After a flying start to the year for risk assets, there are three questions to consider as we head into Q3

Highlights

- After a flying start to the year for risk assets, there are three questions to consider as we head into Q3:

- Is slowing US economic growth bad news for risk assets?

- Does narrow market performance presage a correction?

- How are you shifting your asset allocation in the lead up to the US election?

- We conclude that all of these considerations are manageable and remain overweight equities vs. fixed income.

- Nevertheless, we do have more confidence in duration acting as a diversifier and favor US longs to hedge a variety of scenarios, in particular, growing risks of a significant increase in protectionism.

We are halfway through the year and investors don’t have much to complain about. Global stocks have posted double digit returns, high yield credit has delivered solid income and spread tightening, and a diverse basket of commodities has posted gains. Even high grade bonds, which sold off meaningfully on an inflation reacceleration to start the year, are earning enough in coupons to deliver roughly flat total returns so far this year. It has been a good environment for balanced portfolios and particularly for the risk-on tilts we have held over the course of the year.

But 2024 is only half over, and there are dynamics entering Q3 which warrant attention. First, US economic growth is clearly cooling, raising concerns about a sharper slowdown. Second, equity leadership has become increasingly narrow, and some question the sustainability of the rally. Third, the US election is coming into view, with policy uncertainty which has the potential to increase volatility.

Below we address these three challenges and explain what we are doing about them in portfolios. None of these challenges are leading us to change our overall tactical asset allocation, which remains overweight equities, neutral credit and bonds, and underweight cash. However, we do have more confidence in sovereign bonds as a diversifier and favor increasing US longs into the US election on growing risks of a spike in protectionism.

Is slowing US economic growth bad news for risk assets?

The US economy is cooling. The unemployment rate is gradually ticking higher, up from 3.4% to 4% in a little over a year. The labor market has unwound pre-pandemic distortions, suggesting that further softening in the labor market may not just mean fewer hires but also a rise in layoffs. The housing market, lower income consumers, and small businesses are feeling the pressure of higher rates.

At the same time, the underlying fundamentals of the economy are still quite healthy. Real incomes continue to grow at a healthy pace, balance sheets in aggregate are in good shape, and manufacturing numbers are coming in stronger. So as much as the economy is losing momentum, it seems that real GDP growth is now in the process of shifting from a 3% annualized rate in 2023 to a trend-like 2%. Meanwhile, the rest of the world (and Europe in particular) looks set to provide more support for global growth.

Critically, inflation is starting to come in much better than was the case at the start of the year, decelerating sharply in April and May. UBS Investment Bank economist Alan Detmeister, who has ranked as the most accurate forecaster of consumer price inflation in Bloomberg’s monthly economic survey, projects 2% annualized CPI for June and a benign path for inflation in the second half of the year.

Lower real growth and inflation mean a downshift in nominal GDP, which all else being equal should lead to softer earnings. That said, a shift from a 5%-6% nominal GDP range to 4%-5% is far from fatal. Of greater importance is investor faith in the extension of the cycle, in other words a soft landing. And the shift in the balance of risks away from an inflation reacceleration and towards a Federal Reserve that can begin an easing cycle and respond forcefully if the growth slowdown intensifies provides a powerful cushion.

In general, we believe equities should outperform bonds for as long as the expansion is ongoing. But with growth and inflation losing momentum, bonds should perform better vs. cash than they did in the first half. Most importantly, the shifting balance of risks has given us more faith that the stock-bond correlation will shift negative should growth meaningfully deteriorate. The diversifying properties of bonds reinforces their value in a balanced portfolio.

Does narrow market performance presage a correction?

The spectacular performance of mega cap tech is well documented. The largest six stocks have contributed nearly two-thirds of the S&P’s 15% return this year. NVIDIA alone has contributed 300 basis points of the 12% return in the MSCI World, an index containing 1,500 of the world’s largest companies. Logically, there is concern that any hiccup in the artificial intelligence (AI) theme which has underpinned much of these gains will lead to a sharp correction in major US and global indexes.

Given the sheer weight of these companies, it will likely be difficult for the rest of the market to drive the indexes themselves materially higher amid an AI correction. But some have extrapolated the market’s ‘poor breadth’ to suggest that if the AI theme runs into trouble it will lead to a significant sell-off in other industries.

We calculate equity market breadth as difference between the S&P 500’s drawdown vs. 52-week high vs. the median drawdown of S&P 500 constituents. This stands at -10%, one of the lowest levels over the last 40 years.

Exhibit 1: Equity market breadth has deteriorated as performance is increasingly driven by fewer stocks

Equity Market Breadth % below 52w high:

SPX Index less median stock (lower = narrower breadth)

Line chart showing the deterioration in equity market breadth as performance is increasingly driven by fewer stocks.

