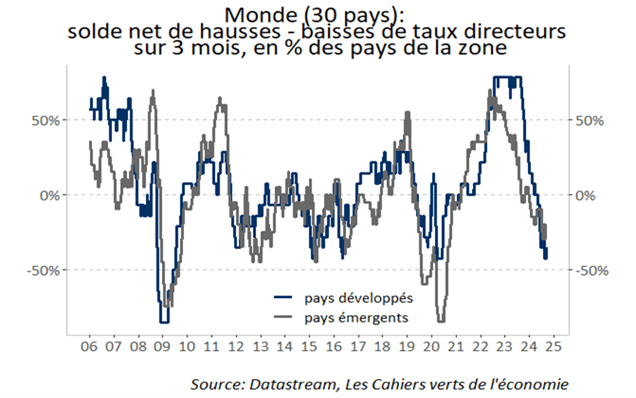

Overall, the global balance of “key rate hikes vs cuts” has continued to fall rapidly in recent weeks (see chart below).

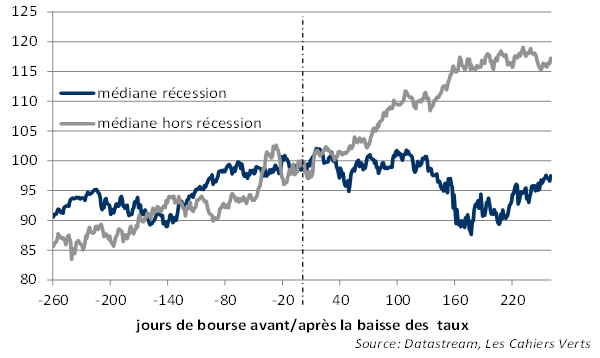

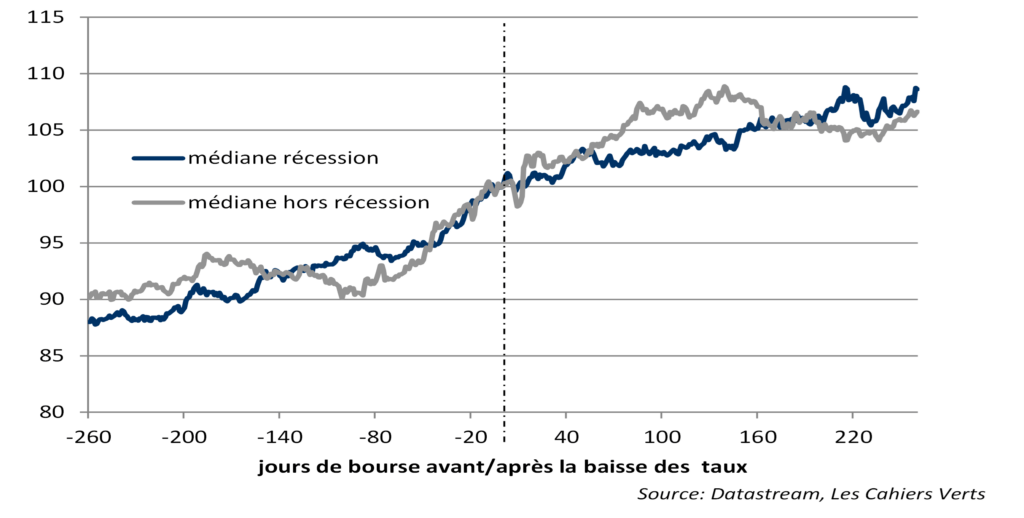

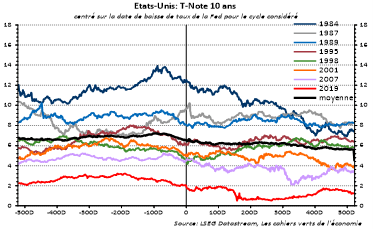

It is also obviously interesting to look at what happens on the markets after a 1st key rate cut, by studying experience over the last 40 years. We need to distinguish between periods characterised by recession (when the Fed was behind the curve, as in 2001 and 2007-08) and others, which are in the majority. Over the last 40 years, the Fed has cut interest rates on 5 occasions (1984-86, 1987, 1995-96, 1998, 2019) without any major risk of recession. Unsurprisingly, the 6-month balance sheet for equities is negative in the event of a recession and positive in the opposite case, without the performance being exceptional.

S&P 500: movements around identified rate cuts for 40 years

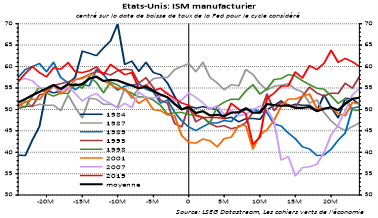

This is quite logical, as the macro trend tends to stabilise, or even improve, when the Fed is not behind the curve. This can be seen (see chart below) in the ISM manufacturing index 6 months after the start of easing.

In terms of sector and investment style, the Fed’s rate cut is slightly favourable for tech, healthcare, growth stocks (Growth/Value) and the S&P 500 vs Eurostoxx (in local currency, but not in common currency).

For the bond market, performance 6 months later is favourable, both in recession (which is logical) and out of recession (see charts below).

T-Note 10 years: performance trends around identified rate cuts over the last 40 years

The fall in long-term yields is obviously favourable to the improvement in financial conditions and the performance of financial and real assets. However, in terms of risk-adjusted expectations, the bond market appears slightly more attractive than equities in general. This is all the more true that equity market valuations are currently high, risk premia low and investor positioning aggressive, with a high appetite for risk.