While China is celebrating its mid-Autumn festival, the Politburo might be trying to digest the latest slew of economic data released last week. Thus far the weak data has seen various piecemeal attempts to kickstart the economy, however more than a sticking plaster seems to be needed to restart the World’s second largest economy.

The downturn in the Chinese economy first became apparent in the Real Estate market with the 2021 default and subsequent liquidation of Evergrande Group. Evergrande had once been China’s top-selling developer, however slowing homes sales and growing offshore debt obligations led to it having to halt construction as liquidity abruptly dried up. The Chinese leaders tried to stem the contagion by loosening various standards for the banks, as well as a relaxation on the limits on granting new mortgages in attempts to encourage the banks offer lines of credit and restart demand in the Real Estate sector. However as the chart below shows, these efforts have done little to rekindle interest in the sector.

This content is intended for professional clients only.

Time for a policy reset?

While China is celebrating its mid-Autumn festival, the Politburo might be trying to digest the latest slew of economic data released last week. Thus far the weak data has seen various piecemeal attempts to kickstart the economy, however more than a sticking plaster seems to be needed to restart the World’s second largest economy.

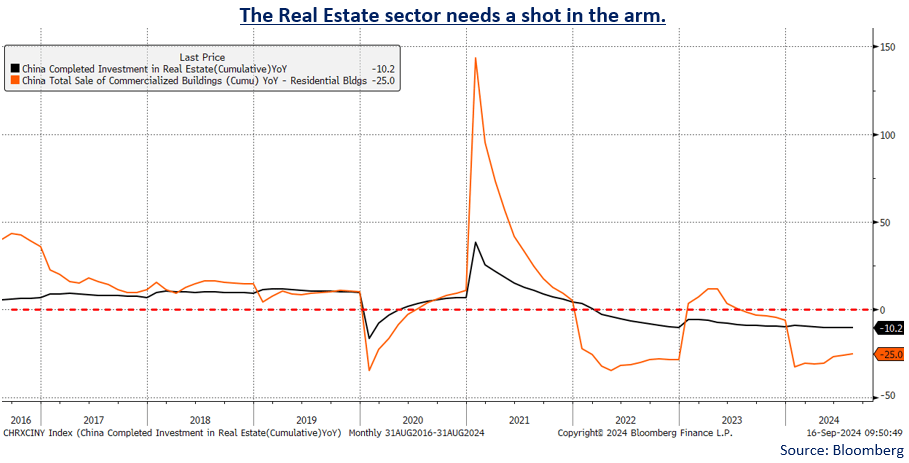

The downturn in the Chinese economy first became apparent in the Real Estate market with the 2021 default and subsequent liquidation of Evergrande Group. Evergrande had once been China’s top-selling developer, however slowing homes sales and growing offshore debt obligations led to it having to halt construction as liquidity abruptly dried up. The Chinese leaders tried to stem the contagion by loosening various standards for the banks, as well as a relaxation on the limits on granting new mortgages in attempts to encourage the banks offer lines of credit and restart demand in the Real Estate sector. However as the chart below shows, these efforts have done little to rekindle interest in the sector.

Evergrande was not the only casualty of the liquidity crisis, and developers such as Country Garden, owned by Yang Guoqiang, who in 2023 ranked 206th in the Forbes Global 500 list, also failed to fulfil its offshore debt obligations, defaulting on $11 billion of bonds. Kasia Group, Fantasia Holdings, Sunac Holdings and Modern Land all also defaulted or filed for bankruptcy and there is little sign that the actions of the Chinese government has stemmed the crisis, so they may not be the last.

Real estate has historically been used as savings vehicles for Chinese households and was one of the main engines of the Chinese economy over the past decade, despite the fact that land in urban areas must be owned by the Chinese state. Home ownership is deeply ingrained in Chinese culture as a sign of prosperity and success, and as such the country has a home ownership rate of 93%. Additionally, 20% of urban households own multiple homes. According to National Bureau of Statistics, there were 391 million square meters of unsold property as of April which is not only proving a drag on GDP but also undermining the consumer’s view as property being a viewed as a safe bet for increasing or preserving wealth.

