As COVID restrictions are lifted, fiscal support is implemented and supply chain issues are worked out, the Japanese market could see many supporting factors for future outperformance. Our focus remains on identifying the many mispriced Japanese companies with good quality income streams that are yet to be recognised by the market.

The Japanese market recorded double digit returns in 2021 with MSCI Japan rising by 13.81% in local currency terms. Despite respectable returns, Japan was a laggard versus other developed markets. This was likely driven by a multitude of factors such as delayed COVID outbreak and containment, political uncertainty as the country leadership transitioned to the new Prime Minister Fumio Kishida, the pandemic-induced China economy slowdown and supply chain disruptions, and the increases in material costs.

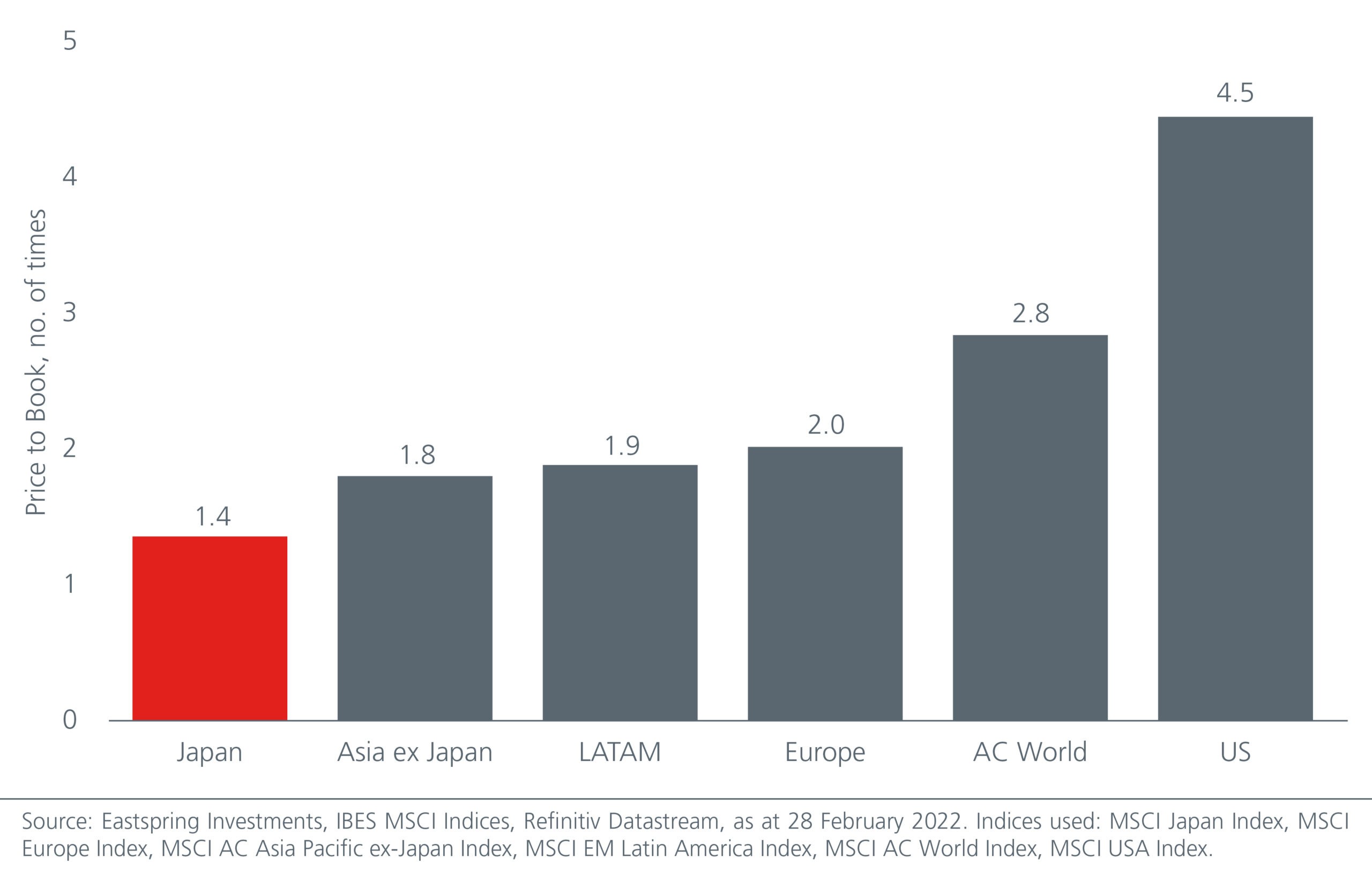

Despite the strong earnings revisions and improved companies’ fundamentals, the market did not re-rate and it is now trading at very attractive valuations versus its global peers. See Fig. 1. Lower starting valuations are supportive of likely future outperformance for the Japan market.

