The Fitch downgrade to the US sovereign rating is largely symbolic, but it brings attention to the fiscal deterioration. US growth has been supported over the past year by another blowout in the deficit. We believe future fiscal policy seems set to show more restraint.

Fitch has stripped the US of its coveted AAA rating. This follows S&P’s downgrade 12 years earlier, leaving Moody’s alone with the top rating. Fitch has received a barrage of criticism for the somewhat arbitrary timing of the change. They cite an erosion of governance given the repeated debt-limit standoffs and the rise in past and projected deficits and debt.

Given how far the US has strayed from the principles of George Washington, this reassessment of US creditworthiness seems justified. However, many will argue that the US dollar’s reserve currency status means the US government has extraordinary financing flexibility and so should be treated differently to other countries.

The downgrade seems unlikely to lead to any changes in the behaviour of treasury holders, in our view, but it throws some light on the budget challenges and loosening of fiscal policy over the past year that has contributed to the resilience of US growth.

Stealth fiscal boost

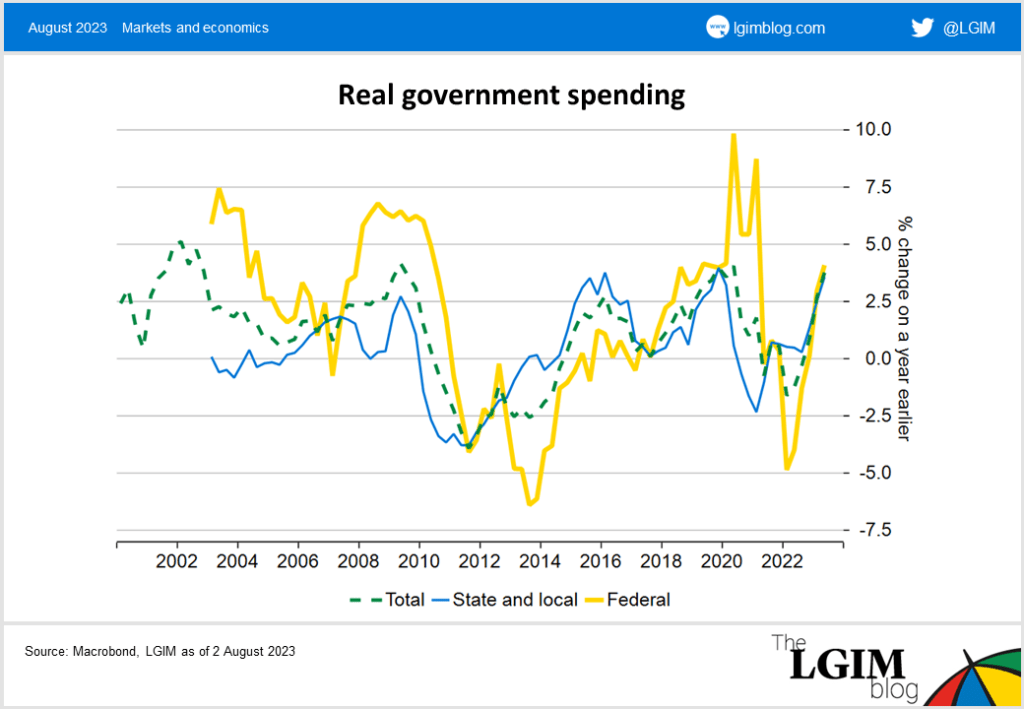

There are two ways to look at the government contribution to growth. First, we can see the direct effect as measured in the national accounts. Real government spending initially weakened as the pandemic stimulus wore off, but over the last year real spending has grown by 3.8%, thus contributing 25% of the overall real GDP growth of 2.6%. But this understates the fiscal support to the economy as the direct government contribution does not include transfer payments, multiplier effects on the private sector or tax credits.

The second way of looking at the government contribution to growth is to assess the change in the fiscal deficit. On current projections the underlying federal fiscal deficit is set to widen by almost $1 trillion in the 2023 fiscal year (end September) versus the 2022 fiscal year when adjusting for the accounting treatment of student loan forgiveness. If we think of the fiscal impulse as the change in the deficit, this 3.2% of GDP increase is the biggest since 1950 (excluding the global financial crisis and COVID-19 pandemic).

Why has this not been part of the narrative?

There are the usual lags in the data and timing shifts, which make a fiscal change beyond the policy announcements difficult to spot in real-time. But more importantly, COVID-19 has muddied the water. It has been tough to disentangle the fading fiscal support as the pandemic eased (which led to an improving budget situation from initial massive deficits) with this fresh stimulus (leading to a renewed deterioration in the budget deficit) which has caught us and consensus by surprise across several categories.

Sources of federal fiscal boost:

- Government discretionary spending

- Healthcare

- Transfer payments

- Higher interest payments

- Bank bailouts

- Lower tax receipts (partly California extending tax deadline)

