Initial fears of the impact of US trade policy on emerging markets (EMs) were sizeable, but now that the dust has started to settle, it seems EMs are well positioned to thrive in this new reality of higher tariffs, according to Xavier Hovasse and Naomi Waistell, co-managers of the FP Carmignac Emerging Markets Fund.

The old global structures are crumbling.

Gone are the days of Asia as merely the outsourced manufacturer of the West, Europe the home of luxury and tourism, and the US tech industrial revolution. Not so long ago, investors needed only to invest in the US and Europe to garner robust performance. EM wasn’t even a consideration, consisting of underperforming markets, political risk, and self-destructive political leadership.

No longer, though. The re-election of Donald Trump has given investors globally a wake-up call, and it is making EM great again.

The Trump effect

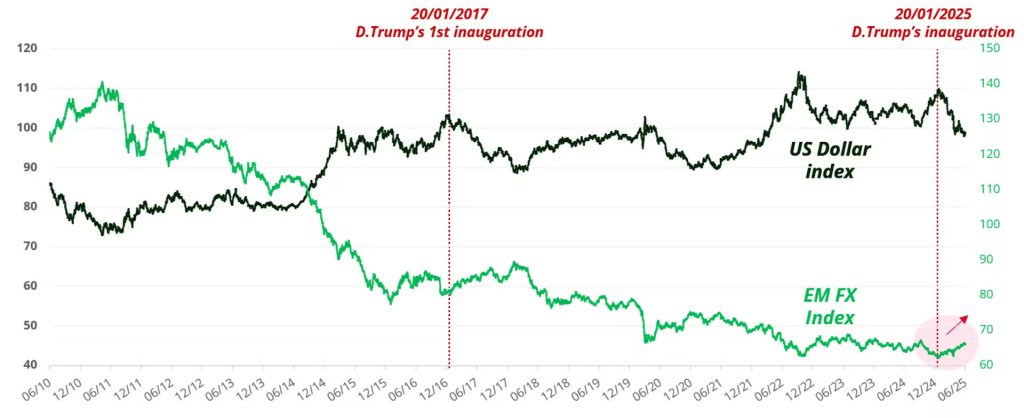

Trump’s second term not only started with a bang; it tore up half a century of global norms. The risk-free rate – long the preserve and luxury of the US – is gone. Political risk is now a US phenomenon, while institutions have been challenged and, in so doing, weakened. In short, the US is now behaving like an emerging market. Normally, in a risk-off market like today, the risk-free assets – US Treasuries and the US dollar – are the strongest performing asset class and currency. But we are witnessing the polar opposite: Treasury yields are rising, US equity markets are flailing, and the dollar is weakening (it has fallen versus all EM currencies in 2025, see charts below). Investors are selling the US.

The result is that investors are considering deploying more capital outside of the US, and into EM. Trump’s attitude has certainly been a trigger but there is a greater force: it has also coincided with the resurgence of China.

US Dollar index vs JP Morgan EM FX index since 2010

US vs EM local bond yields

China’s evolution

10 years ago, China would have been recognised for its rapidly growing economy and manufacturing strength, but you might have questioned the quality of its products. It was not comparable to US or European equivalents. Not anymore.

China now has some of the leading scientists and engineers in the world– the product of its stellar education system – and has significantly upgraded its industrial capacity and capability. The country is no longer the manufacturing hub of trainers and denim – they outsource this to Cambodia and Vietnam – but instead leads the world on renewable energy, electric vehicles and artificial intelligence (AI). China is taking advantage of new technology to dominate global manufacturing.

Interestingly, the global manufacturing chain for renewable energy is dominated by China, so the greater the adoption of renewables in the West, the more China will benefit. Furthermore, China is now the largest car exporter in the world, with BYD selling more cars in Europe than Tesla. China’s auto dominance threatens the very existence of Germany’s car industry, with German manufacturers significantly lagging on EV battery range and charging speeds1.

“We are now at the point where the world realises that China is no longer merely a low-cost manufacturing hub; it is now much more sophisticated and can dominate global manufacturing in almost every way, even in biotech, healthcare and petrochemicals.”