Fig. 1: Japan is attractively valued versus global peers

That said, the global recovery momentum has been impacted by the Russia-Ukraine war. This conflict has cast a shadow on financial markets; global equities have declined by 5%1 in the first quarter of 2022.

Japanese corporates are in good shape

With no meaningful resolution in sight thus far and the likelihood of a prolonged war, it is important to note that the direct exposure of Japanese corporates to both countries is small. This is hardly surprising due to the low direct dependence of Japan on Russia’s economy. Japanese car manufacturers, for example, sell only around 1-3% of their consolidated sales volumes to these countries. However, the secondary effects of the war to the companies’ profitability, namely through increased energy, commodity, and other input costs need monitoring.

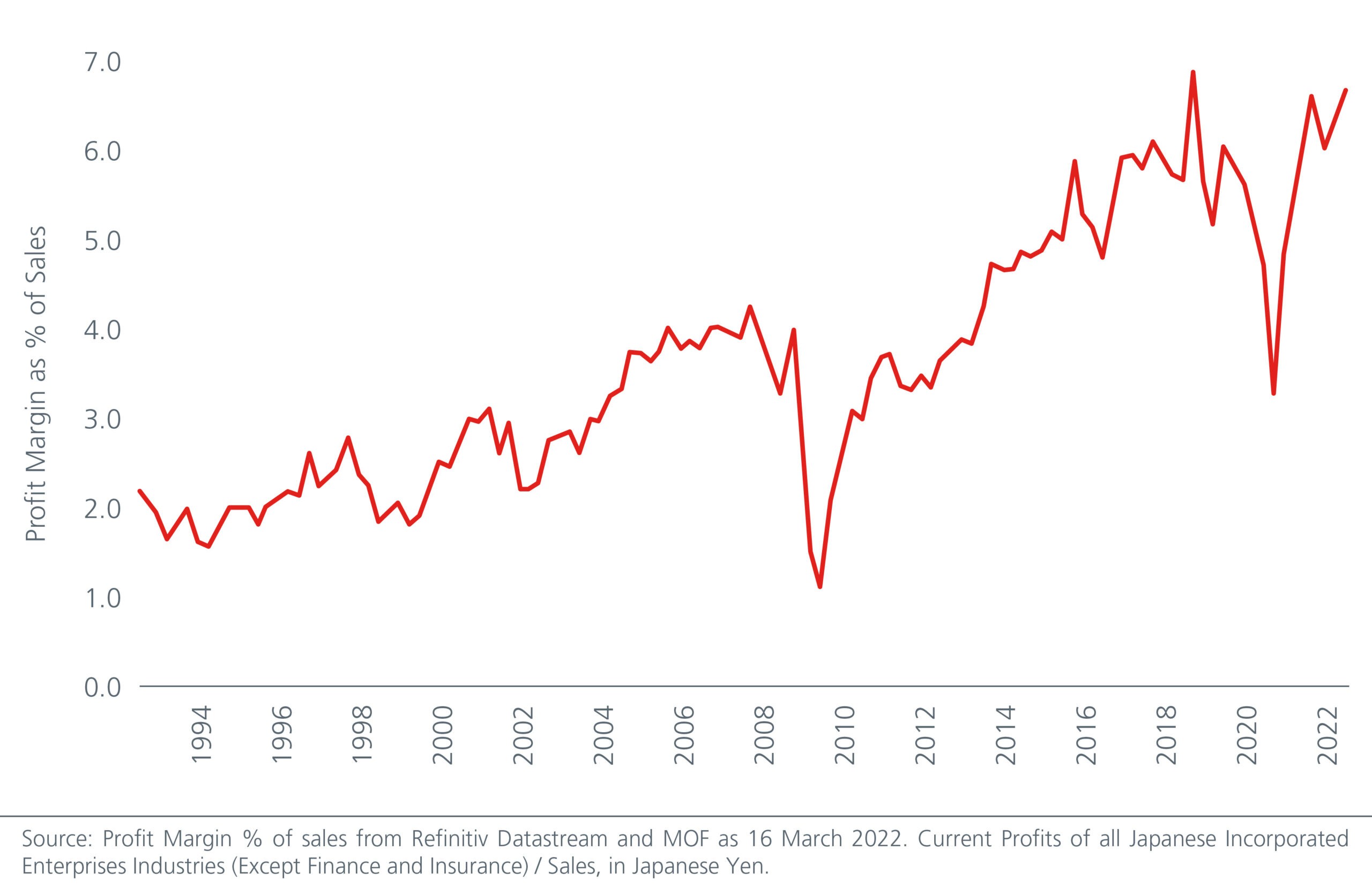

The good news is that Japanese companies are coming into this crisis in a relatively good shape. Profitability has improved on a trend basis; even during the height of the