The Chinese economy’s still steady 2Q growth suggests that China’s latest RRR cut is more likely a “precautionary” move to buffer against potential downside risks identified by policy makers. Although the A-share market may remain volatile in the short term, recovering fundamentals, low risk-free rates and strong earnings growth especially in the new economy sectors, will help to sustain current valuations while creating opportunities for long term investors.

On July 9, the People’s Bank of China (PBoC) announced that it would cut the reserve requirement ratio (RRR) for all banks by 0.5%, effective July 15th. The move reduces the amount of reserves which banks are required to keep with the central bank, effectively releasing USD154 bn into the economy.

The move came after the State Council called for greater support to the real economy and for the Small and Medium Enterprises (SMEs) just two days earlier. The cut has triggered concerns that the Chinese economy may be slowing faster than expected. At the same time, it has raised hopes among some investors, that this would be the start of an easing cycle in China.

We make three observations in response to the RRR cut.

One, the State Council and PBoC have different focus and mandates. Historically, the State Council has not always called for a RRR cut before the PBoC takes actions, nor has the PBoC always followed the State Council’s recommendation. This is because the State Council focuses on the economy while the PBoC pays greater attention to the signaling effect of its monetary policies and their impact on overall market liquidity. As such, only six of the last 15 RRR cuts since 2011 were first signaled by the State Council and subsequently implemented by the PBoC.

For example, when the PBoC cut the RRR twice in March 2020 to increase liquidity in the system at the depth of China’s post-COVID slowdown, the central bank did not cut the rate further in June despite the State Council’s urging, as it deemed that the prevailing liquidity conditions were then sufficient.

In this recent move, the PBoC has indicated that the cut was made to counter the reduced liquidity in the system as RMB 400 bn of medium-term lending facilities are set to expire in July and also to make up for the liquidity gap caused by the peak tax period in mid and late July. Netting out these effects, the liquidity of the banking system would remain relatively stable.

Two, financial conditions remain accommodative. Investors have been concerned that China’s tightening credit conditions in the first half of 2021 would hurt growth. Total social financing has slowed and the growth in new financing (credit impulse) contracted in April 2021, the first contraction since August 2019. Fig. 1.

Fig. 1. Total Social Financing Growth and Credit Impulse

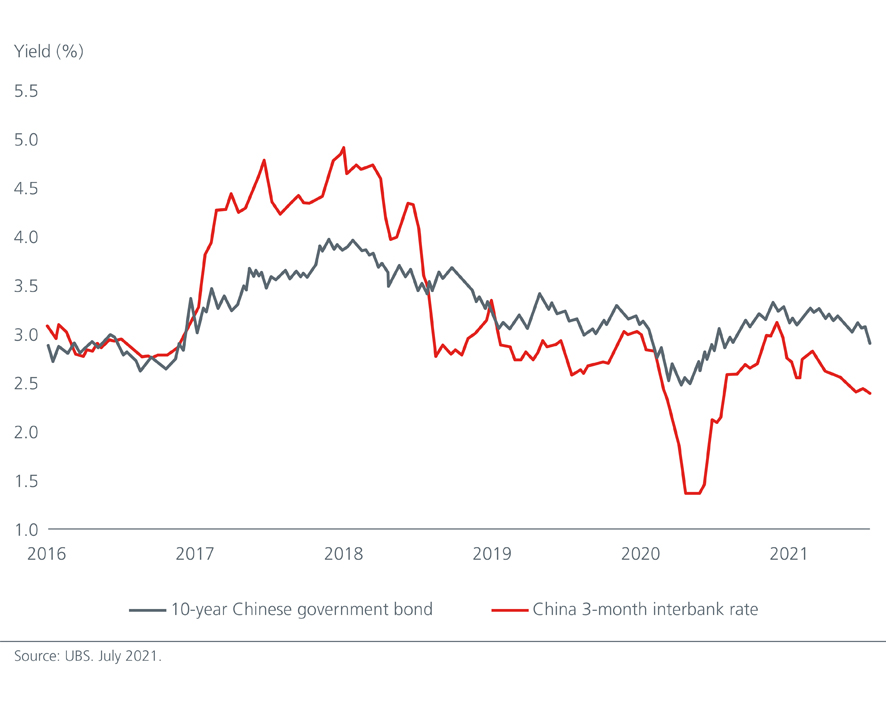

In a post-COVID era, the linkage between China’s economy and credit growth may weaken as the Chinese economy shifts away from credit intensive sectors such as construction towards new economy sectors that tend to be less credit intensive. We note that China’s service sector already accounted for 55.7%% of GDP as of 1H20211. Meanwhile, the government’s three red lines policy which seeks to rein in excessive leverage in the property sector has made the property companies more prudent in their land acquisition strategies and has also led the companies to secure more funds through pre-sales activities instead. These moves would have helped to temper credit growth in the economy. China’s 10-year government bond yield has fallen to around 3% after rising to a high of 3.2% in February. The 3-month interbank offered rate has also declined from its most recent peak in November 2020. These should help keep financial conditions accommodative. Fig. 2.

Fig. 2. 10-year Chinese Government Bond Yield and 3-month Interbank Offered Rate

Three, China’s recovery is moderating but still intact. China’s economy grew 7.9% year-on-year in the second quarter. Compared to 2019, average annual growth was 5.5% during the quarter, up from 5.0% in the first quarter.

Despite the repeated outbreaks in the developed and other emerging markets, China’s exports continue to beat expectations. Key economic indicators also improved almost across the board in June. Notably, in terms of average growth compared to 2019, fixed asset investment increased by 6.0%yoy, led by stronger manufacturing investment which accelerated from 3.7% in May to 6.0%yoy. Property activities were resilient. Retail sales edged up from 4.5% in May to 4.9%yoy or 5.8%yoy excluding auto. The economy’s still steady second quarter growth failed to justify the PBoC’s RRR cut, making investors worry about “hidden risks” within the Chinese economy.

Investors should monitor the economic data in the coming months as well as look to the upcoming Political Bureau meeting for clues on China’s economic outlook and policy setting in the second half of the year. With many investors interpreting the PBoC’s latest RRR cut as a preemptive move against a precipitous slowdown of the Chinese economy, the China-A equity market may remain volatile in the short term.

We believe that the underperformance of the China-A equity market to date avails opportunities for longer term investors. The market’s underperformance should also be seen in perspective, against the market’s 90.5% gains2 over the last two years. The CSI 300 is trading at 12x 12-month price to forward earnings, one standard deviation above its historical average, underpinned by the recovering economy and low risk-free rate. We remain on the lookout for companies that will benefit from China’s structural trends which includes China’s consumption upgrade, rising technological resilience, ageing demographics and net-zero transition.