The AI leap

Two years ago, Nvidia went from being a frankly boring semiconductor equipment business to the most valuable company in the world. AI had finally arrived. Of course, the assumption was that the US would naturally dominate AI, much like Microsoft and Google ruled the tech space previously, and OpenAI looked set to follow in their footsteps.

Fast-forward two years and DeepSeek blew that assumption apart; it now seems likely that it is a serious contender in the AI race.

As the world’s second-largest economy, China has an incredible education system centred around science and maths, and a government that invests at scale. Semiconductor chip export controls from the US, designed to limit China’s AI capacity, have failed. Nvidia CEO Jensen Huang recently warned that Chinese AI firms are now ‘formidable’, developing their own semiconductor manufacturing facilities at pace. China has been underestimated, and it is naïve to think that it can’t be self-sufficient in this space.

Take almost any industry and China is incredibly well positioned off the back of sustained long-term human and capital investment. Furthermore, it is the number one trading partner for almost all EMs.

Our Chinese exposure is focused largely on tech and consumption; this is a country where consumption as a share of GDP is the lowest among the largest countries in the world. A rebalance is due.

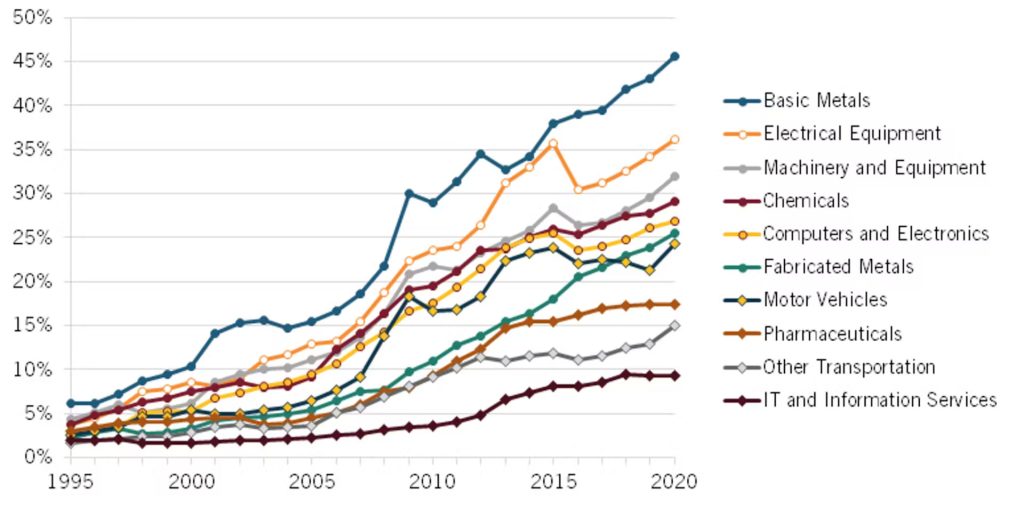

China’s global market shares in advanced industries

Asia’s attraction beyond China

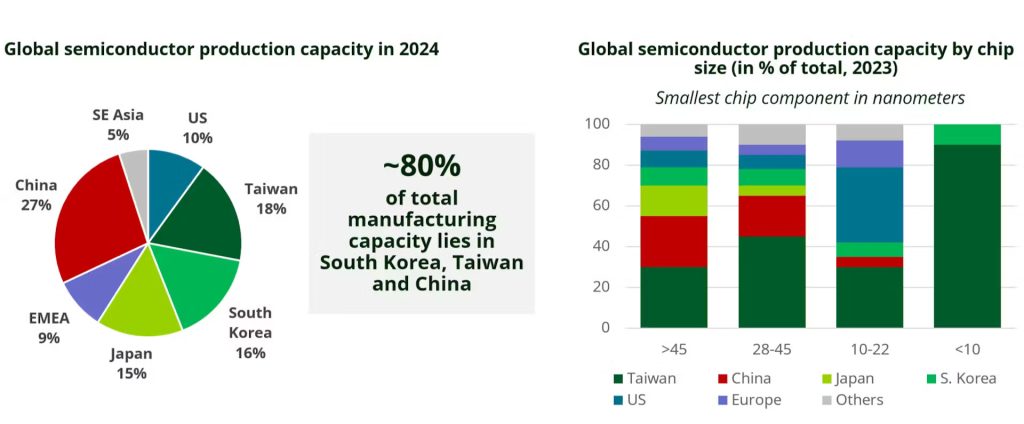

Without doubt, tech is a major attraction for investors considering Asia. Historically, the ideas and design were in the US, while the manufacturing was outsourced to Asia. Now, 100% of Nvidia’s graphics processing units (GPUs) are manufactured by Taiwan’s TSMC, and the bulk of its high bandwidth memory products come from South Korea’s Hynix. The AI revolution will be powered by Asia, and the US knows this. The Trump administration is encouraging these leading firms to invest in the US and manufacture there. This strategy is starting to work, with TSMC having already committed to investing US$150 billion in the US, aided no doubt by Taiwan’s strained relationship with China.

“While plenty of the focus around Asia is centred upon China, the region at large continues to thrive. Asia continues to be a favoured hunting ground for us, with significant exposure across the e-commerce, fintech and healthcare sectors.”

Indian impetus

Where does India sit in this Trump 2.0 world?

We view India through the same lens we viewed China 20 years ago. India’s economic model is a form of economic governance that relies on a long-term view, political stability, and the ‘Made in India’ mantra. It has a well-educated, largely English-speaking population and an industry protected by government – a cornerstone of Prime Minister Narendra Modi’s leadership policy.