pandemic in 2020, the operating profit margins only fell to the peak level of the previous cycle. See Fig. 2. This was achieved by the companies managing capacity and cost base well which resulted in lower break-even points.

Fig. 2: Corporate profitability is improving

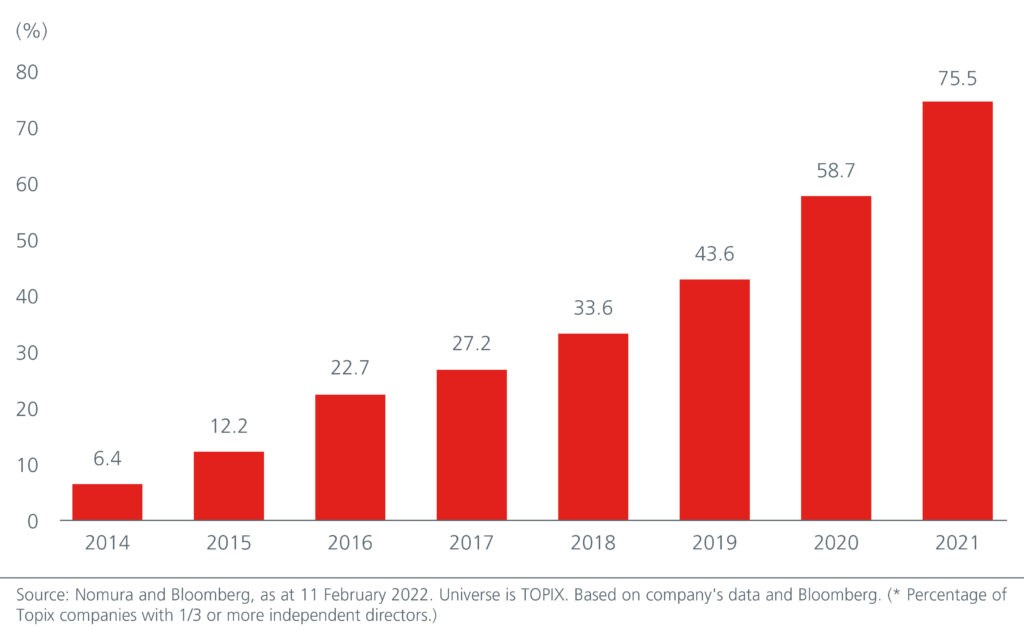

Corporate governance reforms a key profitability driver

Corporate governance reforms have also been a big driver of this improvement, in particular the trend of bigger independence of boards and the unwinding of cross-shareholdings. See Fig. 3. Japan’s corporate governance reforms only took off in a big way following the adoption of the Japan Revitalisation Strategy in 2013. The Strategy’s purpose is to increase the sustainable growth and medium-to-long-term corporate value of Japanese companies. The Corporate Governance Code was compiled in 2015. These were likely turning points for changes in Japanese management attitudes to capital efficiency and corporate profits. The reforms continue to gain momentum with the pandemic accelerating the changes.

