Key Takeaways

- A collapse in spot treatment and refining charges provides an important signal for copper’s future price trajectory

- Supply setbacks have the potential to tighten the global copper market

- The long-term prospects for the copper market remain optimistic owing to demand from the energy transition and China

- Related ProductsWisdomTree Copper, WisdomTree Copper – EUR Daily Hedged, WisdomTree Copper 3x Daily Leveraged, WisdomTree Copper 2x Daily Leveraged, WisdomTree Copper IEFind out more

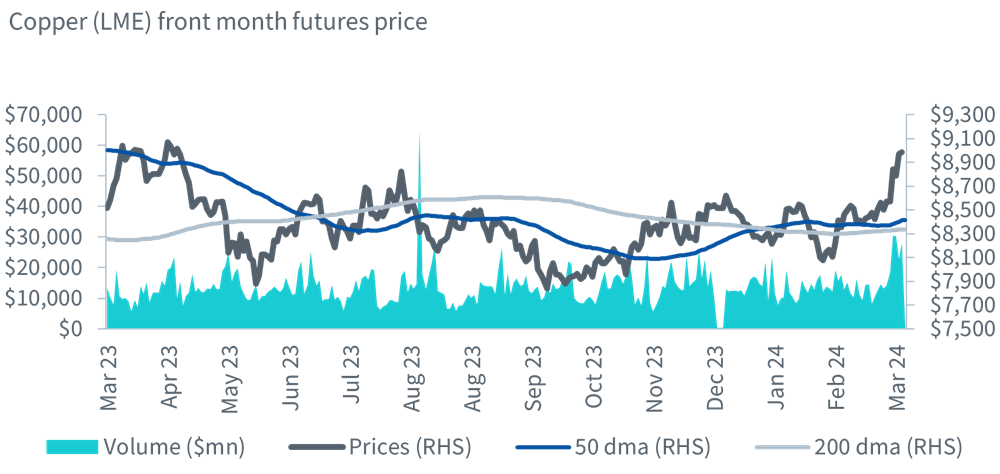

Copper rose above US$9000 per tonne1 after trading in a range for an extended duration. The catalyst driving the price rise was the news from major copper smelters in China who have pledged to curb output in response to a tightening copper ore market.

This comes on the heels of a collapse in spot treatment and refining charges declining to record lows. Spot charges in China fell to US$9.4 per tonne last week2, marking an 80% decline since the start of the year. This matters because treatment and refining charges are the fees paid to smelters to convert concentrate into metal, so they provide an important signal for copper’s future price trajectory.

A tighter supply of concentrates leads to a decline in these charges. The fall in treatment charges is not only a reflection of the tightening concentrates market but also of an expansion in copper smelter capacities in China. This has largely been driven by China’s strategic need for copper, as it aims to become a leader in the energy transition race. According to the National Bureau of Statistics (NBS), China’s production of refined copper surged 13.5% annually to 12.99mn tonnes.

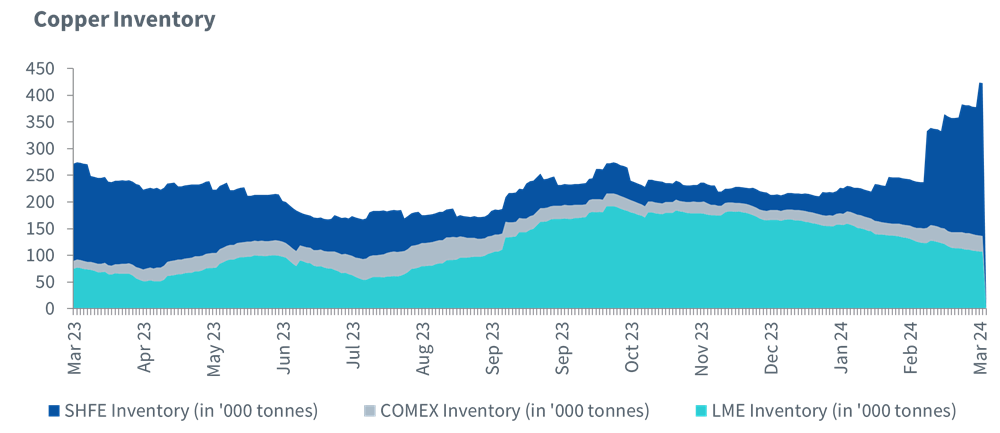

Copper inventories hit seasonal highs on the Shanghai Futures Exchange (SHFE)

Copper inventories in the Shanghai Futures Exchange (SHFE) have reached their highest level since 2020. The deliveries into warehouses are not unusual in Q1, with seasonality heavily influenced by the Lunar New Year Holidays. What remains key will be the extent and effectiveness of the pledged smelter curbs by major Chinese smelters.

It is important to note that the impact of China’s capacity controls on refined copper will depend on the details of the production cuts. The group of 19 smelters stopped short of coordinated production cuts but did vow to re-arrange maintenance work, reduce runs, and delay the startup of new projects.