The Indian economy is set to grow at 6%-7% annualised over the next 10 to 15 years2, and in the near-term, India is a beneficiary of the US/China tensions.

We have a high-conviction view that India will succeed in the long term. There are a number of well-managed, investable companies in India which don’t have the same overcapacity problems as China.

Latin America, the winner of Trump's policies

No Mexican stand-off

Some EM countries, like Mexico, benefit from the trade wars, given its attractiveness for US ‘nearshoring’ and a good political relationship. Mexican President Claudia Sheinbaum has been strengthening this in recent times, cooperating on increasing security along the US/Mexico border and ultimately helping Trump to progress his agenda.

Sheinbaum is more politically moderate than her predecessor which should be positive for the economy and asset prices. Our focus is on domestic names which benefit from nearshoring, industrial REITs, and local banks.

A Brazilian boon?

Elsewhere in Latin America, we continue to be bullish on Brazil, and increasingly optimistic around the prospects for Argentina. Brazilian equities, in our view, are very cheap, and in particular, utilities given the strong infrastructure needs in the country. Of the world’s largest countries, Brazil has the highest real rate, above 7%, making both the Brazilian real and real-denominated debt attractive. Power utilities companies offer on top of the Brazilian sovereign yields an additional 5% equity risk premium – therefore offering overall close to 12% real yields.

Rates need to come down, but with elections next year and a potential change of regime, there is the opportunity for better fiscal and economic development. We believe that the prospects for Brazil are very positive, with oil production rising, agricultural production growing, undervalued assets and a population with a strong entrepreneurial spirit.

Meanwhile, in Argentina, there has been a seismic improvement in the country’s fiscal position, moving from a large deficit to a surplus under the leadership of the mercurial Javier Milei, with sovereign bonds having staged an impressive recovery. Risks remain, of course, and mid-terms loom this autumn, but we keep our cautiously optimistic view from an investment perspective.

With the tailwind of Trump’s second term, the co-fund managers indicate that now is a compelling time to invest in EMs with a wealth of dynamic, global and market-leading businesses across many countries and sectors. China is an integral part of course, but it has started to rebound and regions such as India, Asia and Latin America offer continued investment opportunities at attractive valuations.

1Sources: Campany data, Bloomberg, CICC, BoAML, 2025. 2Source: IMF World Economic Outlook (WEO) forecasts, 2025.