Thematic investing allows investors to access growth stocks in completely novel and targeted ways. However, with 46 potential themes to choose from (listed in the WisdomTree Thematic Classification, as of the end of March 2024), many investors do not have enough time to invest in selecting themes and then selecting single-theme strategies. This is why $54.8 billion1 are invested in multi-thematic exchange-traded funds (ETFs) and open-ended funds in Europe, representing 20% of all assets invested in thematics in Europe. This trend is accelerating, in the last 12 months1, despite outflows in the thematic space, multi-thematic strategies have gathered $2.9 billion of inflows.

Multi-thematic strategies can help investors delegate many of the decisions necessary for the success of an investment in thematic growth:

- the selection of the most relevant themes

- the capital allocation between themes strategically and tactically

- the stock selection in each theme

After years of thematic research, two whitepapers, and many single-theme ETFs, WisdomTree launched our own multi-thematic strategy on 27 October 2023, the WisdomTree Global Megatrends Equity index. Our approach combines a curated portfolio of themes, a quantitative tactical overlay to adapt to current market environments, and expert-driven stock selection (you can find more information on the strategy here).

Nuclear and Energy Transition Metals are coming in

On April 19 2024, the WisdomTree Global Megatrends Equity strategy underwent its quarterly rebalancing in which we reviewed:

- The selection of theme

- The tactical allocation to the selected themes

- The stock selection

Every year, the theme selection focuses on high-conviction themes with high diversification potential and alignment with the US Sustainable Development Goals (SDGs). In 2023, the strategy was launched with 14 themes: seven in Technological Shifts, four in Environmental Pressures and three in Demographic and Social Shifts. Following this year’s review, the strategy will continue to invest in those 14 themes, but two new themes are also being added to the mix:

Nuclear

We are witnessing a renaissance for nuclear energy. With the political focus on the energy transition coupled with the rise of geopolitical tensions with Russia and China, nuclear power is increasingly seen to have a significant role to play in the future energy mix. Nuclear offers a reliable source of base-load power with minimal carbon emissions that could complement renewable energy sources. Political support is increasing for this source of energy – with its inclusion in the EU Taxonomy, for example – as is renewed investments across the world. From a more technical perspective, Nuclear is a diversifying theme for our multi-thematic strategy, with low correlation to the rest of the theme. The theme is also showing strong tailwinds with $260m inflows in 2023 and a performance of 42.5% over the year.

Energy Transition Metals

Lorem ipsum dolor sit amet, consectetur adipiscing eli

Green energy generation is infrastructure intensive. It requires more metals and minerals and, thus, more mining than our current setup. Enabling clean energy technologies to grow is dependent on the rate at which critical minerals can be found and mined. This is why energy transition metals mining plays a focal role in supporting the energy transition. This theme is also very interesting from a diversification point of view as it is highly correlated to the commodities themselves, leading to decorrelation with other ‘green themes’ in the portfolio. This was quite evident in Q1 2024. While almost all climate-change-related themes suffered underperformances and outflows during the quarter, energy transition metals gathered $139 million during the period. In March, it was also the best theme for performance with 9.4% compared to 3.1% for the MSCI All Country World.

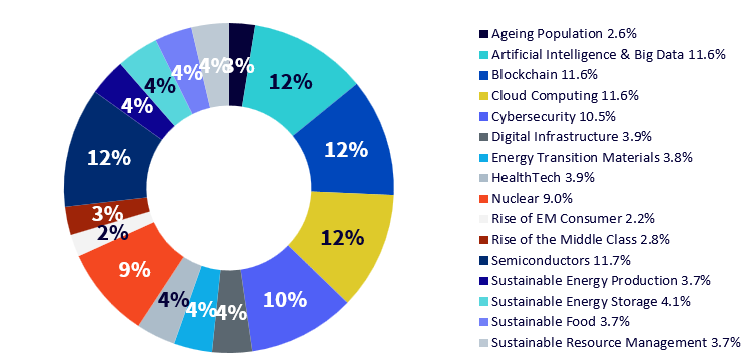

Figure 1: Strategic thematic asset allocation

Moving on to our tactical thematic asset allocation, Figure 2 highlights that:

- Artificial Intelligence, Blockchain, Cybersecurity, Cloud and Semiconductors remain overweighted

- Nuclear entered the portfolio with an overweight

- All remaining themes are underweights

Figure 2: Thematic tactical signals

Overall, the portfolio is still overweighted in Tech with around 12% in AI, Cloud, Blockchain, Semiconductors and 10.5% in Cybersecurity.

Figure 3: Theme allocation

Outperforming the MSCI All Country World (MSCI ACWI) and the Nasdaq-100

Since its launch, the WisdomTree Megatrends Global Equity index has returned 20.8%2. This is a 1.9% outperformance to the MSCI ACWI and 0.3% outperformance to the Nasdaq-100.

Figures 4 and 5 below detail the contribution of the different parts of the strategy to this outperformance. In Figure 4, we observe that the strategy performed very strongly in the first rebalance period, outperforming by 5.9% the MSCI ACWI. The theme selection created 1.15% of outperformance, the tactical overlay added 4.62%, and the stock selection added 0.12%. Looking at themes: Semiconductors, Cybersecurity and Blockchain added around 2% each.

Figure 4: Performance attribution in the first rebalance period (27 Oct 2023 to 19 Jan 2024)

Performance in the second rebalance period was a bit more difficult with an underperformance of 3.5%. The theme selection created -2.8% underperformance, mainly due to some of the Tech themes that had done well previously (Cloud Computing and Cybersecurity). The tactical overlay continued to deliver with a contribution of .9%. Finally, the stock selection was detrimental by -1.6%. Overall, Blockchain was a very positive investment with +2.5% while AI, Cloud Computing and Cybersecurity created significant negative contributions.

Figure 5: Performance attribution in the second rebalance period (19 Jan 2024 to 19 April 2024)

Conclusion

A multi-thematic strategy is the result of many difficult decisions from the theme selection, the selection of the relevant companies in each of the themes and including the capital allocation to the different components. In the first six months of its existence WisdomTree Megatrends Global Equity has outperformed both the MSCI ACWI and the Nasdaq-100. With the inclusion of two new themes, Nuclear and Energy Transition Materials, the strategy is well positioned for the rest of the year.

Source

1 WisdomTree. As of end of March 2024.

2 WisdomTree, Bloomberg. From 27 October 2023 to 19 April 2024 in USD. You cannot invest directly in an index. Historical performance is not an indication of future performance and any investments may go down in value.