We find little evidence that such a narrow market is a sign of negative forward-looking returns. In fact, forward-looking returns for the S&P 500 have been quite strong following periods of narrow market performance. In essence, we shouldn’t worry too much when the best players in the game are scoring the most points.

Exhibit 2: A deterioration in market breadth does not presage negative forward looking returns

Equity Breadth between | Equity Breadth between |

|

| % Obs | % Obs | Average | Average |

|

|

|

| Hit Rate | Hit Rate |

|

|

|

| Median | Median |

|

|

|

| |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Equity Breadth between |

|

|

|

| % Obs |

| Average | 3m |

| 6m |

| 12m | Hit Rate | 3m |

| 6m |

| 12m | Median | 3m |

| 6m |

| 12m |

Equity Breadth between | -100 | -100 |

| -10 | % Obs | 11% | Average | 3.9% |

| 7.3% |

| 11.0% | Hit Rate | 65% |

| 75% |

| 77% | Median | 4.2% |

| 7.1% |

| 12.2% |

Equity Breadth between | -10 | -10 |

| -7.5 | % Obs | 19% | Average | 2.4% |

| 4.8% |

| 11.0% | Hit Rate | 62% |

| 69% |

| 81% | Median | 2.4% |

| 4.4% |

| 11.9% |

Equity Breadth between | -7.5 | -7.5 |

| -5 | % Obs | 31% | Average | 2.7% |

| 5.3% |

| 10.8% | Hit Rate | 70% |

| 77% |

| 82% | Median | 2.4% |

| 5.1% |

| 12.0% |

Equity Breadth between | -5 | -5 |

| -2.5 | % Obs | 30% | Average | 2.4% |

| 5.1% |

| 11.0% | Hit Rate | 73% |

| 75% |

| 79% | Median | 4.0% |

| 5.9% |

| 12.4% |

Equity Breadth between | -2.5 | -2.5 |

| 100 | % Obs | 8% | Average | -0.3% |

| -0.1% |

| 1.4% | Hit Rate | 58% |

| 51% |

| 49% | Median | 1.3% |

| 0.2% |

| -0.7% |

Of course the AI theme remains key to the global indexes, but we believe the narrowness of the market does not presage looming peril. If we are right about the cycle extending, then if mega cap tech takes a breather, we can expect rotation to more cyclically-sensitive areas of the market. That environment should also provide the potential for active equity managers to outperform.

How are you shifting your asset allocation in the lead up to the US election?

We expect investor attention on the US election to rise following the June debate. But we do not expect to make significant election-driven changes to allocations in the coming months. The impact of the election result on stocks and bonds will depend a great deal on whether the winning candidate’s party also takes Congress and is able to enact their desired fiscal program.

Moreover, the market’s reaction to different fiscal initiatives is more ambiguous than in the last two elections. While in 2016 anticipation for Trump’s tax cuts and in 2020 expectation of Biden’s fiscal stimulus were clearly positive for stocks and negative for bonds, the inflation and interest rate environment has changed such that higher yields may not be taken as friendly for risk assets. A 2024 Trump victory will likely come with the tailwinds of fully extended tax cuts and deregulation, but more serious headwinds from higher yields (in a red sweep) and the sheer scale of Trump’s threatened tariffs.

