Every investor wants performance across an entire economic cycle.

The job of an active, unconstrained fixed income manager is to adapt a bond portfolio (sometimes very rapidly) as the cycle progresses, shifting allocations to capture different risks as market conditions evolve.

The credit market gives managers plenty of flexibility, because it covers a huge universe of bonds from different issuers and geographies, offering a huge range of risk characteristics, maturities and ratings.

To maximise risk-adjusted returns across the economic cycle, we are always trying to balance three considerations – the amount of credit we hold, the quality of that credit and the duration of our credit allocation.

Let’s look at how this three-dimensional view of credit works across a typical cycle.

End cycle/recession

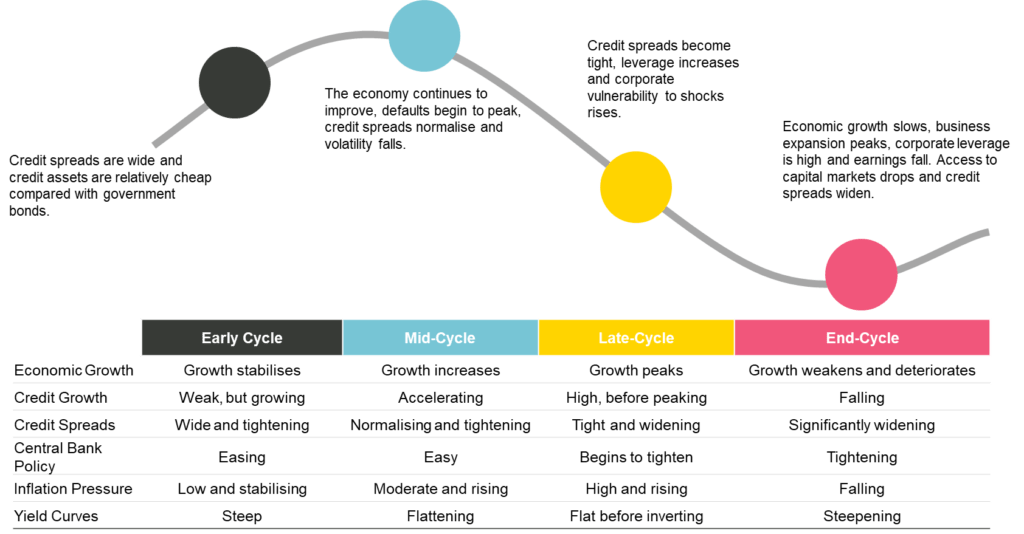

Cycles don’t simply die of old age; invariably some catalyst tips the economy from late cycle conditions into recession, and it can often be painful for risk assets – think the 2008 global financial crisis or the COVID-19 crisis of early 2020.

In general, downturns arise in response to slowing economic growth or a potential recession. Business expansion peaks, corporate leverage has usually increased and corporate earnings fall. Banks tighten the availability of credit and companies’ access to capital markets drops.

The combination of slowing economic growth and high leverage increases the risk of defaults, with some companies unable to deleverage effectively. As a result, we see a flight to safety and credit spreads widen as investor confidence in corporate debt takes a hit.