Fig. 3: Growing independent Director representation on boards

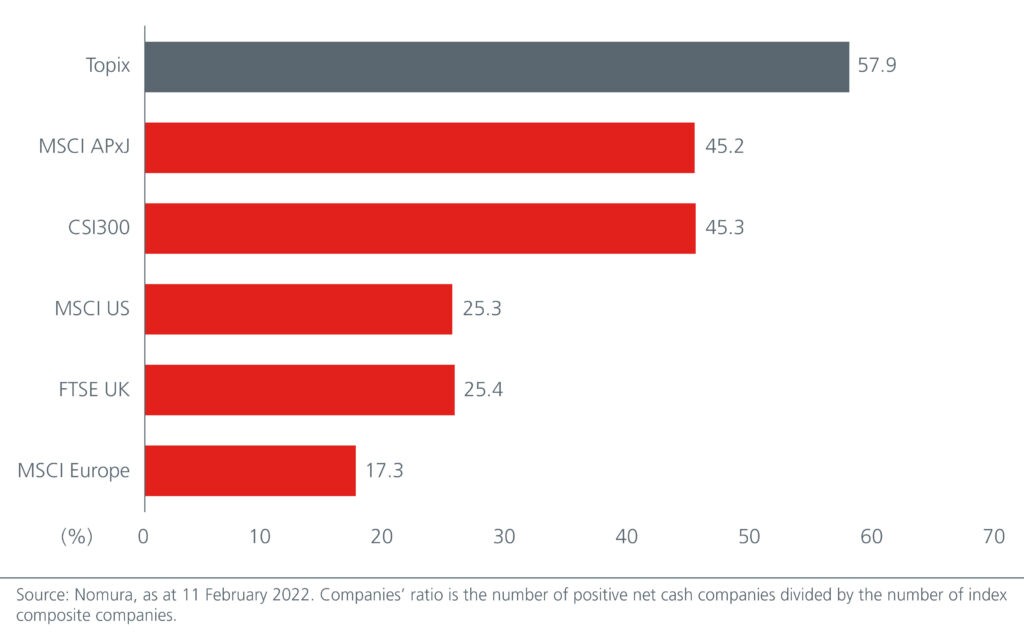

Japanese companies also boast much improved balance sheets. See Fig. 4. In fact, more than 50% of non-financial companies in Japan have net cash on their balance sheets, far more than rest of world, resulting in a continued record level of dividends and share buybacks even during the pandemic.

Fig. 4. More Japanese companies are “cash rich”

Another interesting but less known factor driving corporate reforms is Japan’s aging demographics, long considered a scourge. It is slowly becoming a force of change. Japan’s corporates are now being forced to give priority to the shareholders. This is not merely driven by the need to keep up with the global competitive markets but also from domestic social pressures, especially from the government pension funds which need to deliver returns to their stakeholders. As the population gets older, the demographics increasingly favour the interests of pensioners who tend to be shareholders.

Inflation may not be a bad thing

Rising inflation is a major concern in major advanced economies but in Japan it seems to be still well contained. To be sure, prices have risen, driven by energy and the pass-through of cost increases in processed food. Inflationary pressures also seem to have become more broad-based in consumer goods and services. Some macroeconomists think that core CPI inflation could hit +2% year-on-year in the coming months.

But inflation is not always bad news; a little bit is healthy, especially for Japan. It may not only stimulate private sector consumption and investment borrowing but also start to challenge deeply ingrained views of deflation and low interest rates continuing in perpetuity. Moreover, companies are seeing pricing power after years of not being able to raise prices without impacting volumes or losing market share. For the first time since the 1980s, the Tankan survey of the output price diffusion index, which indicates the number of companies that have been able to raise prices, is at its highest level.

