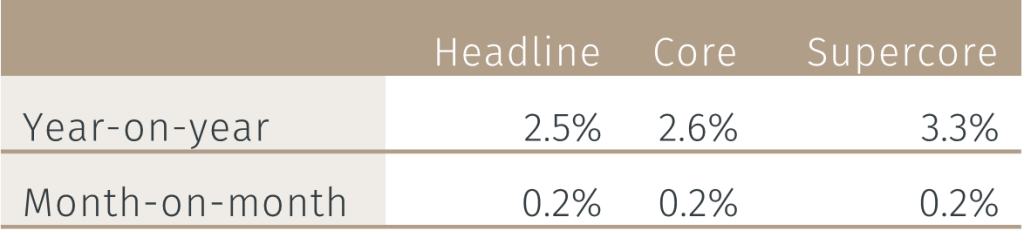

The Fed’s preferred measure of inflation, the core personal consumption expenditure (PCE) deflator, rose 0.2% month-on-month in July as expected, and year-on-year inflation remained at 2.6% rather marginally below the 2.7% predicted by the consensus.

Headline and supercore inflation were also unchanged at 2.5% and 3.3% respectively with both rising by 0.2% month-on-month.

Table 1. PCE Inflation in July

Source: Fred. Data as of 30 August 2024.

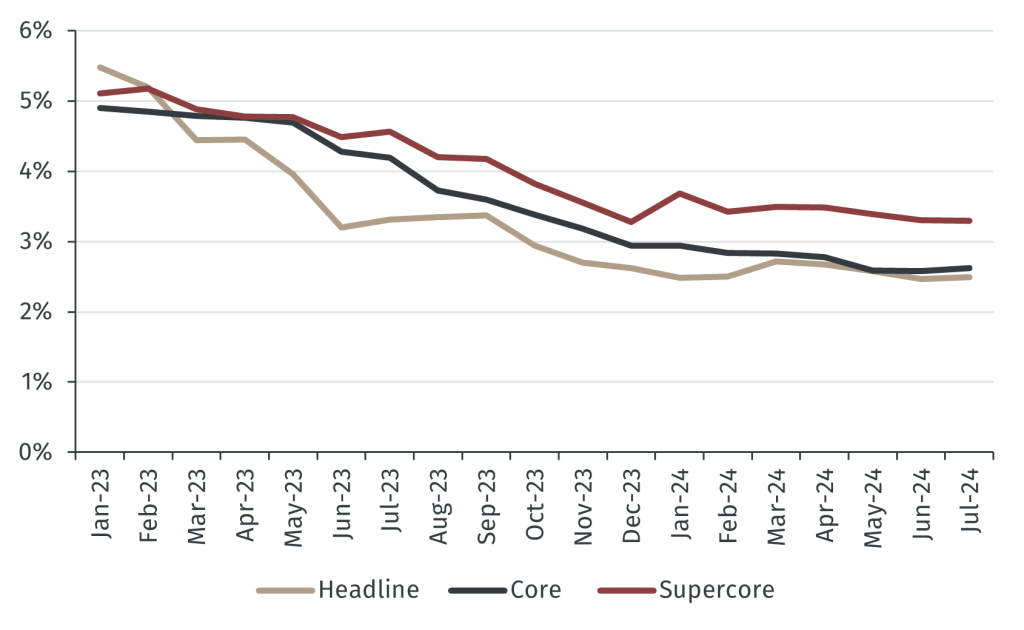

Looking over a longer time period allows us to assess the progress the Federal Open Market Committee (FOMC) has made with respect to lowering inflation, as shown in Chart 1 which suggests the decline in inflation has slowed. Indeed, annual headline, core and supercore inflation all fell by only 0.2% in the four-month period between March and July, indicating that it could take another year before inflation has fallen to 2%.

Chart 1. Inflation over 12 months

Source: Fred. Data as of 30 August 2024.

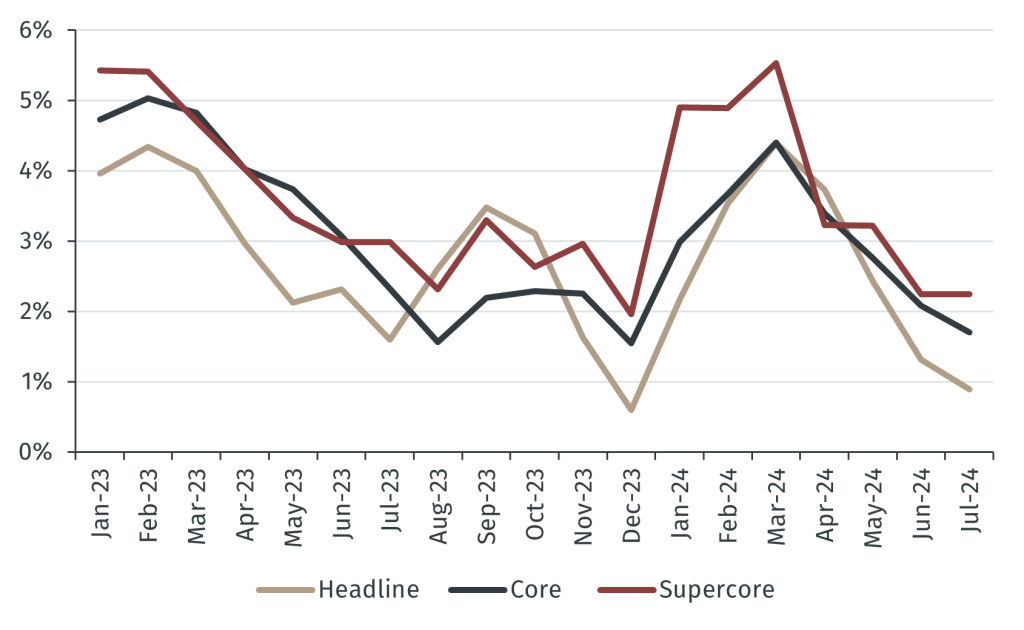

To get a clearer sense of the decline in inflation, it is helpful to look at annualised inflation over a shorter period. The graph below shows annualised inflation over three months. On this basis, inflation declined throughout 2023 but rose between January and March 2024. This episode of renewed price pressures triggered the shift in investor expectations of Fed policy in the first quarter.

However, since April three month annualised inflation has weakened substantially, and on a headline basis is currently running at 0.7% (core 1.7% and supercore at 2.2%). If this situation continues, price stability will have been restored which will increasingly be reflected in year-over-year inflation.

Chart 2. Inflation over three months (annualised)

Source: Fred. Data as of 30 August 2024.

The Federal Reserve will be pleased by these data as they support the case for cutting interest rates in September. Following the PCE release futures markets reduced the likelihood of a 0.50% cut to close to 0% but a 0.25% cut remains fully expected. However, futures markets are fickle and the size of the cut will be heavily influenced by incoming data, notably this week’s labour market statistics.