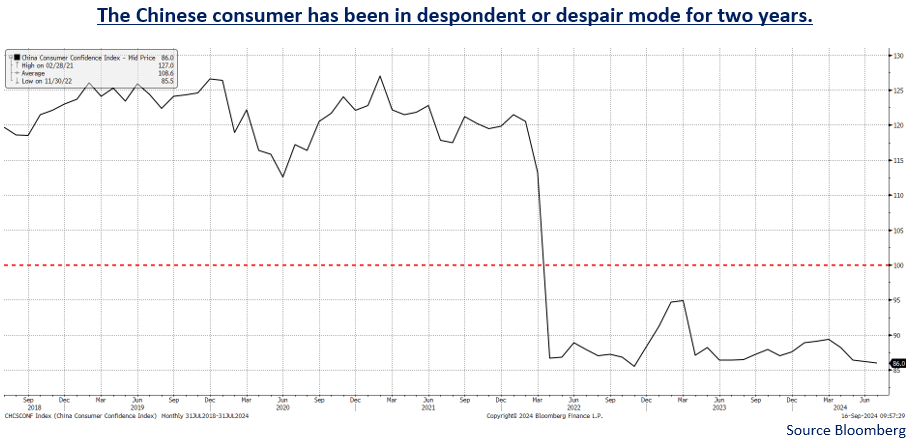

Since the onset of the property crisis, Chinese consumer confidence has been languishing at unprecedented low levels and despite the centre’s attempt to boost demand and sentiment, the data remains steadfastly stuck at these levels.

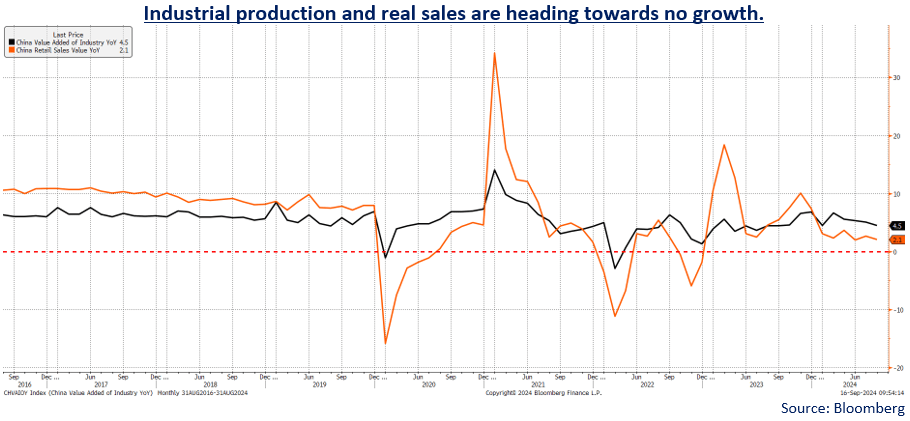

Without the consumer being in the mood to spend, there are implications for Chinese and multinational companies alike. Even the luxury-goods sector, which remained remarkably unfazed by the lacklustre national sales data, has started to caution of weaker demand on the mainland. Global investors are not only withdrawing capital from Chinese stock markets but also global companies that have large exposure to the region. The decline in discretionary spending has been widespread, ranging from automobiles to home décor, cosmetics to jewellery; mobile communication devices appear to be the only area where consumers are still willing to spend their savings.

The recent idea of the People’s Bank of China to create a 300 billion yuan ($24 billion) relending fund to help local government and state-owned enterprises buy up unsold housing stock and turn it into affordable housing seems like a drop in the ocean compared to the $13 trillion of debt in the real estate sector. Despite export data remaining robust, the proposal by Donald Trump to impose a 60% tariff on Chinese imports, should he win the Presidency in November, undermines the only positive data that the Chinese state has been able to release recently.

With GDP running at 4.7% year-on-year and given this data is likely to be in the region of 4.5%, the stated target of 5% seems a long-way off; there needs to be a large scale, coordinated response from the PBOC and the government to turn sentiment and spending positive again. So far they have failed to sum up the will to conjure up anything like a sufficient response, but you can only keep your population’s confidence at rock bottom for so long, and the Politburo keeps a careful eye on the popular mood in the country.

We saw, after the pandemic lock downs were relaxed, that the expected sharp uptick in spending, from the length of time the Chinese people were kept in their homes and unable to spend their savings, failed to materialise. We expect that should the centre manage to re-energise the consumer that they will once again only slowly start to spend, and thus remain cautious on companies with large exposure to Chine retail sales.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not