Our focus is on mispriced assets

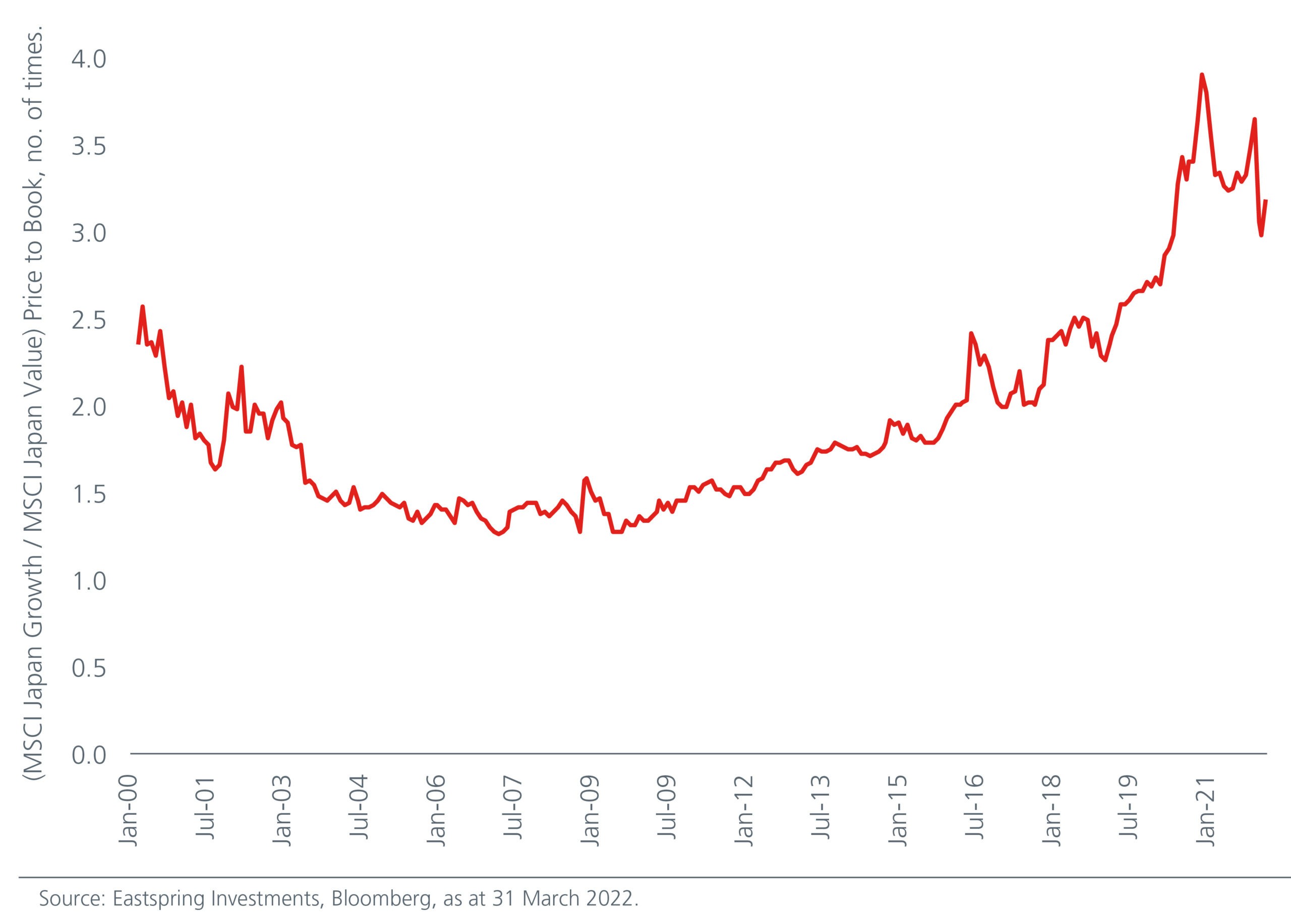

Within the attractively valued Japan market, we see significant relative valuation bifurcation between growth and value indexes. See Fig. 5. This bifurcation was accelerated during the initial pandemic period in 2020. It was driven by the market’s inclination for quality and thematic growth, while the indiscriminate sell down of other more cyclical assets or assets that faced short-term headwinds due to COVID was seen.

Fig 5: Valuations for growth style versus value surpass Dot com bubble peaks

While we have observed some normalisation, these relative valuations are still at extreme levels. The current backdrop of an early US Fed rate hike cycle and global economies reopening is supportive for Japan equities and value investing.

However, the more important point is that there are many companies in Japan with mispriced but good quality income streams that remain out of favour with the market. There are cyclical tailwinds, but companies have also made a significant progress in improving their returns structurally. This still seems unrecognised by the market.

As we do not try to time the cycle, we look through the whole market and try to identify outlier stocks where the market might be making a significant mistake regarding the future trend returns of a company. With a disciplined valuation approach and willingness to be patient we rely on our durable investment process to identify these opportunities.

This is the fourth of a series of eight articles which examines the different investment strategies investors can adopt to tap on the opportunities that are emerging in Asia.