Tariffs are net negative for the USD—they act as a major tax on businesses and consumers and hurt US credibility as a trade and financial partner. Currencies more exposed to tariffs, like the Scandinavians and AUD, face the biggest downside risk.

Thematically, we expect tariff negotiations and the market’s repricing of growth, inflation, and earnings to continue driving currency moves in the near term. Beyond the current crisis, we anticipate that currency drivers will shift from peak tariff shock to the fiscal and monetary responses, as well as the medium- to long-term global portfolio rebalancing channel.

Fiscal/Monetary response: The outlook is negative for the US dollar, not great for the pound, but more favorable for other G10 currencies. Currencies of countries with the flexibility to implement fiscal or monetary stimulus in response to this shock are likely to outperform after the initial market turmoil. Once markets gain a clearer sense of peak tariff levels, investors will shift focus to which countries have the policy space to mitigate the fallout. Arguably, the US has the most room for fiscal offsets, as it will collect the tariff revenue. However, political divisions in Congress are likely to delay any material response. Moreover, with the US fiscal deficit already large, deficit hawks are likely to argue that the additional revenue should go toward deficit reduction. On the monetary side, the Fed remains constrained by the likely inflationary impact of tariffs.

Outside the US, the shock is deflationary, allowing for a more aggressive monetary response. At the same time, the tariffs may help galvanize political will to enact meaningful fiscal stimulus. The UK appears more constrained in its policy options due to persistently high inflation and limited fiscal space—though the recent drop in yields offers some marginal relief.

Global Portfolio Rebalancing: We see this playing out in two dimensions. First, a rebalancing of portfolios away from an extreme concentration in currency-hedge-free US assets—either through outright selling or by increasing currency hedge ratios. Even a modest 10–20% rise in US dollar hedge ratios could trigger $2–3 trillion in US dollar selling, more than enough to drive a sustained and significant downtrend in the dollar. Second, a rebalancing of global trade and financial cooperation, as countries outside the US are pushed toward deeper free trade, knowledge sharing, and financial integration. These developments would likely boost relative potential growth versus the US and reduce reliance on the US dollar. Together, these portfolio and real-economic shifts would reinforce each other, driving a gradual—or perhaps not so gradual—erosion of US exceptionalism and a weakening of the US dollar.

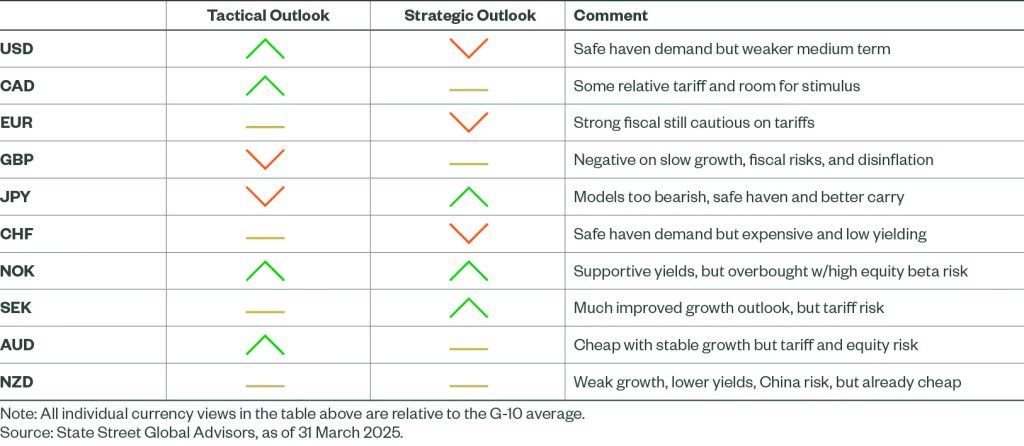

Figure 2: March 2025 Directional Outlook

US Dollar (USD)

We have long held the view that the US dollar is likely to decline at least 15% over a two-year horizon as US yields and growth converge with the G10 average and the country continues to grapple with high fiscal and current account deficits. We believe the tariff shock will likely hasten and deepen this expected downturn. Outside brief periods of strength during market meltdowns, we see sustained US dollar weakness driven by weaker expected growth and persistent portfolio outflows, whether via outright asset sales or increased currency hedging on US dollar exposures.

