Despite the recent volatility in the Chinese equity markets and the rout in the global bond markets, the yields on China’s onshore corporate bond market remain at historical lows. An understanding of local dynamics can help investors seize the unique opportunities in China’s bond markets, while fully appreciating the risks that reside.

The continued challenges confronting China’s property market and property bonds have raised investor concerns over the bonds issued by China’s Local Government Funding Vehicles (LGFV). LGFVs are set up by the local governments and primarily engage in financing, investing in and operating local public infrastructure and social welfare projects (public policy projects). While LGFV bonds are technically corporate bonds, investors typically price in some form of implicit support by the local governments.

The slowdown in land sales has led to a decline in the land transfer fees to the local governments, which historically have accounted for more than 90% of local government funds and are an important source of local fiscal revenue. In addition, some LGFVs have participated either directly or in partnership with private property developers, in real estate projects, and are also affected by the weaker property sales. The woes of China’s property market have weakened the ability of local governments to support the LGFVs, as the shortfall between their fiscal revenues and expenditures rises. In view of this, investors would need to differentiate between the bonds issued by LGFVs in regions with varying financial strength.

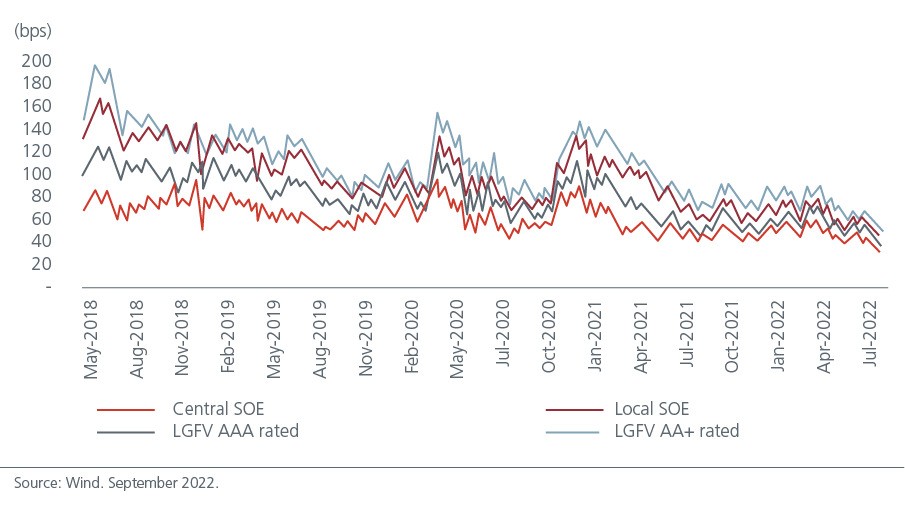

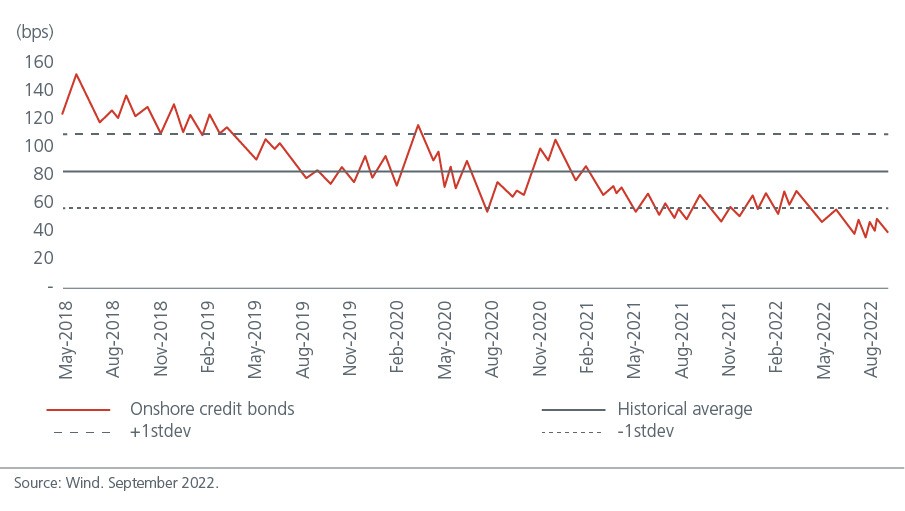

One would expect the spreads of the LGFV bonds and that of China’s corporate bond market to widen on the back of China’s troubled property market and overall growth concerns, but the reverse appears to be happening. While the 10-year China government bond yields have range traded in the last few months, the yields of higher quality LGFV and government-linked bonds have trended lower. Fig. 1. Overall, the yields of China’s onshore corporate bonds are at historically tight levels. Fig. 2. This has helped to underpin the performance of China’s onshore corporate bond market.

Fig. 1. High quality corporate bond yields have trended lower

Fig. 2. Onshore credit yields are at historical lows

This phenomenon reflects the significant amount of liquidity that is residing in China’s interbank system, as banks remain reluctant to lend to private companies and credit-worthy borrowers stay cautious. The People’s Bank of China keeping monetary policy easy while other central banks are busy tightening has also helped.

As onshore bond spreads tighten, domestic investors, including banks’ wealth management subsidiaries, insurance companies, etc. have turned to the offshore LGFV bond market, where the USD denominated bonds offer a higher yield pick up over their local currency counterparts. Fig. 3.

Fig. 3. Dollar LGFV bonds offer a yield pick up

Amid healthy demand, supply is relatively tight in the dollar LGFV bond market due to the higher costs of financing arising from higher Fed rates. Tight supply would be positive for the prices of the existing bonds. That said, local knowledge and credit differentiation are important in accessing the dollar LGFV bond market given the lower liquidity and un-rated status of many of the issuers. In addition, investors often need to make a judgement call on the potential level of implicit government support – municipal, provincial or central, which would have significant bearings on the bond prices. For these reasons, many foreign investors may choose to forgo the opportunities within the offshore LGFV bond market.

As highlighted above, while uncertainty remains over China’s macro environment and policy making, there will be tactical opportunities in China’s onshore and offshore bond markets for active managers. We expect China’s monetary policy to remain loose, although we believe that the odds of another policy rate cut this year have fallen. In our view, a cut to the Reserve Requirement Ratio is more likely if China’s economic recovery remains subdued. We remain defensively positioned in duration and look for new opportunities while rebalancing out of our local government bond trades.

Disclaimer

This document is produced by Eastspring Investments (Singapore) Limited and issued in:

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

This document is produced by Eastspring Investments (Singapore) Limited and issued in Thailand by TMB Asset Management Co., Ltd. Investment contains certain risks; investors are advised to carefully study the related information before investing. The past performance of any the fund is not indicative of future performance.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. – UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing.

Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company, a subsidiary of M&G plc (a company incorporated in the United Kingdom).