Fixed income portfolio managers Tom Ross and Tim Winstone explore how a drive to improve among corporate borrowers can have winning results for both companies and investors.

Key takeaways

- The past two years has seen the credit rating upgrade/downgrade ratio swing from a decade low to a decade high.

- Absent a shock we anticipate a particularly strong year in 2022 for corporate bond issuers moving from high yield to investment grade status.

- The large spread differentials between BB and BBB rated bonds and pricing inefficiencies in the crossover space continue to make this an important area of fixed income for return potential.

There has been no shortage of sporting events in 2021. The passion to compete, to climb the rankings and secure glory are a powerful motivator. The corporate world is equally competitive, with companies seeking to drive returns for their investors and wider stakeholders.

Misnomer

2021 was a peculiar year for sport, with the Euro 2020 football championship and Olympics 2020 carrying the moniker of the previous year. In our view, something similar has occurred in the world of corporate credit where bond issuers are still carrying the credit rating of yesteryear.

The fear back in 2020 as coronavirus took hold was that companies would be debilitated by the closure of swathes of the economy. Many companies turned to capital markets to tide them through the difficult days of revenue shortfalls. This consisted either of equity capital raised from shareholders, loans from banks or debt from issues of bonds. Leverage levels in aggregate climbed for both investment grade and high yield bond issuers. Credit rating agencies tried to look through the COVID-19 difficulties but with so much uncertainty companies’ creditworthiness had to be marked against what was visible.

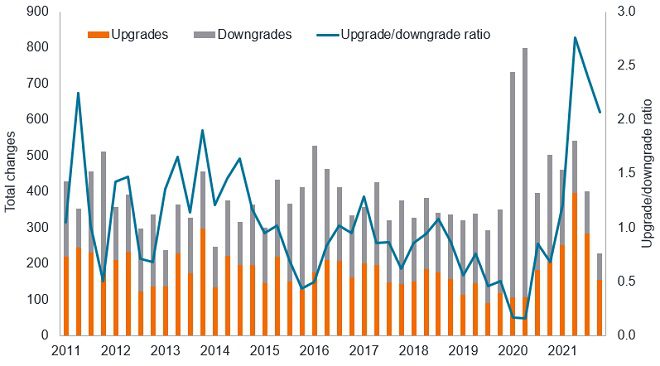

As a result, 2020 was a year in which credit rating downgrades exceeded upgrades by a wide margin. Taking just the US as an example, the upgrade/downgrade ratio plunged to a low for the past decade.

Figure 1: US corporate ratings actions and upgrade/downgrade ratio

2021 has seen a sharp recovery, with the ratio firmly above 1, signifying an excess of upgrades over downgrades. Helping to drive the advance has been a recovery in cash flow and earnings among companies. Balance sheets have improved as companies have used the low yield environment to refinance at attractive rates.

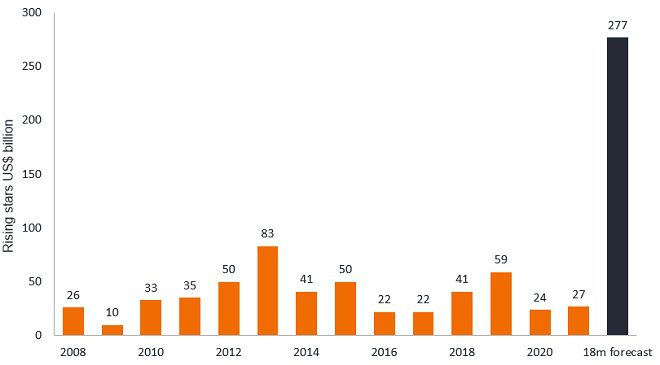

This positive momentum within credit upgrades has powerful repercussions for the outlook for rising stars. These are issuers who make the move from high yield to investment grade status. Typically, this involves incremental gains as credit rating agencies gradually raise the credit rating of a bond a notch or two, say from BB- to BB+ and then to BBB- (using the S&P methodology as an example).

There was such a volume of downgrades in 2020 that this created a pool of companies that sit just below investment grade and are potentially ripe for elevation to investment grade status. JPMorgan reckons there could be as much as US$277 billion of bonds globally that could make this migration by mid-2023 (absent another economic shock).