Because we now see an increasingly strong bear case for the dollar, we believe it will be a less reliable safe haven—even during the current market crisis. This does not mean the dollar will move in lockstep with risk assets. On the worst trading days, the dollar may still rise due to concerns about the immediate impact of tariffs on export-driven economies and the need to maintain US dollar funding. But safe haven demand is unlikely to reach previous levels, given the weakening long-term US growth outlook and the increasing likelihood of global portfolio rebalancing— potentially even in the form of modest increases in hedge ratios on historically unhedged US asset holdings.

Canadian Dollar (CAD)

Poor manufacturing and services Purchasing Managers’ Index and weaker labor market data highlighted the drag from tariff uncertainty. In the near term, Canadian dollar may come under renewed pressure due to recession fears stemming from slower US growth, the implemented tariffs, subdued consumer and business sentiment, and weaker commodity and risk asset prices. But beyond that there are many reasons to expect a recovery in the currency. That said, the medium-term outlook is more constructive.

The Canadian dollar appears undervalued based on long-run fair value measures. Canada was spared from reciprocal tariffs, retains ample fiscal and monetary policy space, and could benefit from deregulation and expanded trade opportunities beyond North America. Moreover, we expect that the latest North American tariff tensions will eventually lead to a renegotiated the United States–Mexico–Canada Agreement (USMCA) that largely preserves regional free trade.

As policy clarity improves and the economic benefits of Bank of Canada rate cuts and fiscal stimulus begin to materialize, we expect USD/CAD to fall back into the high 1.30s later this year.

Euro (EUR)

Our tactical outlook for the euro has stabilized at neutral. Household balance sheets remain strong, unemployment is low, and real wage growth is positive. The need for a sharp increase in defense spending, alongside the proposed infrastructure fund, remains euro supportive. Moreover, the case for European Union (EU) investors to reduce their heavy exposure to US assets, or at least increase average hedge ratios, is strong, particularly as the US becomes a less reliable trade and security partner.

However, growth remains soft, and a persistent tariff shock could drag on the economy through Q2 and Q3. We believe the EU is likely to avoid recession, assuming more immediate, targeted fiscal measures and further European Central Bank (ECB) rate cuts to help offset tariff effects. A negotiated reduction in tariff rates is possible, though we expect the Trump administration to take a tough stance with the EU. For those reasons the euro may have trouble maintaining its initial resilience against the US dollar and other traditional safe haven should the market sink further into crisis conditions.

British Pound (GBP)

We remain bearish on the pound in both the short and medium term, though we see some potential for medium-term upside against the US dollar once the immediate tariff shock fades. The UK is subject to the 25% auto tariff and the 10% broad tariff, a smaller hit than the EU, Japan, Switzerland, and most of Asia. Still, the UK is likely to suffer from negative spillovers tied to a global growth slowdown.

With limited room for monetary and fiscal stimulus, the UK will find it harder to counter those headwinds, even if the initial impact is smaller than elsewhere. This constrained policy flexibility increases the risk of a sharper domestic slowdown later in the year, potentially just as other economies begin to rebound. That suggests deeper and faster BoE rate cuts in 2025 and 2026 and poses challenges for the pound’s medium-term outlook.

That said, while the pound may remain under pressure versus most G10 currencies, it may end 2025 above 1.35 versus the US dollar, largely on the back of a broad-based US dollar selloff.

Japanese Yen (JPY)

Our model is negative on the yen over the tactical horizon, driven by strength in the commodity signal and a short-term value model that suggests the yen is overbought following its sharp appreciation in early 2025. That said, we discount these signals due to the difficulty quantitative models face in accounting for hard-to-quantify events like the tariff shock. The global demand impact of tariffs is likely to put further downward pressure on yields, which would benefit the yen.

Moreover, the yen retains its strong safe haven characteristics—particularly in light of rising doubts over the US dollar’s reliability as a haven asset. These concerns are tied to the effective tax hike from tariffs and the potential for sustained portfolio outflows, either through direct US asset sales or increased currency hedging of dollar exposures.

While standard model signals remain bearish, we take a more constructive view and see the yen as the preeminent safe haven currency during this period. However, once the current shock subsides, we expect it to underperform more cyclical currencies—particularly the Norwegian krone, Swedish krona, and Australian dollar.

Swiss Franc (CHF)

We turn neutral on the franc over the tactical horizon. While there is a strong fundamental case for depreciation, the ongoing tariff-related shock may continue to support the franc through renewed safe haven demand. Looking further out, we maintain a negative view. A key shift this month is that the franc may hold up better than previously expected against the US dollar, given our more bearish medium-term US dollar outlook. Still, we expect the franc to underperform the broader G10.