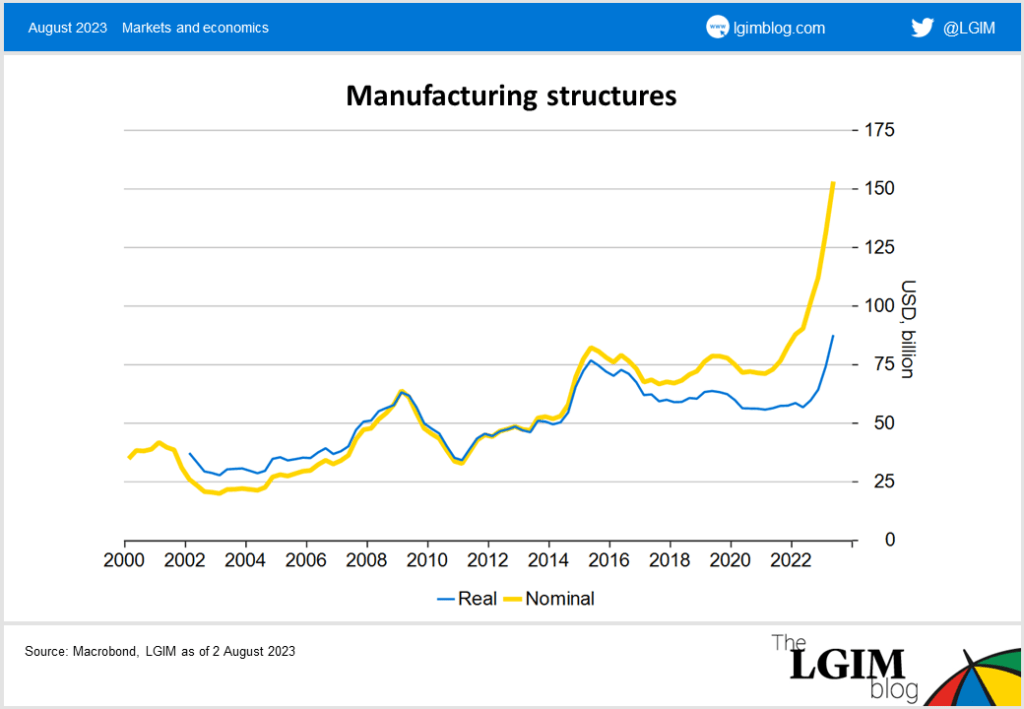

- Tax credits and subsidies in the various infrastructure bills. This is showing up in an unexpected surge in investment in structures by manufacturing companies

State and local government have also been underappreciated

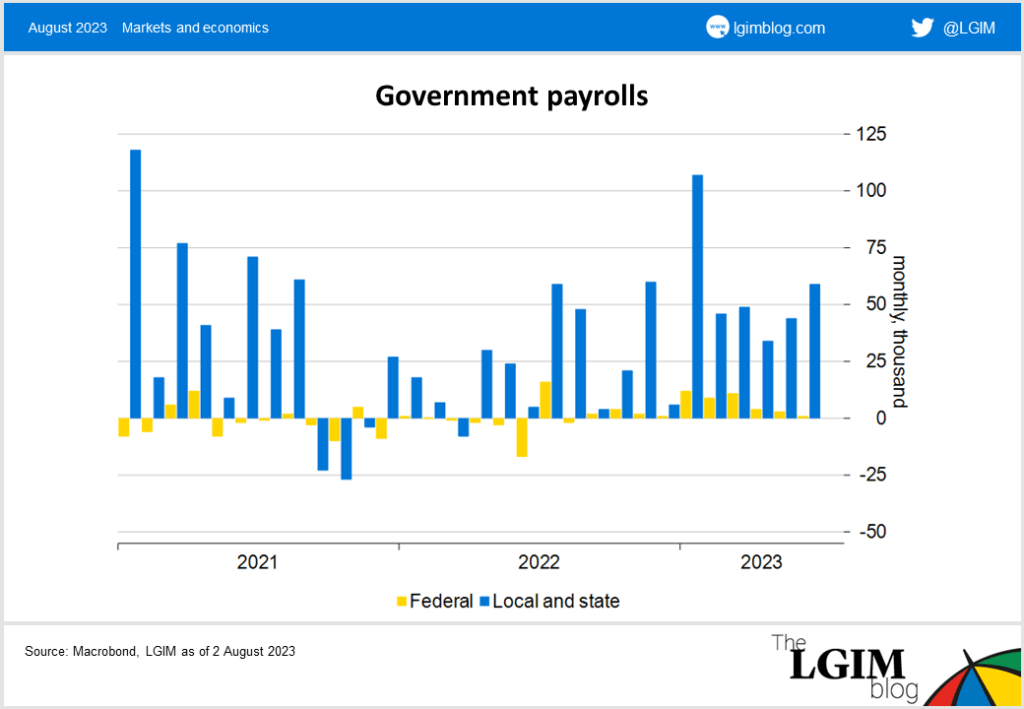

The direct boost to real GDP over the last year from state and local government expenditure is even bigger than at the federal level. It has also led to a large boost to government job growth. After the initial post-COVID-19 rebound, State and local hiring slowed, but then has surprisingly strengthened in 2023 to 56k a month on average. State and local governments came out of COVID-19 with a strong budget position due to large federal transfers as part of the stimulus packages.

Much of the initial spending boom was just offset by inflation, but more recently as nominal spending growth has remained strong, this has translated into more real expenditure. This direct boost in the national accounts understates the contribution to growth because state and local governments also cut taxes (which shows up in private consumption).

However, Fitch shows that budget positions are deteriorating (not part of the federal deficit), which should limit future growth.

How large is the stimulus?

Even after the larger than expected federal deficits, many economists still argue that most of this is not true stimulus (i.e. lower tax payments are not the same as an actual tax cut).

Still, we are left with the uncomfortable question of where did all the money go?

These are actual dollars the government has borrowed. As discussed above, it seems likely that the overall contribution to growth has been larger than merely the direct impact of government spending.

The end of stimulus

Fitch projects the deficit to stabilise around this higher level (near 7% of GDP) over the next few years. A shocking development for an economy expected to be around full employment.

This is including the debt ceiling deal which caps discretionary spending in nominal terms and means the fiscal impulse (change in the deficit) and contribution to growth from the government is set to come to an abrupt halt.

In the long term the US will face some even tougher budget choices, but for now we believe that markets are unlikely to punish the US for its unsustainable debt trajectory