Early cycle

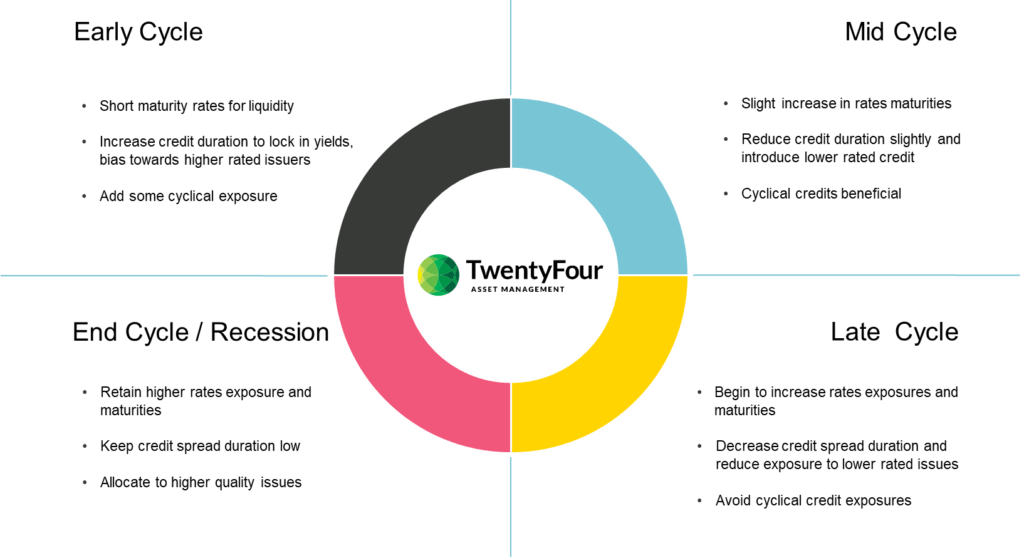

As investors sought the safety of government bonds during the preceding downturn, this will have contributed to credit spread widening. As growth begins to improve and inflation expectations rise, the attraction of longer duration rates falls, though shorter dated government bonds remain useful as a source of liquidity.

At the same time, elevated spreads denote the relative cheapness of credit, indicating the potential for spread compression. However, while credit spreads tend to tighten sharply, and almost indiscriminately once signs of economic renewal are evident and central banks ease monetary policy, not all credit is equal at this stage.

Cyclical industries tend to outperform other parts of fixed income in the early phase of the cycle, but higher quality bonds tend to lead the recovery as investors remain fearful of defaults from lower rated issues. Therefore, an allocation to higher rated cyclical credit should deliver outperformance. Additionally, we would attempt to lock in attractive yields in these sectors by taking longer dated positions, increasing credit spread duration.

Mid cycle

As the credit cycle approaches its midpoint, the economy continues to improve, defaults begin to peak and profit growth rises. Balance sheets appear healthier and corporate deleveraging begins as asset prices recover. With the economy recovering, fundamentals start improving and the potential for rating upgrades increases.

With credit spreads tightening and volatility suppressed, investors can incorporate some lower rated bonds into their allocations. The key consideration now is how far down the credit spectrum investors should reach. For some, CCC issues become compelling given issuers’ extra incentive to ascend the ratings spectrum. Opportunities normally outweigh risks during this phase because the surviving high yield issuers will have improved their balance sheets.

To prevent the threat of inflation, central banks will eventually respond to the improving economy by tightening monetary policy. While tighter spreads are prevalent and valuations seem expensive, the stability of the economy represents an attractive carry environment for credit. However, investors might consider shortening their credit spread duration here as rising government bond curves can potentially erode their gains.

Additionally, investors should explore the balance between rates and credit, with higher government bond yields starting to offer a bit more protection, suggesting a slight increase to interest rate duration.

Late cycle

As the credit cycle reaches maturity, bond portfolios become much more vulnerable to external shocks, higher leverage increases corporate vulnerability and valuations begin to look stretched. At this stage, in the face of slowing economic growth, retaining a high allocation to credit represents an unwanted source of risk, and potential rating downgrades.

Therefore, investors rebalance their rates and credit exposures by tilting portfolio allocations towards risk-free assets like US Treasuries. Likewise, portfolio managers should gradually increase the interest rate duration of their rates allocation, providing protection for the portfolio and potentially benefitting should rates fall as economic growth falters.

Meanwhile, shortening the maturity of credit positions will help bolster capital preservation during any market volatility. Investors should also increase overall credit quality by weaving in exposure to higher rated segments of credit, reducing single-B exposures and eliminating CCC rated exposures, in addition to avoiding cyclical industries and those industries that typically detract from performance during a downturn.

However, we cannot ignore relative value. Valuations may look stretched, but there is still time for certain names and sectors to outperform and room for more compression between ratings bands. Disciplined bottom-up credit work and liquidity are vital here, since periods of spread widening can be buying opportunities even at this late stage.

Flexibility is paramount

No two economic cycles are the same. For example, the new cycle ushered in by COVID-19 during early 2020 has moved with remarkable speed, such that spreads in some sectors of credit reverted to their lows of the previous cycle within twelve months – a process that should ordinarily take years.

Active fixed income managers can adjust the three dimensions of their credit allocation – amount, quality, duration – quickly in response to changing market conditions.

This can be particularly beneficial in the transition between phases. Between mid and late cycle, for example, tilt your allocation toward rates too early and you may miss out on continued credit spread compression; too late and you might incur mark-to-market losses as investors begin to fear the riskier end of credit.

With no clear demarcation between each of the above phases, for us the key to maintaining returns across an entire economic cycle is flexibility. This three-dimensional view of credit gives us the flexibility to target relative value across the cycle and adapt to the unique characteristics of each cycle as it plays out.