Broadly in line with media reports, the Chancellor cut employee National Insurance Contributions by 2 percentage points (at a cost of more than £9bn) with other tax cuts (compared to previous plans at least) including extending the freeze on alcohol and fuel duty.

The Chancellor also increased the income threshold for receiving Child Benefit alongside a host of smaller (cheaper) measures. He also announced around £3bn of investment in the NHS (spread over three years).

The Budget is net stimulative for the economy especially for the 2024-25 fiscal year with the major announced tax cuts being implemented next month and total policy decisions costed by the Treasury at nearly £14bn for that year (or about 0.5% GDP). In isolation therefore, you could argue that it raises the risk of later/fewer rate cuts from the Bank of England, though the Bank will presumably use a slightly longer horizon and also consider how some of these measures will increase supply as well as demand (and therefore not be so inflationary). I still assume, for now, that we will see (only) two rate cuts from the Bank of England later this year, with the policy changes announced today not enough in isolation to change my view.

So where does the money come from to pay for all this? Eating into headroom, a few tax-raising measures, some offsetting measures to reduce public spending… and a touch more borrowing

- The OBR’s (Office for Budget Responsibility) forecasts for the public finances and the economy, before taking into account any policy changes today, left some ‘fiscal space’ (i.e. room for tax cuts/spending increases before breaking the fiscal rules). At the November Budget, the Chancellor had fiscal space of £13bn, which got reduced by the OBR to £12.2bn ahead of today’s policy changes. The Chancellor now has £8.9bn of fiscal space, with most of the reduction reflecting policy decisions today – i.e. the Chancellor has decided to eat into the margin/fiscal space he has against the fiscal rules.

- The Chancellor also announced a set of revenue raising measures, including the well-trailed reform of the so called ‘non-dom’ regime.

- According to the OBR, the Chancellor’s public spending measures largely net off in fiscal terms; He has increased investment spending, focused on the NHS, but “The Government has reduced the assumed aggregate level of current departmental spending by £0.8 billion per year on average beyond 2024-25.”

- From 2024-25 the public sector borrowing numbers are also higher than they were (i.e. some of the policy measures today are paid for by borrowing more than planned previously in those years).

Not so prudent: The Chancellor left less fiscal space (or room for manoeuvre) against the fiscal rules against a set of forecasts that already ‘bake in’ implied future cuts to unprotected department budgets that some see as unrealistic.

The OBR are clear that there is risk around their central forecast and that the margin/fiscal space the government has left is a “small fraction of the risks around their central forecast”. They point out for example that the forecasts are highly sensitive to movements in interest rates which have been very volatile of late.

The OBR also point out that: “The fiscal forecast is also conditioned on the tax take rising to near record highs, including through planned rises in fuel duty that have not, in practice, been implemented since 2011.”

And then there’s the matter of those planned spending cuts, left for the next government: The OBR’s fiscal forecasts include a path for departmental spending beyond 2024-25 that follows government assumptions but which now implies “no real growth in departmental spending per person over the next five years”, despite committing to increase spending on some major public services (NHS and defence, for example) that is in line with or faster than GDP. Many have pointed out that the public spending projections imply some unpleasant real terms cuts to non-protected day-to-day department budgets that some would consider unrealistic at a time when public services are already under strain. The OBR’s calculation is that, once you include commitments on schools, childcare and overseas aid, you’d be looking at a real terms cut in other departments’ budgets of 2.3% a year from 2025-26). This continues to leave some very difficult decision-making for whoever forms the next government.

The multi asset view – from Trevor Greetham, Head of Multi Asset

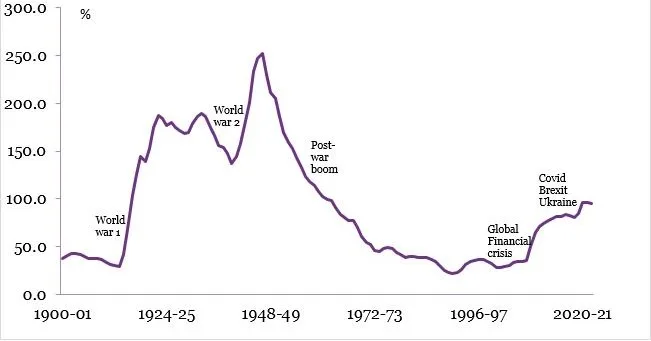

The UK fiscal position has worsened significantly over the last 16 years, with one shock after another raising government debt and reducing potential growth. Public sector debt has risen from around 35% of GDP in 2007 to close to 100% today, the highest level since the aftermath of World War II (Chart 1).

Strong nominal growth is the best solution to high debt levels but achieving it is easier said than done. Liz Truss threw caution to the wind with unfunded tax cuts that the markets and the Office for Budget Responsibility didn’t find credible. Jeremy Hunt is triggering some scepticism, albeit to a lesser degree, with implausibly large real terms cuts in departmental spending pencilled in for future years in order to balance modestly stimulative tax cuts over 2024/5.

Financial markets look through all of this noise, expecting whoever forms the next government to implement a new round of austerity or tax rises, unless action is taken to bolster potential growth against ongoing challenges including Brexit and demographics. From a multi asset perspective, a muted UK growth outlook strengthens the case for international diversification. That said, the UK stock market is already very global, its greater inflation resilience can offer a useful counterweight in portfolios to the more growth-biased US market, as we saw in 2022, and a Great British ISA may see additional money funnelled in its direction.

Chart 1: UK Public sector net debt (% GDP)

Source: OBR Public Finances Databank as of February 2024; labels are RLAM

The views expressed are those of the speaker at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.