Figure 2: Rising star volumes expected to accelerate as recovery solidifies

Why is this important? Well, there remains a significant cost difference between a high yield rating and an investment grade rating for bond issuers. For example, the average credit spread on a high yield BB rated bond is 218 basis points (bps) compared with 115 bps for an investment grade BBB rated US bond, a spread differential (218 minus 115) of 103 bps. The spread differential is even more stark in Europe where BB rated bonds trade on average with spreads of 256 bps compared with 114 bps for the BBB cohort.1 In fact, the spread ratio (BB spread divided by BBB spread) is relatively high historically, which could be taken to indicate better value in BB rated bonds compared with BBB rated bonds.

These spread differentials of 100 basis points or more offer potential opportunities to benefit from spread narrowing as some bonds climb the credit rating ranking. This can offer a win-win situation for both investors (as existing bonds reprice higher from any decline in yield) and the issuing company (as the cost of borrowing declines).

The reasons for upgrades are varied. For example, Fiat Chrysler was upgraded in January 2021 as Fiat Chrysler merged with stronger-rated Peugeot to create Stellantis, as well as on expectations the auto industry would rebound from the COVID-19 downturn. JBS, the Brazilian meatpacker, was upgraded in November 2021 because of strong demand for protein from a recovering US economy and its positive free cash flow generation.

Creative disruption

For some companies the disruption caused by COVID-19 and the associated lockdowns was not all bad news. This is because it caused a realignment of consumer habits. One of the major beneficiaries was Netflix, the content streaming company, which saw a massive jump in subscriber numbers as households – deprived of external entertainment – flocked to its streaming service. As a result, S&P moved to upgrade Netflix to investment grade in October 2021, citing Netflix’s improving margins and positive cash flow expectations.

Identifying potential candidates for upgrade can therefore prove profitable for investors and it is one of the reasons why the crossover space between investment grade and high yield remains, in our view, one of the most compelling areas for seeking returns within fixed income.

1Source: Bloomberg, ICE BofA BBB US Corporate Index, ICE BofA BB US High Yield Index, ICE BofA BBB Euro Corporate Index, ICE BofA BB Euro High Yield Index, Govt OAS, 18 November 2021. Basis point equals 1/100th of a percentage point. 1bps = 0.01%, 100 bps = 1%.

Credit spread: The additional yield (typically expressed in basis points) of a corporate bond (or index of bonds) over an equivalent government bond.

Crossover space: The credit ratings area surrounding the border between investment grade and high yield.

High yield: A bond that has a lower credit rating than an investment grade bond. Sometimes known as a sub-investment grade bond. These bonds carry a higher risk of the issuer defaulting on their payments, so they are typically issued with a higher coupon to compensate for the additional risk

Investment grade: A bond typically issued by governments or companies perceived to have a relatively low risk of defaulting on their payments. The higher quality of these bonds is reflected in their higher credit ratings.

Leverage: The level of debt at a company.

Upgrade/downgrade: A bond is upgraded when it is given a higher credit rating eg moves from BB to BB+. A downgrade is when a bond is given a lower credit rating.

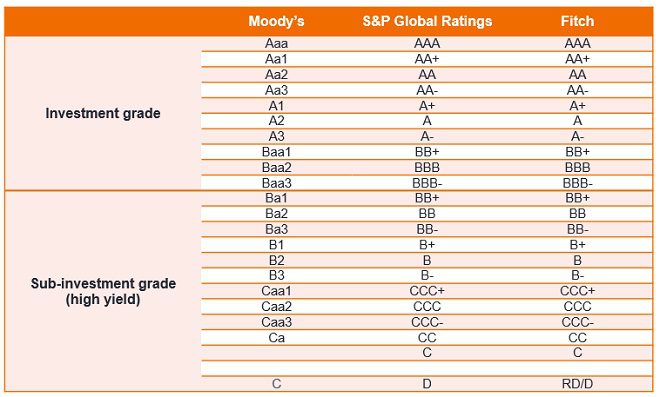

Ratings/credit ratings: A score assigned to a borrower, based on their creditworthiness. It may apply to a government or company, or to one of their individual debts or financial obligations. An entity issuing investment grade bonds would typically have a higher credit rating than one issuing high yield bonds. The rating is usually given by credit rating agencies, such as Standard & Poor’s or Fitch, which use standardised scores such as ‘AAA’ (a high credit rating) or ‘B-’ (a low credit rating). Moody’s, another well known credit rating agency, uses a slightly different format with Aaa (a high credit rating) and B3 (a low credit rating) as per the table below. The ratings spectrum starts at the top with AAA (highest quality) and progresses down the alphabet to C and D, which indicate a borrower that is vulnerable to defaulting or has defaulted.

hese are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.