The Swiss franc remains the most overvalued G10 currency by our long-run fair value estimates. It also carries the lowest yields and core inflation in the group. With the SNB’s policy rate near the zero bound, the central bank may become more inclined to intervene directly in currency markets to weaken the franc, particularly as safe haven flows drive its value higher against a weakening fundamental backdrop.

While we expect a longer-term decline in the US dollar, the portfolio rebalancing channel that typically supports the franc is less relevant. Swiss investors already hedge a large share of their foreign currency exposure, leaving little room for hedge-ratio increases. Moreover, any direct selling of US assets in favor of a more geographically balanced allocation is unlikely to drive large FX moves due to those high hedging ratios. Overall, we see the franc entering a period of gradual depreciation as it begins a longer-term reversion toward its estimated fair value.

Norwegian Krone (NOK)

We expect heightened volatility for the krone in the near term, given its sensitivity to equities and commodities. On 4 April alone, the krone fell 4.05% versus the US dollar and 3.2% versus the euro. Beyond that we believe krone is setting up for stellar gains once we reach peak tariffs, reprice risky assets, and begin to focus on tariff reductions and fiscal/monetary stimulus.

Norway’s fiscal and monetary flexibility positions it well to manage external shocks. The krone is historically undervalued by our long-run fair value estimates and benefits from solid long-term growth prospects and a strong sovereign balance sheet. As the dust settles and markets shift attention toward recovery, we see substantial upside potential for the krone.

Swedish Krona (SEK)

We retain a modestly positive bias on the krona in the near term, supported by improved economic data and firmer inflation. That said, as a small open economy with a less liquid currency, Sweden remains vulnerable to downside volatility during this tariff shock—especially if markets begin to focus more acutely on the near-term drag from tariffs on regional growth.

Looking ahead, we remain constructive. The krona is undervalued by our long-run fair value estimates. Sweden maintains ample room for monetary and fiscal stimulus to cushion against trade-related headwinds and is well-positioned to benefit from increased EU defense expenditure.

Additionally, portfolio rebalancing flows should offer support. The sizable foreign asset holdings in Sweden and across the EU create scope for a rotation away from US exposure—even if only via increased US dollar hedge ratios—which should act as a meaningful tailwind for krona appreciation.

Australian Dollar (AUD)

Our models maintain a slight positive tilt on the Australian dollar, underpinned by stable—albeit below-trend—growth, resilient commodity prices, and relatively high yields. However, these models are not well equipped to factor in unquantifiable shocks, such as the recent spike in US tariffs. Asia—a vital region for Australian trade—was heavily affected by the tariff escalation, with total Chinese tariffs now exceeding 50% and 25–35% tariffs for most other countries.

Not to mention the retaliatory tariffs from China on the US of 34% effective on 10 April. The direct tariffs on Australia are small but the spillover effects of Asia tariffs and the Australian dollar’s historically high beta to global equity market drawdowns present significant near-term risks to the currency.

As we get a better sense of peak tariffs and look forward to negotiations to reduce the reciprocal tariffs, the currency is set up for a strong rebound. Australia and most Asian countries have ample room for fiscal and monetary stimulus to limit the damage from high tariffs.

Like most countries outside the US, Australian investors appear to have historically high levels of currency unhedged US dollar asset exposure that we believe will be subject to higher currency hedge ratios or an outright rotation into a more diversified global portfolio. Both would support the Australian dollar. And relative to our estimates of long-term fair value, the Australian dollar remains extremely undervalued versus the US dollar, British pound, euro, and Swiss franc—offering substantial room for appreciation over time.

New Zealand Dollar (NZD)

Our tactical model maintains a slightly negative view on the New Zealand dollar, and we see heightened downside risk in the near term as the tariff shock plays out. New Zealand remains vulnerable to slowing growth in Asia and has a historically high beta to global equity market declines. These risks are amplified by a fragile domestic backdrop characterized by rapid monetary easing, an early-stage economic recovery, and elevated external sensitivity due to the country’s persistent and sizable current account deficit.

On a more positive note, the large selloff in New Zealand Dollar over the past 5 months already reflects a discount for lower growth, tariff risks, and lower yields which may limit further losses beyond the near-term tariff shock risks.

Looking further ahead, our long-term outlook is mixed. Valuation metrics suggest that the New Zealand dollar is undervalued relative to the significantly overvalued US dollar and Swiss franc, indicating potential for appreciation. However, the currency still looks expensive versus the yen and Scandinavian currencies.