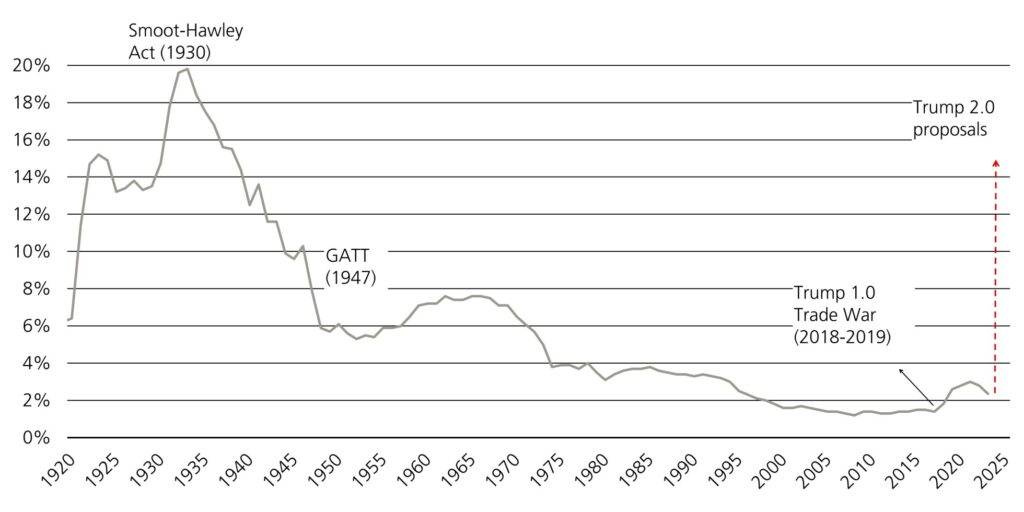

Former president Trump has stated he would raise tariffs to 10% on all imported goods and 60% on imports from China, which would bring the US’s effective tariff rate back to levels last seen in the 1930’s. While much of this likely represents a bargaining position, and ultimately tariffs are quite unlikely to reach those levels, we should expect a significant rise in protectionism under a Trump administration. Exchange rates should adjust to reflect this potential terms-of-trade shock, and risk premia should rise on countries that rely on exports to the US.

Exhibit 3: If enacted as proposed, Trump’s policies would bring the effective tariff rate back to levels last seen in the 1930’s.

Line chart showing the increase in U.S. weighted-average tariff rate if Trump’s policies as proposed are enacted.

Asset allocation

In the coming months, we expect a benign slowdown in growth and inflation to kick start Fed easing and reinforce faith in cycle extension. Economic narratives have switched frequently this cycle and there is potential for a growth scare, but we think inflation data will cooperate enough for the Fed to get ahead of the curve.

We still favor equities over fixed income, but do recognize the balance of risks have shifted away from an inflation acceleration and towards slower growth. Bonds have a role to play in balanced portfolios as a diversifier; we believe bonds will rally meaningfully if the economy deteriorates more sharply than we expect.

The US dollar also plays a role in portfolios, either via FX overlay or hedging of existing positions. USD has been very dependable in hedging balanced portfolios against upside inflation and rate surprises. We expect it will play an increasingly important role in hedging the potential of tariff risks ahead of the US election.

Asset Class Views

Asset Class | Asset Class | Overall / relative signal | Overall / relative signal | UBS Asset Management's viewpoint | UBS Asset Management's viewpoint |

|---|---|---|---|---|---|

Asset Class | Global Equities | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Profits growing, breadth improving, and inflation slowing. |

Asset Class | US | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Despite elevated valuations, room to advance as earnings grow and rates volatility calms. |

Asset Class | Europe | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Cheap valuations and leading indicators turning up amid rate cuts. Political risks manageable. |

Asset Class | Japan | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Ongoing corporate reform, supportive valuations but earnings and activity data losing momentum. |

Asset Class | Emerging Markets | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | EM outperformance requires USD weakness, more evidence of China strength. Asia ex-China supported by tech goods rebound. |

Asset Class | Global Government Bonds | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Bonds more attractive with clearer evidence of a growth/inflation stepdown. Still prefer equities. |

Asset Class | US Treasuries | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Gradual growth and inflation moderation improves hedging properties but don’t expect significant outperformance versus what is priced. |

Asset Class | Bunds | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | ECB to ease policy amidst cooling inflation, but tight labor markets and improving growth limit degree for easing |

Asset Class | Gilts | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | BoE eager to cut rates as employment has slowed, but sticky services inflation curtails ability to ease significantly |

Asset Class | Global Credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Credit spreads are tight but not irrational as default rates remain low. Most attractive carry in Euro HY and Asia. |

Asset Class | Investment Grade Credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Spreads are around usual cycle tights, while corporate fundamentals remain supportive. Returns likely driven by carry. |

Asset Class | High Yield Credit | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Further price upside is limited with spreads around 3%. But all-in yields remain attractive. Prefer Euro HY over US. |

Asset Class | EMD Hard Currency | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Good restructuring news has been largely priced in in recent months. Carry-driven returns look likely from here. |

Asset Class | FX | Overall / relative signal | - | UBS Asset Management's viewpoint | - |

Asset Class | USD | Overall / relative signal | Overweight | UBS Asset Management's viewpoint | Bullish against G10. Several major central banks started the easing cycle ahead of the Fed. USD offers a carry-positive hedge against adverse scenarios. |

Asset Class | EUR | Overall / relative signal | Underweight | UBS Asset Management's viewpoint | Still room for more monetary policy divergence. Short EUR a good hedge for French political risks |

Asset Class | JPY | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | BoJ’s move towards tightening is slow, methodical. Better currencies to be long despite cheap valuation. |

Asset Class | EM FX | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Bullish high carry LATAM, cautious AXJ on slow China, geopolitical risks. |

Asset Class | Commodities | Overall / relative signal | Neutral | UBS Asset Management's viewpoint | Non-OPEC supply growth vs manufacturing pick-up keeps Brent in USD 70-90 range. Supply constraints on copper. |