Supply setbacks have the potential to tighten the global copper market

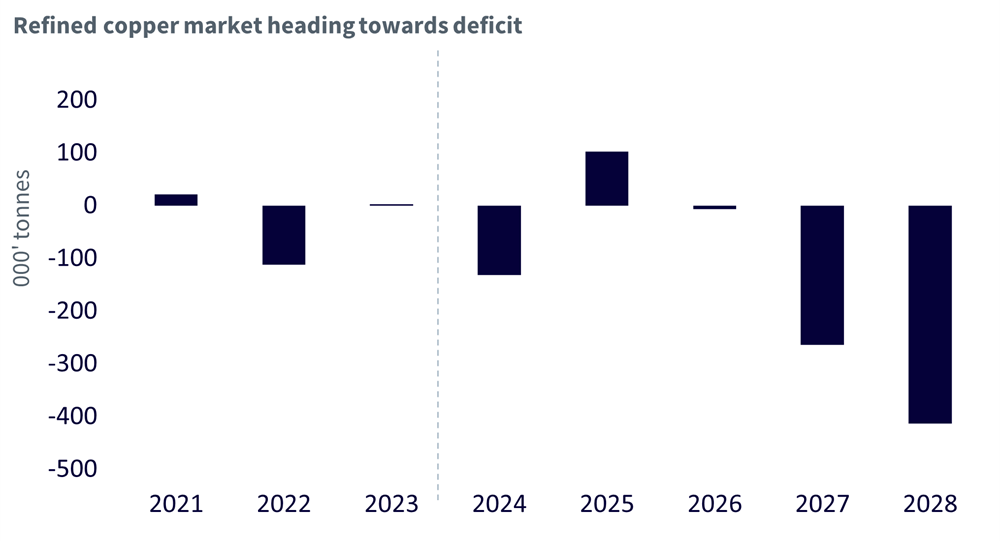

Supply setbacks at global mines also point in the direction of a tightening global copper market. In Panama, Canada’s First Quantum mine has ignited widespread protests in the country and has been forced to shut down activity. Cobre Panama copper mine, one of the largest sources of copper, accounts for 1.5% of global copper output. It accounted for 2.5% of China’s copper concentrate imports last year. Copper mines currently in operation are also nearing their peak owing to declining ore grades and reserves exhaustion. Escondida in Chile, the world’s largest copper mine, has already reached its peak. Its production in 2025 is expected to be at least 5% lower than its current levels. In Chile, Codelco, the world’s biggest supplier of copper, is struggling to return production to pre-pandemic levels of about 1.7mn tonnes a year by the end of the decade (from around 1.3mn tonnes this year owing to ageing assets and declining ore grades). At the same time, there remains a dearth of high-quality, large-scale projects in the pipeline that could drive the copper market into a deficit as demand from the green energy sector garners momentum.

The copper concentrate supply contracts, that set processing charges for 2024, have been fixed at 9% lower, providing yet another sign that the copper ore market is tightening as smelters expand3. This would be the first fee fall since 2021 after attaining a six-year high last year. While the global refined copper market was expected to be fairly balanced in 2024, the shortfall in mine supply points us toward a deficit. The extent of this deficit will largely depend on the scope of Chinese smelters’ production curbs alongside the prospects of copper demand resuming in Q2 2024 (which historically is seasonally the strongest quarter for copper demand).

China and the energy transition remain supportive for copper demand

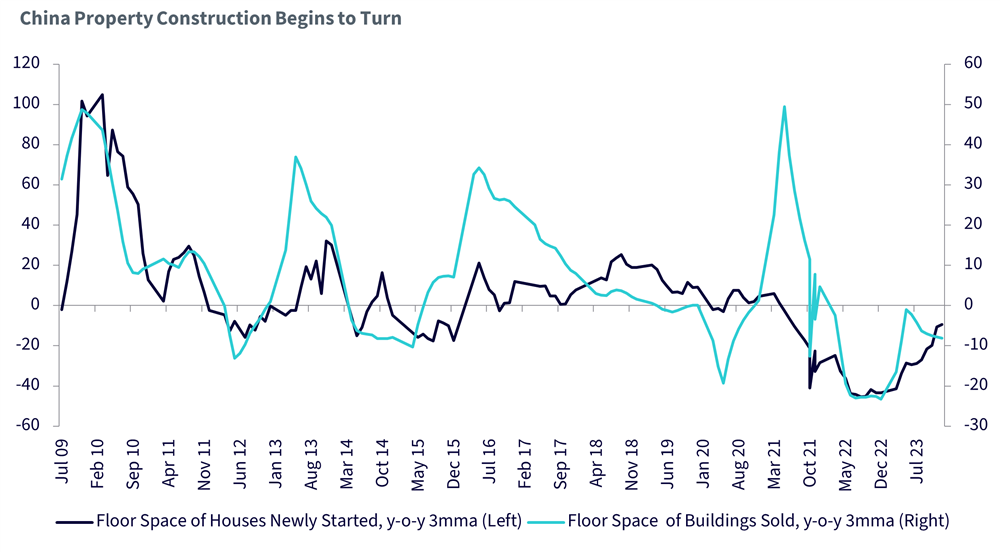

We remain optimistic over the long-term prospects for the copper market spurred by rising demand from the energy transition. Copper is a highly conductive and cost-effective metal which makes its usage ideal for a wide array of electricity-related renewable energy technologies. While the energy transition appears to be in a lull, owing to the impact of the higher rate environment, the momentum is expected to reaccelerate as interest rates ease, which should remain supportive for higher copper demand. A slowdown in China, the world’s biggest consumer of copper, has been a bottleneck for copper demand last year. However, housing starts are beginning to recover and further improvements to China’s weak property sector should also support copper prices. Amidst the supply setbacks facing the copper market, we expect production to expand at a slower pace versus demand, which should support prices.

Sources

1 Bloomberg as of 18 March 2024

2 Fastmarkets, weekly data

3 CRU