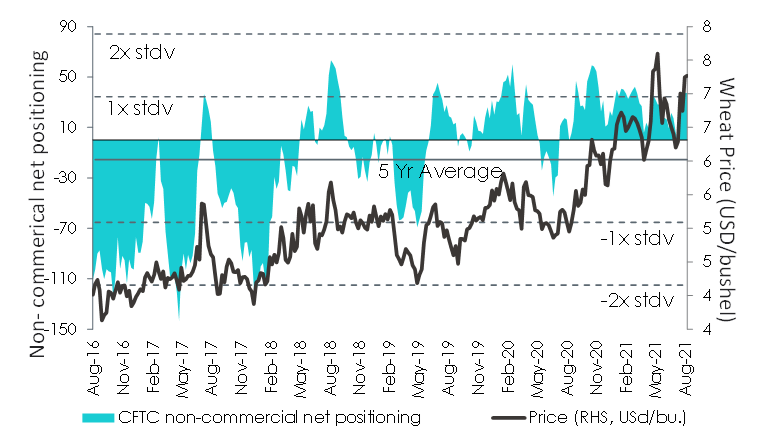

Wheat prices have risen to their highest level in more than eight years owing to a tighter supply situation among major producers. Over the prior month, net speculative positioning in wheat switched from -2683 contracts1 to +37,356 contracts2 (more than one standard deviation above the 5-year average), underscoring the improvement in the outlook for wheat prices by investors. Over the prior month, wheat’s upward trajectory has largely been predicated on the weak outlook for the US spring wheat crop due to the extreme heatwave in the Northern US plains. However, the supply of wheat now appears to be tightening further – not only in the US but also among other key wheat exporters such as Russia, Canada and the EU.

Figure 1 – Historical comparison of speculative positioning versus wheat prices

Source: Bloomberg, Commodity and Futures Trading Commission (CFTC), WisdomTree as of 3 August 2021. Please note: stdv represents the standard deviation which is a measure of the variation of a set of values from its average.

Historical performance is not an indication of future performance and any investments may go down in value.

Tight supply extends beyond the US

Wheat’s price surge last week was triggered by the release of the latest monthly WASDE3 report, in which the US Department of Agriculture (USDA) published the latest crop estimates for 2021/22. The most notable revision was attributed to Russia’s crop forecast, which was reduced to 72.5mn3 tons (having previously predicted a figure of 85mn tons). Compared to the analytical firm IKAR, which slashed Russia’s crop forecast to 78.5mn4 tons, USDA’S forecast is the lowest of all main market observers. Russia’s crop estimate reductions result from lower yields than expected in key growing regions coupled with dry weather conditions that delayed sowing in the autumn. USDA also made a sharp adjustment lower for the Canadian wheat crop, which is now only expected to total 24mn3 tons (previously estimated 31.5mn tons). Accounting for the reductions in Russia and Canada alone explain the 15.5mn ton reduction in the global wheat crop. USDA expects the global wheat market to show a supply deficit of 10mn3 tons in sharp contrast to the prior forecast of a small surplus of 1.5mn tons.

Further tailwinds ahead

We remain optimistic on the outlook for wheat prices as further downgrades are envisaged for the European wheat crop, which accounts for nearly 19% of global wheat supply. The latest WASDE report did not lower its figure for the EU wheat crop, which we expect to see in the next monthly report. Harvesting is making only sluggish progress in parts of the EU after the drought in the autumn had an impact, as did the excessively wet weather experienced of late. The French Agricultural Ministry lowered its estimate for the wheat crop from 37.1mn to 36.7mn tons. This remains 26% above last year’s weak crop but is significantly lower than previously anticipated. More importantly, the quality has suffered to a large extent which could prove difficult to meet the quality requirements of importers. A similar situation has been seen in Germany. In July, the German Farmers Cooperative (DRV) reduced its expectation of the wheat crop from 23mn tons to 22.8mn tons, marking an annual increase of only 3.2%.

Conclusion

World wheat trade, unlike that of corn and soybeans, is more evenly represented. However, due to the extreme weather conditions, several key exporters, namely US, Russia, Canada, and the EU, are facing sharp reductions to the crop estimates, which is likely to continue lending buoyancy to wheat prices.

Sources

1 Commodity Futures Trading Commission as of 13 July 2021

2 Commodity Futures Trading Commission as of 3 August 2021

3 World Agricultural Supply and Demand Estimate released on 12 August 2021

4 IKAR – Institute for Agricultural Market Studies