After hiking fed funds rate from 0% in February to 3.25% today, the US Federal Reserve (Fed) is starting to see the effects of its aggressive moves to counter inflation. But it will still be a while before we see a real slowdown in consumer-price growth.

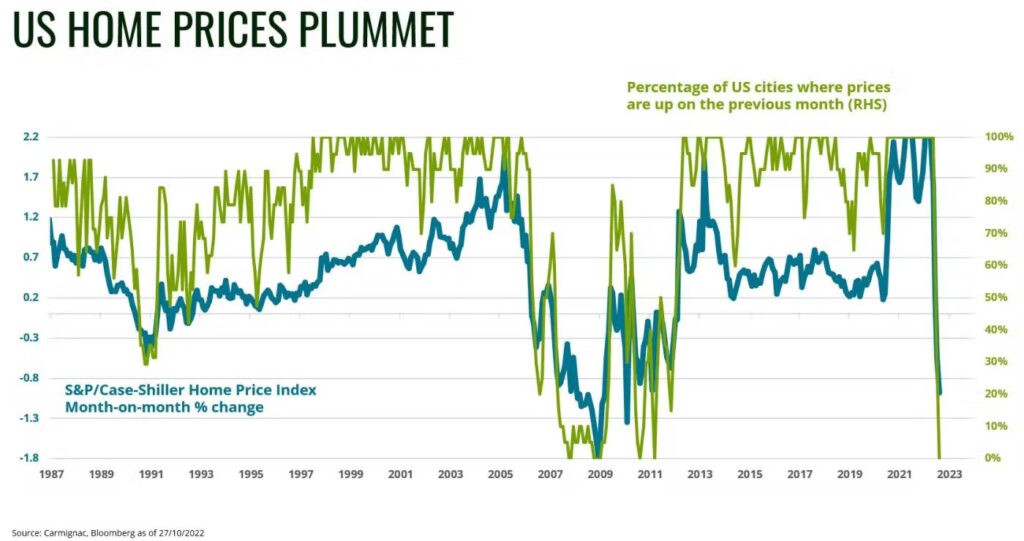

The US real estate market has experienced one of the worst contractions on record, as shown in the graph above. But this downturn relates to the prices of homes and not rents – the biggest component of the consumer price index. Rents generally move with a lag of six to nine months behind home prices; as households turn to renting when home prices or interest rates have risen to an extent that buying is no longer an option, pushing up demand for rental properties, and therefore rents.

Wages are another key driver of inflation. The US jobs market is still running hot and the first signs of cooling began to appear only in recent weeks, when employment data showed a significant drop in job openings. However, the decrease hasn’t yet been enough to rein in the country’s robust wage growth, which reached some 7% in September year on year.

The Fed’s victory over inflation will come in the form of an economic recession, which it’s in the process of engineering. This recession will secure the turnaround in the jobs market and drag down both demand and output. Given that an economic slowdown is certainly on the cards, the Fed will soon have to ease up on its monetary tightening.

Financial markets are beginning to price in a turnaround by the Fed. Investors see the drop in interest rates that will accompany the recession as an opportunity to reinvest in bonds and in stocks most likely to benefit from the stabilisation in rates.

But we shouldn’t get carried away. Structural inflationary forces are still at work, whether in terms of demographics, trade, sociology, or the energy transition. These forces mean it will be several more years before inflation stays below the 2% target so prized by central banks in the developed world.