Valeo’s debut €700m sustainability-linked bond (SLB) signals the wider automotive sector is serious about transitioning to sustainable, low carbon mobility.

Valeo, one of Europe’s leading automotive suppliers, issued its first sustainability-linked bond (SLB), successfully raising €700 million at a seven-year maturity with a coupon of 1%. It is also the first European auto-parts manufacturer to issue an SLB.

Valeo’s inaugural SLB, for which BNP Paribas acted as joint global coordinator and joint active bookrunner, is linked to one key performance indicator (KPI): to reduce its total carbon footprint scope 1, 2 and 3 across all of its operational activities, its supply chain and use of products. Sustainable finance is evolving to increasingly integrate scope 3 emissions targets into financing structures in order to scale up the transition to net-zero across multiple sectors.

The SLB includes a Step Up linked to Valeo’s ability to achieve, by 31 December 2025, a total carbon footprint below 37.95 million CO2eq tons.

Valeo noted in its Green and Sustainability-Linked Financing Framework, updated 20 July 2021: “As forward-looking performance-based instruments, SLBs help demonstrate Valeo’s integrity to its sustainability ambitions by aligning its corporate financing with its sustainability strategies, while providing transparency and disclosure to investors and stakeholders.”

“This transaction underlines Valeo’s commitment to achieving carbon neutrality and is a natural extension of our commitment to global sustainable development, an area in which the Group is recognized as a leader,” said Jacques Aschenbroich, CEO of Valeo in a press release.

The bond attracted strong interest from the investor community, with a final book over €2.3 billion (more than three times oversubscription).

Wider automotive sector joins the ESG movement

Once the playing field of larger automobile manufacturers, other actors in the life cycle of a vehicle are now using sustainable finance as an effective tool to help them transition.

Guilio Baratta, Head of DCM Corporates EMEA, BNP Paribas, said: “Sustainability has largely been led by car manufacturers, until now. Valeo’s SLB signals that the automobile industry is entering a virtuous cycle where ESG has an impact across the value chain as car parts suppliers are joining the movement.”

Having signed the “Business Ambition for 1.5oC” commitment, Valeo has committed to being net-zero by 2050. Valeo established an extensive Green and Sustainability-Linked Financing Framework which enables the company to also issue green bonds in the future.

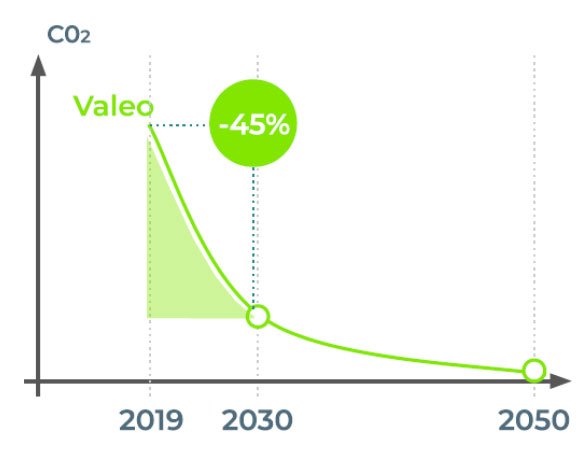

The company noted in its Framework that it “is committed to reducing its emissions across its entire value chain (scopes 1, 2 & 3) in absolute value from 49.6 million tons emitted in 2019 to 27.9 million tons in 2030, (i.e. a reduction of 21.7 million tons of CO2 corresponding to -45% in 2030 compared to 2019), with an intermediary target in 2025.”

Moreover, “The targets for reducing CO2 emissions by 2030 will be achieved without any recourse to carbon offset actions.”

Scopes 1, 2 and 3 emissions

The Greenhouse Gas (GHG) Protocol Corporate Accounting and Reporting Standard classifies a company’s GHG emissions into three ‘scopes’:

- Scope 1 emissions are direct emissions from owned or controlled sources

- Scope 2 emissions are indirect emissions from the generation of purchased energy (electricity, steam, heat, or cooling).

- Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the company

Driving toward clean mobility

The transport sector accounts for 23% of global greenhouse gas emissions. Within the sector, 64% of all travels are happening in cities, and road transport accounts for 72%. (sources: 21st Century Cities, Global Smart Cities Primer.)

“The entire automotive sector has a key role to play in the world’s transition to net-zero. Valeo’s inaugural SLB will help push the sector in its transition. As their banking partner, we are proud to support clients like Valeo as they accelerate their transition to net-zero,” said Chamsia Sadroudine, Global Relationship Manager, Corporate Coverage France, BNP Paribas.

Also, as a technology company, Valeo’s stated mission is to offer innovative products and systems that contribute to the reduction of CO2 emissions and to the development of more autonomous driving.

Big brand carmakers have mostly taken the lead, with recent transactions including Daimler‘s €1 billion, 10-year green bond for which BNP Paribas was joint bookrunner, and Volvo Cars’ debut €500 million 7-year green bond to help finance investment in electric vehicles, with BNP Paribas acting as structuring adviser.